Statutory Audit is of two types

- Tax Audit

Tax Audit is an Examination of Tax records under Income Tax Act 1961. Income tax audit is an examination of the business or tax returns of the individuals by the state tax authority - Company Audit

Company audit means verification of Financial statements i.e. Balance Sheet, Profit or Loss Account or Income and Expenditure Statement and Cash Flow Statement of the auditee Company. It is required to be done at the end of every Financial year.

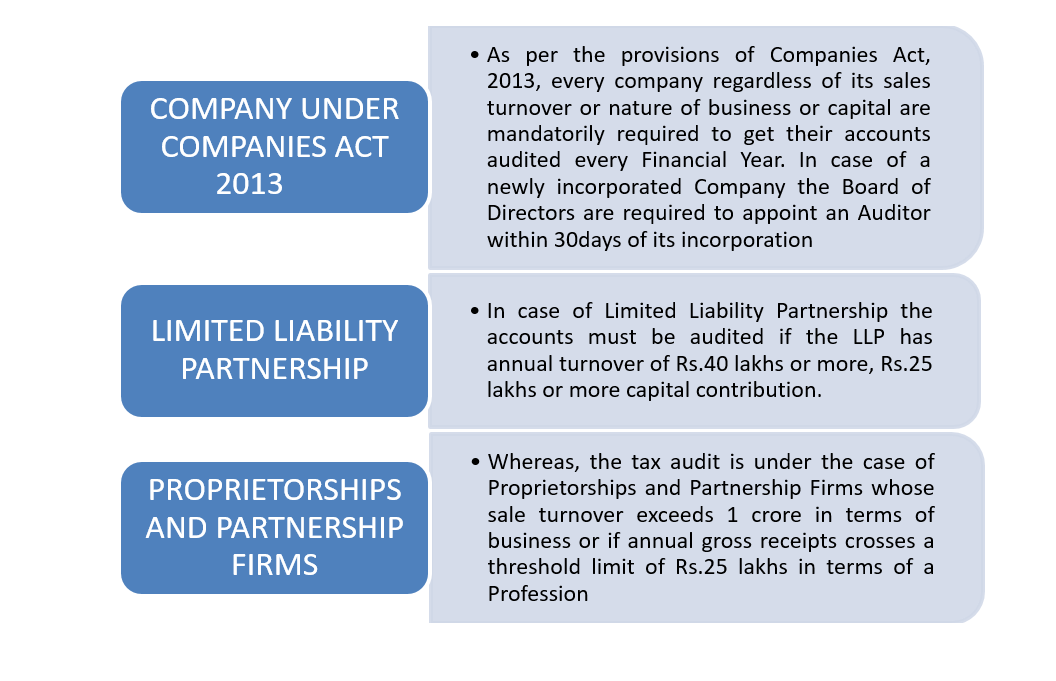

Who Requires to Get its books of Account Audited?

Objectives of Statutory Audit

The objective of statutory audit can be categorized into primary objectives and subsidiary objectives.

Primary Objectives of Statutory Audit

The primary objectives of the statutory audit are as follows:

- Examination of the financial statements of the company.

- Evaluation of arithmetical accuracy of books of accounts and verification of casting, posting, balancing, etc.

- Confirmation of the appropriate distinction between revenue and capital nature of transactions.

- Verification of the authenticity and validation of transactions.

- Confirmation of the value of assets and liabilities.

- Presentation of a correct and fair picture of operating results via income statement and financial position via a balance sheet.

- Confirmation of proper appropriation of funds.

Subsidiary Objectives of Statutory Audit

Subsidiary objectives of Statutory Audit are as follows:

- Detection and deterrence of errors

- Detection and deterrence of frauds

Tests under Statutory Audit Procedure

An auditor has to carry out an array of tests to complete the Statutory Audit in compliance with government rules & regulations. This starts with confirming the internal working environment of the company in consonance with the standards set for the industry and ends at the examination of financial accounts and balances.

Let us read the procedure in a precise and proper manner.

- Evaluation of Operating Environment

An auditor evaluates whether or not internal practices of the organization are in harmony with industry guidelines & regulatory benchmark and that the practices are ethical. - Evaluation of Operating Controls

An auditor examines the operating controls of the business entity by communicating with industry consultants, employees, external auditors or by going through industry publication or audit reports of previous years. - Evaluation of Controls

An auditor evaluates whether or not the corporation executes and controls - operating mechanisms for prevention of fraud or error following the industry practices and standards prescribed by regulators. - Examination of Account Balances

An auditor examines the account balances to confirm the authenticity & validation of financial reports along with their compliance with regulatory standards, statutory principles and industry practices. - Examination of Account Details

An auditor evaluates the accounts and balances available with a bank, insurance company or any other financial institute to ensure that the balances and corporate financial statements are accurate and fair. - Crucial Takeaway

- A statutory audit is a legal requirement to check the accuracy of a company's financial statements & records.

- A statutory audit examines the records held by a business entity, government entity or person, which involves financial analysis.

- The statutory audit confirms the proper management of funds and the accuracy of the filings.

- A Statutory audit applies to firms including banks, public companies, brokerage & investment firms and insurance companies.

For a smooth and quick Statutory Audit that comply with Government rules and regulatory standards, get in touch with us!

Process of Statutory Audit

The whole process of design registration can be divided into the steps mentioned below:

-

Review:

Statutory Audit should take the basic understanding of internal and external environment of the company auditor should obtains a deep understanding of the business, Financial Statements and books of accounts prepared by the Business and internal control.

-

Statutory Audit

In the next step, the auditor will verify the Financial Statements of auditee and verify it on sample basis. The important thing under any audit is to make sample, it is called sample audit.

-

Reporting

Based on the data and information collected by the auditor from the various procedure performed procured now auditor will prepare a report thereby expressing the opinion on the Financial Statements based on the audit evidence collected portraying a true and fair view on the financial statements i.e. whether the financial statement prepared by the management are free from all material misstatement.

Types of Audit Opinion

- Modified: Modified Report means that financial statement prepared are materially misstated. Modified report can be of three type:

- Qualified: An audit report becomes qualified when auditor finds that financial statements are not prepared according to GAAP standards

- Adverse: This is the worst type of audit report. An adverse opinion states that the financial statement prepared are material misstated and does not give a true and fair view.

- Disclaime: This will happen when auditor is not able to give any opinion on the financial statement. This stating that an opinion upon the firm’s financial status of the company could not be determined.

- Unmodified: This is a clear audit opinion which states that Financial statement prepared are free from any material misstatement

Who Is Eligible to Appoint as a Statutory Auditor

As per the section 141 of companies Act 2013 statutory auditor of a company should be a Chartered Accountant practicing in India. In case auditee is a firm then maximum number of partner in such firm should be Chartered Accountant practicing in India.