Overview of Sole Proprietorship

A sole proprietorship is a convenient and simplified way to commence a business in India. It is neither considered as a corporation nor a company where the business is owned by a single person who is the nowner/director/shareholder of the proposed entity.

Some common examples of proprietorship business are shops such as chemist, saloons, grocery, etc.

An individual who wishes to sell his/her own products or services can run their business as a sole proprietor, and can enjoy the rights provided to a registered legal company. Most of the entrepreneurs find it as an ideal business entity and have registered their business under it. The loss or profit of the company is considered as the loss or profit of the individual and the income of the company are considered as the income of the owner as per the Income Tax Act.

Who is a Sole Proprietor?

A living individual who is the owner of the sole proprietorship firm is known as the Sole Proprietor. Moreover, he must be both an Indian citizen and also a resident. Further, a Sole Proprietor is solely entitled to all the profits earned in the firm and also solely and personally liable to bear all the losses incurred.

Hence, as per the concept of the Sole Proprietorship, there is no legal dissimilarity between the owner and business. Furthermore, it shall be relevant to take into consideration that a corporate entity is not eligible to become the Sole Proprietor of the firm.

Benefits of Sole Proprietorship Registration in Jaipur

- Start Business in One Day: Proprietorship formation is the easiest among all other business forms and can be started within one working day.

- 100% Online & Easy Process: We help small business to start their business as proprietorship firm in an entirely online environment and without any hassle.

- Ease of Compliance: The compliance requirement is significantly less, and there is no need to get the accounts audited or file any annual return.

- Easy to Close: There is no specific process to close the proprietorship firm. Simply surrender all registration and licenses and close business.

- Easy to Control & Manage: As there is no separation of ownership and control, it is considerably easy to manage and control the proprietary business.

- Tax Advantage: As the taxable income forms part of the Proprietor’s ITR, the benefit of slab based income tax is available to proprietorship.

- Limited Capital Requirements: There is minimum or limited capital requirements for sole proprietorship registration. For example, the capitalisation requirements for other forms of business entities would depend on the capital subscribed by the promoter. Depending on the owner of the business, the capital will be contributed.

Basic Requirements and Options Available for Sole Proprietorship Registration

Registering a sole proprietorship business is a digital process that can be accompanied with the help of an expert. However, a person interested in registering as a sole proprietorship requires fulfilling some basic requirements like opening a bank account in the name of the business entity, etc.

- Sole Proprietorship Registration through Udyog Aadhaar under Ministry of MSME

- Sole Proprietorship registration under Shop and Establishment Act

- Sole Proprietorship registration through GST Registration

Documents Required for Sole Proprietorship Registration in Jaipur

For all the types of registrations which are recommended for the sole proprietorship firms, the following general documents are required for most of them. There can be some exceptions for specific types of registrations. The owners are advised to check the official website of the government body issuing that registration to make sure to have all the documents required for the same.

To register a sole Proprietorship, the following documents are mandatory:

- Aadhar Card: Aadhar card number is necessary for the official registration. This is important to link business along with the other details which are linked with Aadhar card

- PAN (Permanent Account Number) card: PAN card is needed at the time of proprietorship registration to file Income Tax Returns. Thus, it is also mandatory to get a GST registration number (if applicable)

- Bank account number: The bank account linked with office transactions needs to be submitted. This can also be applicant’s personal account, if he/she do not have a separate bank account for business

- Registered office proof: The certified office proof is needed for any registration mentioned above. Registered office proof is discussed in detail above

These are the documents which are necessary for registering as sole proprietorship firm. These are the essential documents and it is recommended to check the official website for any updates and changes in the same. Once these documents are sorted, sole proprietorship firm registration goes very smooth and hassle-free.

Procedure for Sole Proprietorship Registration in Jaipur

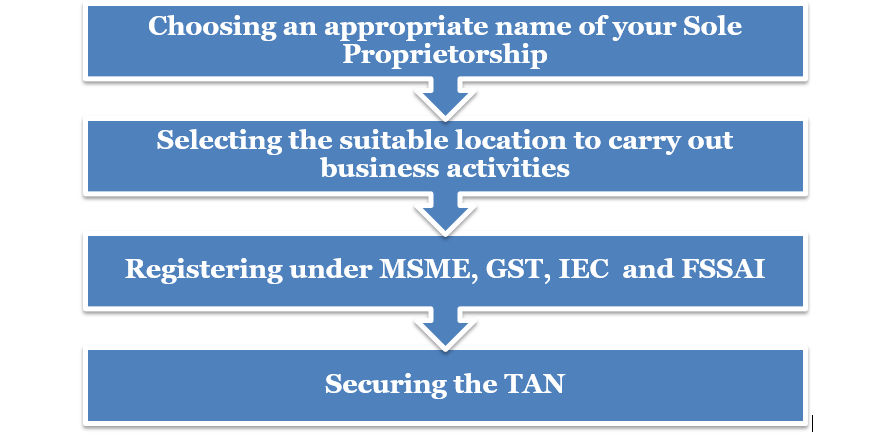

The whole process of Company registration can be divided into four steps:

