The implementation of the Goods and Services Tax (GST) regime leads to significant transformation under taxation landscape. This implies that the indirect taxation system has been simplified by merging several taxes into a single category. In addition to these alterations, businesses and individuals who are registered must also comply with necessary regulations such as GST Audit & Annual Returns filing.

These procedures play a crucial role in guaranteeing visibility and responsibility within the GST system. This detailed article will explore about GST audits and the annual returns filings, in accordance with the Central Goods and Services Tax (CGST) Act of 2017.

Meaning of GST Audit

A GST audit, according to Section 2(13) of the CGST Act, 2017, there is a lot of importance of GST Audits, Section 2(13) of CGST Act, refers to the scrutiny of records, filings, and other papers kept or provided by a person registered with GST. The main objective of this audit is to ensure the accuracy of multiple elements, including: The turnover for the purpose of GST Audit is announced, and taxes are settled, with a refund requested and input tax credit taken. In addition, GST audits under CGST Act, 2017 evaluate a registered individual’s adherence to the regulations stated in the CGST Act and its related rules. Making sure that businesses and individuals who have registered are adhering to regulations and meeting their tax responsibilities accurately is a vital step in this procedure.

Types of GST Audit

- Registered individuals are responsible for conducting audits. If the registered individual’s turnover surpasses the specified threshold limits, this particular audit becomes compulsory. In particular, this is applicable to individuals or businesses whose turnover is above INR 2 crore for GSTR 9 and above INR 5 crore for GSTR 9C. In this situation, the individual who is registered performs a self assessment and files self-certified GSTR-9 and GSTR-9C.

- General Audit by GST Authorities: The General audit is carried out by Deputy Commissioners, Assistant Commissioners, or officers who have been given authorization. This is a regular check-up performed to guarantee conformity to GST laws and regulations. Audit of particular significance. There is a time limit for GST Audit by department.

- Special Audit by GST authorities: Chartered Accountants (CAs) designated by Deputy Commissioners, Assistant Commissioners, or authorized officers’ conduct specific audits. Taxpayer’s financial records are subjected to scrutiny by authorities if there are doubts or complications regarding their accuracy or compliance. Special audits frequently entail a comprehensive analysis of the financial statements and transactions.

Special Audit Key Points

Special audits, as their name implies, are unique and commence in specific situations. There are important points to consider when it comes to special audits.

- Section 65(3): The individual who has been registered receives an official notification regarding a unique audit via a written notice. Stating a minimum requirement of 15 days prior notice, usually given in the form of GST ADT-01, this notification is stipulated.

- Section 65(4): Special audits should be finished within a three-month timeframe starting from the commencement date. Nevertheless, if the Commissioner deems it necessary, there is an option to prolong the extension for up to six months. When such situations occur, it is necessary to document the reasons for the extension in written form.

- Section 65(6): Report on the Audit: This document outlines the results of the special audit. The conclusions and findings of audit will be in the audit report. The designated audit officer after audit completion must notify using Form GST ADT -02 to a registered person.

Annual Return Filing under CGST Act

As per CGST Act filing of Annual return is a mandatory compliance. The annual return needs to be filed by December 31 st of the following financial year by each registered person who needs to file annual return. The annual revenue is a comprehensive overview of the registrant’s activities, including financial transactions and compliance with his GST rules and regulations. There is a GST annual return eligibility and GST annual return limit that’s discussed below.

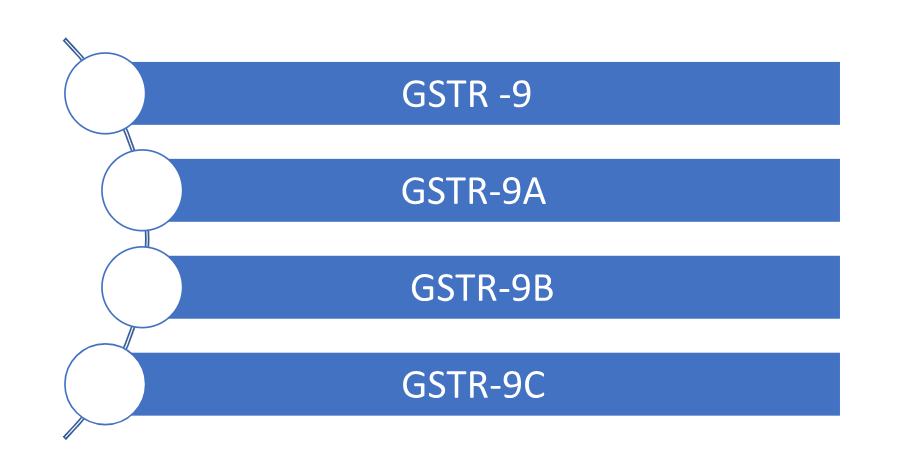

GST Audit Form & Annual Return Form

The specific form for filing a GST annual return depends on the type of registration and annual turnover.

The main forms used for annual tax returns and GST audits are:

- GSTR 9: This form is used to file the annual tax return of an individual who is registered with the scheme and whose turnover exceeds his Rs. 2 Crore

- GSTR 9C: GSTR 9C is applicable to those who are registered under the regular regime and whose turnover exceeds her Rs. 5 Crores. This includes making a declaration of reconciliation.

- GSTR 9A: Composition scheme registered person need to compulsory file GSTR.

- GSTR 9B: E-commerce businesses with an annual turnover of more than Rs 5 crore need to file GSTR 9B. This form also includes filing a declaration of settlement.

- It is important for a registrant to note that irrespective of whether he has opted for a structure scheme or not, he may be required to file both GSTR 9 and GSTR 9A for the relevant period.

Annual Return Filing

As per section 44 of CGST Act 2017 all the registered person needs to file annual return, but as all rules and sections have exemptions this section also has certain exemptions that are mentioned below.

- Person taxable under Section 51 (TDS deductor): The person deducting TDS under section 51 of CGST Act 2017 need not to file annual return.

- Person taxable under Section 52 (TDS Collector): Asper Section 52 of CGST Act 2017, the person liable to collect tax at source will be exempt from annual return filing.

- Input Service Distributor: The input on credit paid on services are distributed to branches by these entities (Input Service Distributor) , these kinds of entities are not required to file annual return.

- Casual Taxable Person: The entities and individuals who registered themselves as a casual taxable person are not obliged to file annual return.

- Non resident taxable Person: The person who registered themselves as non- resident taxable person although for a limited period are not required to file Annual Return.

Levy of Late Fees

Any registered person who fails to submit annual return by due date will be liable to pay late fees. The late fees are Rs. 100 per day subject to max 0.25% of the turnover of the registered person for the respective union territory and state. In case of combined late fees that are of IGST and SGST the late fees will be Rs. 200 per day subject to 0.50% of the turnover of the registered person in the state or union territory.

Takeaway

In summary, dealing with GST audit & annual returns under the CGST Act requires a clear grasp of the rules. Businesses must handle these tasks carefully, making sure to keep accurate records and meet legal deadlines. By making GST audit and annual returns more understandable, we’re not just bringing clarity to financial dealings but also supporting a smooth tax system. This, helps create a business environment that is both compliant and strong.