Overview of ITR Filing

ITR or Income Tax Return is an annual document that taxpayers in India have to file. It is a declaration of income earned by an individual, Hindu Undivided Family (HUF), company, Association of Persons (AoP), an association of individuals, etc. for a particular financial year. All taxpayers are required to file an ITR if their annual income exceeds the taxable limit prescribed by the Government of India. Filing ITR helps the government to accurately track and assess the tax liability of individuals and companies.

Why choose Banswara to file ITR?

Here are some reasons to choose Banswara to file ITR-

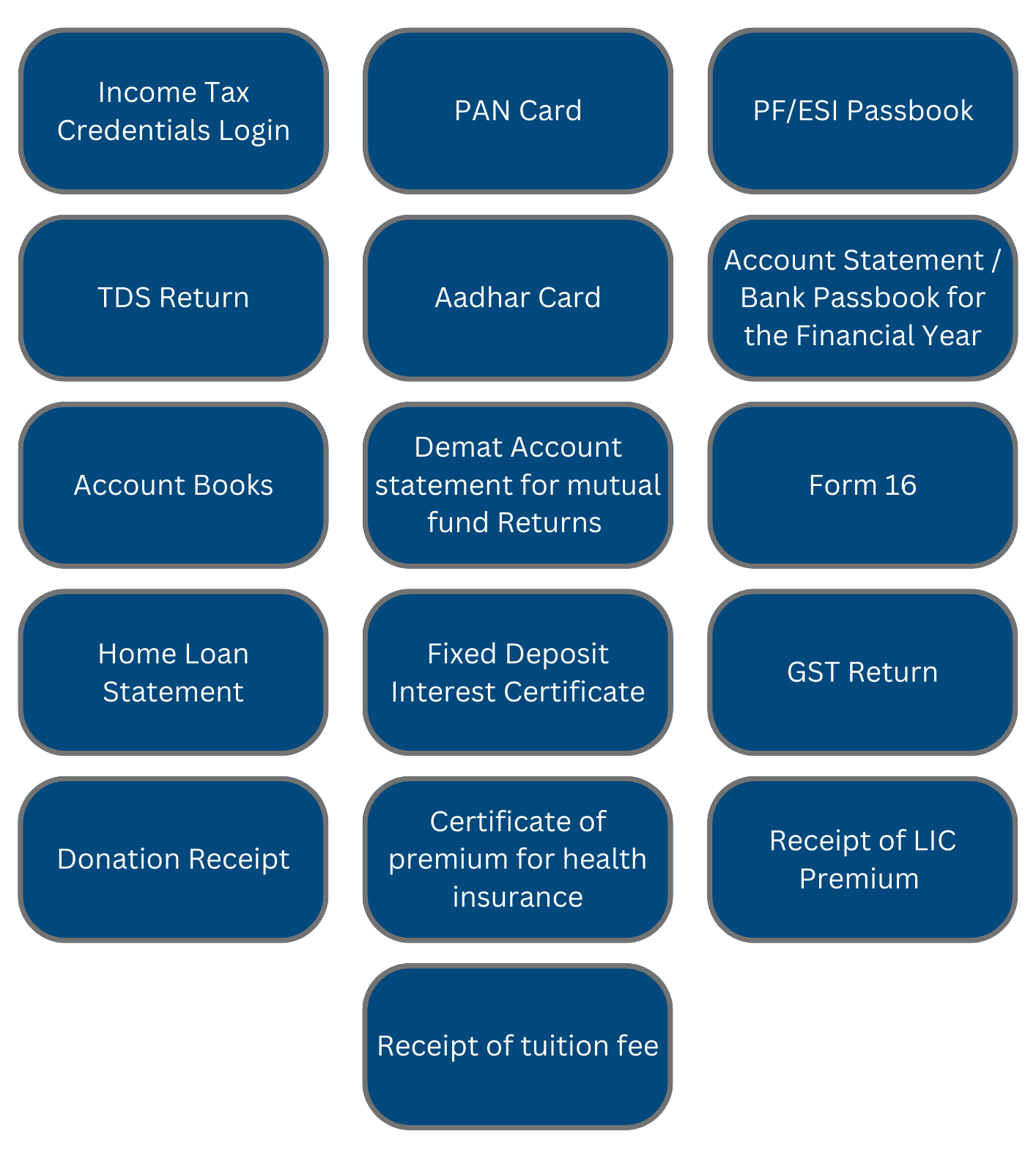

Documents and details required to file ITR/Income Tax Return

The following documents are required for ITR filing in Banswara:

- PAN card

- AADHAR card

- Complete account statement/bank passbook for the financial year

- Income tax credentials Login

- Form 16

- Real estate purchase and sale agreement

- Demat account statement for mutual fund returns

- Home loan statement

- Account books maintained by Sales Ledger, Purchase Ledger, Expense Voucher, Complete Bank Statements, Stock Ledger, Fixed Asset Ledger, Audit Report

- TDS return

- GST return

- Fixed deposit interest certificate

- Receipt of LIC Premium

- Receipt of Tuition fee

- Certificate of premium for health insurance

- Donation receipt

- PF/ESI Passbook

What is the Procedure for ITR Filing in Banswara?

-

Complete a simple questionnaire.

-

Provide us with all the necessary documents as mentioned above.

-

After analysis of all the details and after verification, we will file a tax return before the due date and protect you from any penalty.

-

After completing the ITR, we will inform you further and also provide you with the computation and return form.

Advantages of Income Tax Return Filing in Banswara

-

For Easy Loan Approval

Easy Loan Approval: Banks and NBFCs require ITR of the last three years for high-value loans, so regular tax return filing is crucial for future loan applications. -

Proof of Income

Proof of Income: The ITR confirmation form is crucial for determining an individual's net worth, income type, and taxes paid. -

Filing of ITR avoids fines

Filing of ITR avoids fines: By filing a tax return, you can avoid the penalties imposed on taxpayers who do not file a tax return by the due date. -

Claiming Refund

If you've already paid advance tax or your employer deducted TDS, you can claim a refund if the relevant authority has paid any excess taxrity. -

Required for VISA application

The ITR is a crucial document for foreign embassy applicants seeking to move abroad.

What is the penalty for failure to pay income tax?

Late filing fees for IT returns will be charged from FY 2018-19, with penalties of ₹5,000 for late filings before December 31, and ₹10,000 after December 31, with fines not exceeding ₹1000.

Income | Penalties | |

Before 31st December of AY | After 31st December of AY | |

Income below ₹5,00,000 | ₹1000 | ₹1000 |

Income above ₹5,00,000 | ₹5,000 | ₹10,000 |

Final words

The Income Tax Return (ITR) is a form for taxpayers to provide information about their income and taxes to the Department of Income Tax.