-

Choose the name of the Sole Proprietorship

The first step in the sole proprietorship registration is choosing a unique name for the sole proprietorship. The name of the sole proprietorship must not go against any intellectual property laws in India. As per such the name of the sole trade, organisation must not be offensive. -

Select the Location for Carrying out Business Activities

In the next step, the sole trader requires to select the place of establishment of the business. This requirement is crucial as the sole proprietor would have to register with the relevant authority. Such authority will include the Shops and Establishments Act and Relevant Government Authorities. -

Register with the MSME

As per the MSMED Act, 2006 a sole trader or sole proprietor is required to register under the MSMED to carry out activities. The MSME (Micro, Small and Medium Enterprises) Registration or such Udyog Aadhaar registration can be secured in the name of the sole trader. This would be required to be compliant with the laws of MSMED Act. -

Register for GST

Under the Goods and Services Tax Act, 2017 traders are required to obtain registration if the turnover of the business exceeds a specific amount. Turnover would relate to the annual turnover of the business. For a service entity, if the annual turnover exceeds more than Rs. 20 Lakh then GST registration is required. For a trading business, if annual turnover exceeds more than Rs. 40 lakhs then GST registration is required. -

IEC Registration (Import- Export Code Registration)

In case the sole trader is carrying out export of goods outside India, then IEC registration has to be made by the business. This registration has to be made to the Director General of Foreign Trade (DGFT). This license would not be required in case; the sole trader is not conducting any business related to import and export of products. -

Register with the FSSAI

FSSAI registration would only be mandatory where the business is carrying out activities related to making or packaging foods products. This license would also be required if the sole trader is handling food-related products. If required, the proprietor must apply for the license from the respective authority i.e. the FSSAI (Food Safety and Standard Authority of India). -

Secure the TAN

The Tax Deduction Account number should be immediately obtained from the requisite Income Tax Authority or department. This would only be necessary, if the sole proprietor is making some form of salary payments under the TDS system (Tax Deducted At Source). Hence under sole proprietorship registration, the above would only be required in case of salary payments.

When the procedure related to sole proprietorship registration is complete, the business of trading can commence.

Post Incorporation compliances for Sole proprietorships in India

Getting registration is crucial but it is more crucial to know about the subsequent actions to be performed after getting registered. After the grant of registration one needs to maintain the accounts and facilitate the following information to the ministry at the end of each financial year.

- Like LLPs and private limited companies registered in India, proprietorships must file income tax returns. As the proprietor and the proprietorships are the same, the Proprietorship and the proprietor's income tax return filing would be the same.

- Under the Income-tax Act, all the proprietors below the age of 60 will file ITR only if the total income exceeds Rs. 2.5 lakhs. If the proprietor is over 60 years and below 80 years, he should file ITR only if his income exceeds Rs. 3 lakh.

- Proprietors over the age of 80 years are required to file income tax if the income exceeds Rs. 5 lakh.

FAQs on Sole Proprietorship

Any Indian citizen subject with a current account in the name of his/her business will begin a sole proprietorship business. Registration might or might not be needed, depending on the kind of business that’s planned to be established. However, to open a current account, banks generally need a Shops & Establishments Registration.

A Sole Proprietorship business doesn’t take more than fifteen days to set-up and begin functioning. This simplicity makes it widespread among small traders and merchants. It is also less expensive, of course. This is the reason why it is the most generally used business structure.

Generally, we can see that local businesses are run as sole proprietorships, from grocery stores to fast-food vendors, and even small traders and manufacturers. That’s not to say that larger businesses cannot operate as sole proprietorships, they can! jewelry retailers are sole proprietors, however it’s not recommended.

The procedure concerned could be a very little tedious, however it’s potential. It’s quite common for sole proprietors to convert into partnerships or private limited companies at a later stage of their businesses.

Yes, employees can be hired for sole proprietors. Small scale business entities and MSMEs get major work done through employees and laborer’s. There is no limit on the amount of work force that can be employed in a MSME.

Yes, Foreign Direct Investment is allowed in a sole trader firm. However, there are specific conditions which have to be followed for receiving foreign direct investment under sole proprietorship registration.

Yes, the name can be changed for a sole proprietorship business. The change of name has to be intimated to the public through public and government notices. Apart from this the sole trader has to inform all the respective parties for the change of name.

A name can be used for the sole proprietorship as long as it is not offensive to carrying out the business.