Introduction

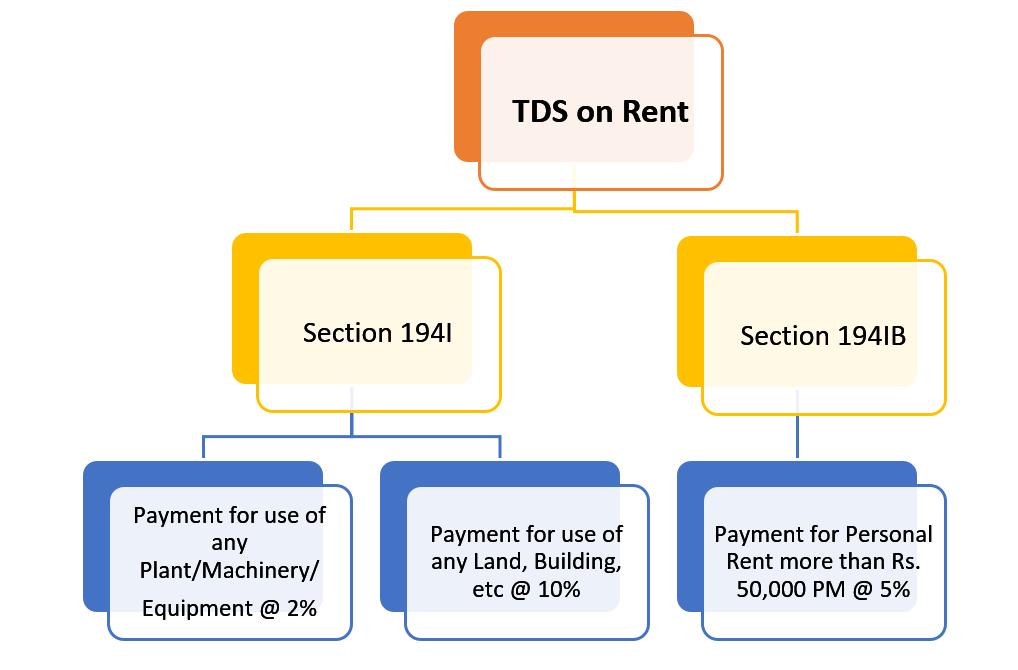

Section 194IB is introduced under Finance Act 2017, which states that TDS will be deducted, if rent payment exceeds Rs 50,000 per month or part of the month is made. If Salaried person is paying rent more than Rs. 50,000 per Month and claiming HRA then he is also required to deduct and pay TDS of Landlord.

| Table of Content |

Applicability

As per the provisions of Income Tax Act, this section is applicable on an individual or a Hindu undivided family who are not required to have tax audit as per Income Tax Act, 1956 in immediately preceding FY.

Provisions under section 194 IB

- TDS to be deducted @5%.

- If PAN of recipient is not available then tax is deductible @20% and in this case amount of TDS cannot exceed rent payable for the last month of the previous year or last month of tenancy.

- The above said tax shall be deducted:

- when rent paid for the last month of the previous year or

- the last month of tenancy, if the property is vacated during the year is booked in books of accounts, or

- at the time of payment,

whichever is earlier.

- The tax deductor is not required to apply for TAN in order to deduct TDS U/S 194IB. CBDT has notified form 26QC filling return, which is PAN based under this section. Form 26QC has to be submitted along with challans within 30 days from the end of month in which TDS has been deducted.

- Form No. 16C is the certificate of deduction of tax & it has to be submitted to the payee within fifteen days from the due date for furnishing the challan-cum-statement.

What if you do not comply with provisions of sec 194 IB?

- If you do not comply with the provisions of sec 194 IB then there are several existing and newly inserted penalties against non- compliance. These are as follows:

-

- General provisions:

- If you don’t deduct TDS then penalty interest @ 1% p.m. can be levied on you and period will be taken from the date tax needs to be deducted till it is deducted.

- If tax is deducted by you but not paid to government within specified time then penalty interest @ 1.5% p.m. can be levied on you and period will be taken from the date tax is deducted till it is paid.

- General provisions:

-

- Specific provisions:

- Penalty of Rs 200 per day may be levied on you if you get delayed in filing of Form 26QC.

- Penalty of Rs 100 per day may be levied on you in case of late issuance of TDS certificate.

- Specific provisions:

In both the cases, the amount of penalty cannot exceed the amount of TDS.