Welcome to our blog where we shed light on the concept of “Specified Employees” and their potential tax implications. In the realm of income tax regulations, Specified Employees hold a crucial position. They are individuals with a certain level of equity shareholding or voting power in a company. As we delve into this topic, we’ll explore the criteria that will actually define that Who are the Specified Employees? and how their taxation might differ from that of other employees. Join us as we demystify this aspect of the tax landscape and provide clarity on its significance for both employees and employers.

| Table of Content |

Who is Specified Employee?

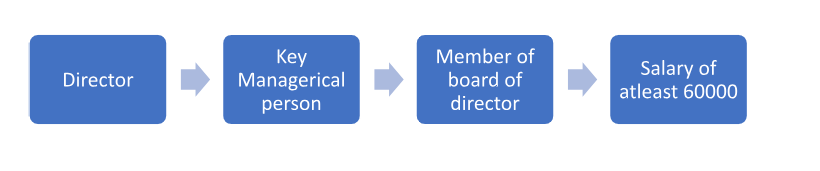

A “Specified Employee” in India is a person who:

- Is a director of the company;

- Holds a key managerial position in the company;

- Is a member of the company’s Board of Directors or Is a member of the company’s Board of Trustees;

- Holds a specified position within the organization and earns a monthly salary of at least 60,000.

Additionally, the term “Specified Employee” is defined in the Companies Act 2013 and the Income Tax Act 1961.

Salary and Wages Taxability for Specified Employees

To comprehend the taxability of salary and wages for specified employees in India, it is necessary to first define “salary” and “wages.” A salary is a fixed quantity of money paid to an employee by his or her employer, usually monthly. In contrast, wages are a variable sum of money paid by an employer to an employee, typically on an hourly basis.

Now, let us examine the taxability of salaries and compensation for specified Indian employees. The Income Tax Act of 1961 specifies the taxability of salaries and compensation for specified Indian employees. According to the Income Tax Act of 1961, an employee’s salary and compensation from a specified employer are taxable in India.

Exceptions to the rules:

- In India, salaries and wages earned from a foreign employer are not taxable.

- Similarly, salaries and wages earned by an Indian resident working abroad are not taxable in India.

- Salary and wages earned by a resident of India who works in India for less than 60 days are also not taxable in India.

- In India, salaries and wages earned by an employee who is a citizen of India but is working abroad are also not taxable.

Taxability of Bonuses and other Compensation for specified Employees

Bonuses and other forms of compensation paid to certain employees in India are subject to taxation. The 1961 Income Tax Act governs the taxability of incentives and additional compensation paid to specified employees. The Income Tax Act of 1961 defines a “specified employee” as an employee who is employed by a public sector company or a non-public sector company and whose annual compensation exceeds 1,00,000 from their employer.

If the bonus or other compensation is paid in cash, the employee must pay income tax at the applicable rate on the amount. If the bonus or other compensation is paid in the form of property, the employee must pay income tax at the applicable income tax rate on the property’s fair market value.

Determination of Stock Option Taxability for Specified Employees

Stock options’ taxability depends on the option type, exercise price, holding period, and employee tax bracket.

The option type influences how it is taxed. Consider a non-qualified stock option. When exercising, the employee pays ordinary income tax on the difference between the exercise price and the stock’s fair market value.

The employee pays capital gains tax on the difference between the exercise price and the stock’s fair market value at sale if the option is qualified. The exercise price also affects stock option taxability. The employee can buy stock at the exercise price. If the exercise price is less than the stock’s fair market value, the difference is taxed as ordinary income. If the exercise price exceeds the stock’s fair market value, the difference will be taxed as a capital gain.

Employees must wait the holding period before trading shares. The reserve must be kept for less than a year to be taxed as a short-term capital gain or loss. Long-term capital gains or losses on shares held for more than a year are taxed.

The employee’s tax categorization also affects stock option taxation. Higher tax classifications and regular income have higher tax rates than capital gains. Thus, if the option is treated as ordinary income, the employee’s tax rate will be higher than if it is capital gain.

List of perquisites that will be taxed in hand of specified employee

- Gas, electricity, or water: If purchased from an outside supplier by the employer

-

- Taxable Value = Actual amount paid or payable by employer to an outside agency minus the amount recovered from the employee.

- If offered by the employer from his own resources:

Taxable Value = Employer’s Manufacturing Cost – Amount Recovered from Employee

- Free domestic servant: Salary paid or payable to such individual – Amount recovered from employee equals Taxable Value.

- Free or concessional education: If the employer incurs expenses, the taxable value is the difference between what was spent minus what was reimbursed by the employee.

- If the education is offered in an education institution that the employer owns and maintains, the Taxable Value is equal to the cost of such education at a facility that is comparable to that in the area, less Rs 1000 per month for each child, less any money that was paid by the employee.

- The deduction of Rs 1,000 per month per child is not allowed if the education facility is offered to a family member. It is only accessible if employees’ children receive access to the educational facilities.

- If the scholarship is awarded by the business to the children of its employees exclusively at its discretion and without consideration of the employment contract, it is not deductible as a reward in the employee’s hands.

- Free transportation supplied to an employee by a transportation company is Taxable Value is calculated as follows: General Public Charges for Similar Facility – Employee Recovery.

- When the car is owned by an employee and maintenance and operating costs are covered or reimbursed by the employer

-

-

- If car is used for official purpose, then tax will be Nil if specified conditions are fulfilled.

- Actual costs expended by the employer minus amounts reimbursed by the employee if the car is used exclusively for personal purposes

- If a car is utilized primarily for personal purposes and primarily for work, then: Actual costs incurred by the employer minus a specific amount, or an amount claimed if certain requirements are met minus a sum recouped from the employee is the tax to be paid

-

- If employer hires or owns car, and employer pays or reimburses maintenance and running expenses

-

- If car is used for official purpose, then Nil tax if specified conditions are fulfilled.

- If a car is exclusively utilized for personal purposes, then then tax will be Actual costs incurred by the employer plus 10% p.a. of the actual cost of the car to the employer (if the car is owned by the employer), plus hire fees and chauffer compensation – The amount that the employee repaid

- If a car is utilized partly for personal purposes and partly for work, then Specified Amount

- When an employer owns or rents a vehicle, and maintenance and operating costs are covered by the employee themselves.

-

- If car is used for official purpose, then tax will be nil

- If a car is exclusively utilized for personal purposes Actual costs incurred by the employer plus 10% p.a. of the actual cost of the car to the employer (if the car is owned by the employer), plus hire fees and chauffer compensation – The amount that the employee repaid will be the tax amount to be paid.

- If a car is utilized partly for personal purposes and partly for work If the cubic capacity is less than 1.6 litres, the rate is Rs. 600 per hour plus Rs. 900 per hour (if a chauffeur is given). If the vehicle’s cubic capacity is greater than 1.6 litres, an additional Rs. 900 per hour will be charged (if a chauffeur is given).

- Regarding any cash that is recovered from the employee, nothing is deductible.

Conclusion

In conclusion, Specified Employees hold a distinctive status under income tax regulations, primarily due to their ownership or control over a company through equity shares or voting power. This unique classification often leads to divergent tax treatment, particularly in scenarios involving employee stock options. As we’ve explored, their tax liability can vary based on factors such as exercise timing and vesting periods. As tax laws evolve, it’s imperative for both employees and employers to stay updated on the latest provisions to ensure compliance and optimize tax planning.