The time limit for issuing invoices under Goods and Services Tax (GST) is a crucial aspect of businesses. Understanding these time limits is essential for businesses to maintain compliance and build a seamless GST workflow. From the supply of goods to the provision of services, each transaction type carries its own set of rules when it comes to issuing invoices within the prescribed time frame. By understanding these requirements, businesses can ensure proper documentation, accurate record-keeping, and a streamlined approach to their GST-related activities. In this article, we will explore the significance of Time Limit for Issuing Invoices under GST regime.

What do you understand by the Issue of Invoices under GST?

The term “issue of invoice under GST” refers to the process of generating and providing an invoice document for a transaction conducted under the GST system in India. It is a crucial step in the business transaction cycle as it serves as a legal document that captures the details of the supply of goods or services, the corresponding taxes, and other relevant information.

When a registered supplier sells goods or provides services to a recipient, then need to issue an invoice that complies with the invoicing requirements outlined by the GST law. The invoice includes key details such as the supplier’s and recipient’s information, invoice number, date of issue, description of goods or services, quantity, value, applicable tax rates, and the amount of tax charged.

Time Limit for the Issue of Invoice Under GST

- Time Limit to Issue GST Invoice in Case of Supply of Goods

In the case of a supply of goods under the GST system in India, the time limit for issuing an invoice depends on the circumstances of the transaction. Here are the general guidelines:

- Regular Supply of Goods: For a regular supply of goods where the goods are delivered or removed, the invoice should be issued before or at the time of removal or delivery of goods to the recipient. The term “removal” refers to the movement of goods from the place of business of the supplier.

- Supply of Goods by Unregistered Persons: If the supplier is an unregistered person and is making a taxable supply to a registered person, they need to issue an invoice before or at the time of delivery of goods.

- Continuous Supply of Goods: In the case of continuous supply of goods, where successive statements of accounts or successive payments are involved and the due date of payment is ascertainable from the contract, the invoice should be issued on or before the due date of payment. If the due date is not ascertainable, the invoice should be issued before or at the time of receipt of payment.

- Time Limit to Issue GST Invoice in Case of Supply of Services – In the case of a supply of services under the GST system in India. The time limit for issuing an invoice is generally as follows:

- Regular Supply of Services: For a regular supply of services, the invoice should be issued within 30 days from the date of supply of services. The date of supply of services is generally considered to be the date of completion of the service. As per the terms of the contract or the date of receipt of payment, whichever is earlier.

- Banking Companies and Financial Institutions: In the case of banking companies or financial institutions, the time limit for issuing an invoice is extended to 45 days from the date of supply of services.

- Time Limit to Issue Credit Note and Debit Note

Under the GST system in India, there are specific time limits for issuing credit notes and debit notes. The time limits for issuing credit notes and debit notes are as follows:

- Credit Note: Issuance of credit note, when there is a reduction in the value of the original invoice or a decrease in the tax amount charged. The time limit for issuing a credit note is as follows:

- Credit Note for Goods: A credit note for goods should be issued by the supplier within the:

- The due date of furnishing the annual return for the financial year to which the invoice relates.

- The date of filing the relevant annual return.

- The date of filing the monthly return for September of the subsequent financial year, or

- The date of filing the annual return of the subsequent financial year, whichever is earlier.

- Credit Note for Services: A credit note for services should be issued by the supplier before:

- The due date of furnishing the annual return for the financial year to which the invoice relates.

- The date of filing the relevant annual return.

- Debit Note: Issuance of a debit note, when there is an increase in the value of the original invoice or an increase in the tax amount charged. The time limit for issuing a debit note is as follows:

- Debit Note for Goods or Services: A debit note should be issued by the supplier before the due date of furnishing the annual return for the financial year. In that the supply was made or the date of filing the relevant annual return, whichever is earlier.

Advantages of Time Limit for the Issue of Invoice Under GST

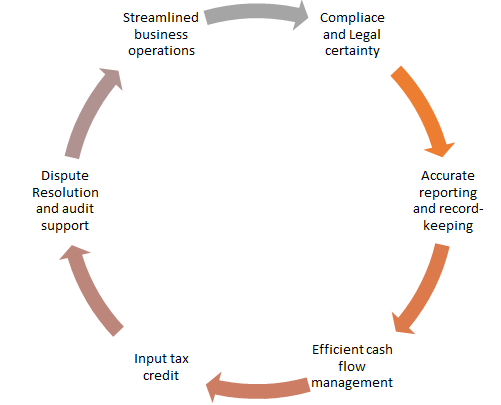

There are several advantages to having Time Limit for Issuing Invoices under GST system. These advantages include:

- Compliance and Legal Certainty: Time limits for issuing invoices provide clear guidelines. Also, it ensures businesses comply with the legal requirements of the GST framework. By adhering to these time limits, businesses can avoid penalties and legal complications, enhancing their compliance efforts and maintaining legal certainty.

- Accurate Reporting and Record-Keeping: Timely issuance of invoices enables businesses to maintain accurate records of their transactions. It ensures that all relevant information is captured on time. Such as the details of the supply, tax rates, and amounts charged. This accuracy facilitates seamless tax reporting, reduces errors, and enhances the integrity of financial records.

- Efficient Cash Flow Management: The timely issuance of invoices ensures that businesses receive payments promptly. This helps in managing cash flow effectively, as businesses can track and reconcile their receivables more efficiently. Prompt invoicing also reduces the risk of delayed or missed payments, improving financial stability.

- Input Tax Credit (ITC) Availability: The time limits for issuing invoices are essential for recipients to claim ITC. Timely invoicing ensures that recipients have the necessary documentation to validate their ITC claims. Along with that the offset of their tax liability against the tax paid on their purchases. This promotes a smooth flow of ITC within the supply chain and encourages compliance.

- Dispute Resolution and Audit Support: In case of any disputes or discrepancies, the timely issuance of invoices provide a clear reference point for reconciliation and resolution. It helps in demonstrating the accuracy and authenticity of the transaction details, making it easier to resolve any disagreements.

- Streamlined Business Operations: Adhering to time limits for issuing invoices promotes efficient business operations. It ensures that invoicing processes are well-managed and timely, minimizing delays in transactions and maintaining a smooth workflow. Streamlined operations enhance customer satisfaction, build trust, and contribute to overall business growth.

Takeaway

Through the above-mentioned information, we can say that by issuing invoices within the prescribed time frames. Businesses can demonstrate their commitment to transparency, build trust with customers, and establish a smooth workflow within the GST framework. Timely invoicing also enables effective cash flow management. As it ensures that businesses receive payments promptly and can reconcile their accounts more efficiently. Understanding the specific time limits for different types of transactions, such as the supply of goods, services, or continuous supplies. It is crucial for businesses to meet their compliance obligations.