“Understanding Audit Report Auditors play a crucial role in upholding transparency, accountability, and financial accuracy within the complex landscape of corporate governance. As businesses continue to evolve and expand, the regulatory framework adapts to ensure equitable business practices and accurate financial reporting. This blog explores the key roles & responsibilities of auditor under Companies Act 2013, including how their diligent scrutiny contributes to preserving the integrity of financial operations and nurturing investor confidence.

| Table of Contents |

Meaning of an Auditor

As per the Companies Act 2013, an auditor is an independent and qualified professional appointed to examine and verify a company’s financial statements, records, and transactions. This individual’s role is to assess the accuracy, fairness, and compliance of the company’s financial information with relevant accounting standards and legal regulations. The Understanding Audit Report auditor’s responsibility extends beyond mere number-crunching; they are entrusted with the task of providing an unbiased and objective assessment of the company’s financial health, internal controls, and overall transparency. Their insights play a pivotal role in maintaining the integrity of financial reporting, fostering investor confidence, and upholding the principles of corporate governance. When a company appoint an Auditor, they need to follow certain criteria and a person that can be appointed as an auditor has certain qualifications & disqualifications.

Duties and Responsibilities of an Auditor

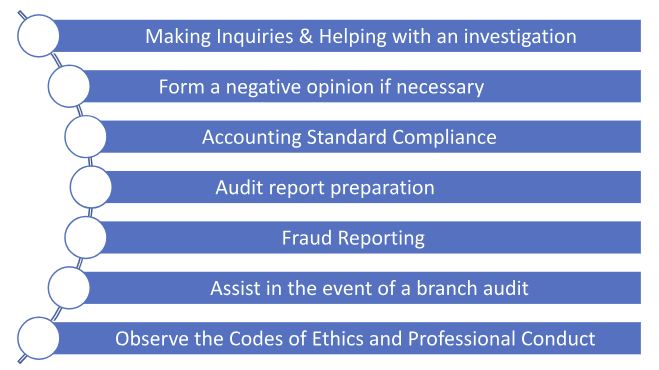

The Companies Act 2013 outlines several key duties and responsibilities for auditors to ensure accurate and reliable financial reporting. These include:

- Audit report preparation: A straightforward definition of an Understanding Audit Report is an evaluation of a company’s financial position. The auditor is accountable for preparing an audit report based on the company’s financial statements. The books of account he examines must be kept in accordance with the applicable laws. He must ensure that the financial statements adhere to the applicable provisions of the Companies Act of 2013, relevant Accounting Standards, etc

- Form a negative opinion if necessary: Due to the auditor’s opinion on the financial statements, the auditor’s report provides a prominent level of assurance and dependability. If the auditor believes that the financial statements do not present a true and fair picture of the company’s financial position, he may also develop a negative opinion.

- Make inquiries: An essential responsibility of the auditor is to conduct inquiries as he deems necessary. Some of them are, whether loans and advances secured by collateral are secured and their terms are reasonable, whether personal expenses (non-business-related expenses) are charged to the Revenue Account, and Compliance of the financial statements with applicable accounting standards.

- Assist in the event of a branch audit: If the auditor is the branch auditor rather than the company’s auditor, he will assist in the completion of the branch audit. He will compile a report based on his examination of the branch’s accounts and then forward it to the company auditor.

- Accounting standard compliance: The Central Government, in consultation with the National Financial Reporting Authority, issues the Auditing Standards. These standards facilitate the auditor’s performance of his audit duties with the requisite comfort and precision. It is the responsibility of the auditor to adhere to the standards while performing his duties, as doing so increases his overall efficacy.

- Fraud Reporting: While performing his duties, the auditor may develop certain suspicions regarding fraud occurring within the organization, such as situations in which the financial statements and the numbers contained therein do not add up. Whenever he finds himself in such circumstances, he must promptly report the matter to the Central Government in accordance with the Act.

- Observe the Codes of Ethics and Professional Conduct: As a professional, the auditor must abide by the Code of Ethics and the Code of Professional Conduct. This includes maintaining confidentiality and exercising care in the performance of his duties. Another crucial requirement is professional scepticism. In layman’s terms, the auditor must be inquisitive and watchful for potential mistakes, errors, and forgeries in the financial statements.

- Help with an investigation: If the company is the subject of an investigation, it is the auditor’s responsibility to provide the necessary assistance to the investigating officers. Thus, the auditor’s responsibilities are quite varied, and that their impact is global and far-reaching. A set of audited financial statements provides significantly greater assurance than a set of regular unaudited financial statements.

Types of Auditors & their roles

Under the Companies Act 2013, there are different types of auditors, each with specific roles and responsibilities. Here are the main types of auditors and their respective roles:

- Statutory Auditor: A statutory auditor is appointed by the company’s shareholders during the annual general meeting (AGM) to conduct an independent examination of the company’s financial statements and express an opinion on their accuracy and fairness Understanding Audit Report

- Internal Auditor: the company employs an internal auditor to assess and evaluate the effectiveness of internal controls, risk management processes, and operational procedures.

Cost Auditor: A cost auditor is responsible for examining the company’s cost records and verifying the accuracy of cost accounting records. - Secretarial Auditor: A secretarial auditor evaluates the compliance of the company’s secretarial and legal requirements as per the Companies Act and other applicable law.

Government Auditor: Government authorities appoint A government auditor to audit certain government-owned companies or entities.

External Auditor: An external auditor may be an independent contractor or an employee of an auditing firm. They are hired by businesses to conduct annual audits of specific departments or the entire organization. - Forensic auditors: The regulatory bodies hire forensic auditors to collect evidence from companies accused of financial misconduct. The reports of forensic auditors are admissible as evidence before both federal and state courts. Forensic auditors investigate various aspects of financial misconduct.

These distinct types of auditors fulfil distinct roles within an organization, contributing to financial transparency, regulatory compliance, risk management, and overall governance. Their collective efforts help maintain the integrity of financial reporting and ensure the smooth functioning of businesses under the Companies Act 2013.

Takeaway

In conclusion, the function of the auditor under the 2013 Companies Act represents a crucial partnership between regulatory compliance and financial prudence. As the guardians of accurate reporting, auditors ensure that a company’s financial statements accurately reflect its health, performance, and legal compliance. Their impartial evaluation and ethical behaviour bolster the credibility of financial markets and inspires the trust of stakeholders. Auditors contribute to a corporate landscape built on integrity, accountability, and sustainable growth by performing their duties with diligence.