As businesses navigate the complex landscape of goods and services tax (GST) compliance in several countries. One of the significant aspects that demand attention is the timely and accurate filing of GST returns. In terms of India, one such return that employers require to familiarize themselves i.e., the In terms of India, one such return that employers require to familiarize themselves i.e., the Simplifying GSTR-7 Return Filing. It is a specific return form that a person requires to deduct tax at source (TDS) and applies under the GST regime. In this article, we will be going to understand the GSTR-7, GSTR-7 return filing process under GST, eligibility criteria, necessary documents and its benefits.

| Table of Content |

What do you mean by GSTR-7?

GSTR-7 is a return form under the GST system in India. It is mainly designed for businesses or individuals who are needed to deduct tax at source under the GST regime. The purpose of GSTR-7 is to capture details related to TDS deducted, paid and any adjustments made during a particular period. It helps in maintaining transparency and accountability in the TDS process and ensures the smooth flow of tax revenues to the government.

Entities such as government departments, local authorities, and certain other specified persons are mandated to file GSTR-7. They are required to furnish information about the TDS deducted and deposited to the government, along with details of the deductee or the person from whom the tax has been deducted. By filing GSTR-7 accurately and within the specified time frame, businesses and individuals fulfil their compliance obligations and contribute to the effective implementation of the GST system.

Who can be eligible for GSTR-7 Return Filing?

GSTR-7 is specifically applicable to entities that are required to TDS under the GST regime in India. The following entities are obligated to file GSTR-7:

- Government departments: Any department or establishment of the Central or State Government, including local authorities, is required to file GSTR-7 for TDS deductions made under GST.

- Local authorities: Entities such as municipalities, panchayats, development authorities, or any other statutory or non-statutory local bodies that are considered local authorities under the GST laws must file GSTR-7.

- Other specified persons: Apart from government departments and local authorities, certain other persons or categories as notified by the government may also be required to file GSTR-7. These specified persons are typically involved in making TDS deductions under GST.

It is important for the entities falling under the above categories to comply with the In terms of India, one such return that employers require to familiarize themselves i.e., the Simplifying GSTR-7 Return Filing. requirements and accurately report the details of TDS deductions and deposits within the specified time frame.

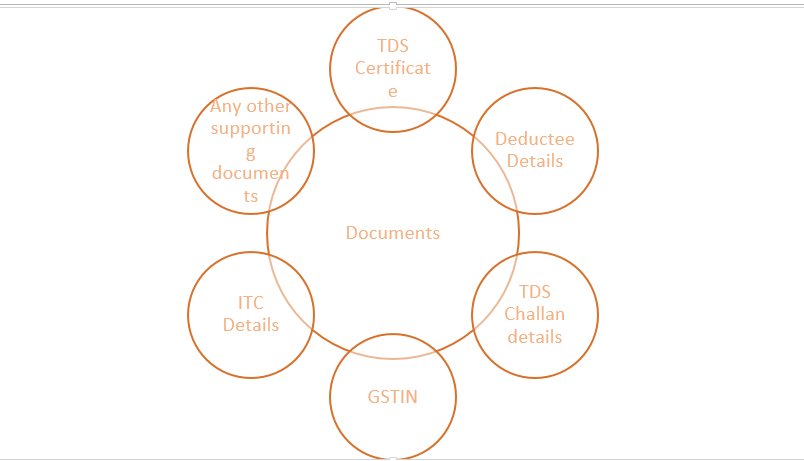

Necessary documents required for GSTR-7 Return Filing

When filing a GSTR-7 return under the GST system in India, you may need to have the following documents and information readily available:

- TDS Certificates: You should possess the TDS certificates issued by the deductor, which provide details of the tax deducted at source.

- Deductee Details: Information about the deductee or the person from whom the tax has been deducted, including their name, address, and GSTIN (Goods and Services Tax Identification Number), should be collected and maintained.

- TDS Challan Details: The details of the challans generated for TDS payments made to the government should be maintained. This includes the challan number, date of payment, and amount paid.

- GSTIN: Ensure that you have the GSTIN of your business or entity, as it’s requirement for the GSTR-7 return filing.

- Input Tax Credit (ITC) Details: If applicable, maintain records of ITC claimed on the TDS amount. As it may impact the overall tax liability.

- Any Other Supporting Documents: Depending on the specific transactions and deductions made, you may need to keep other relevant documents, such as invoices, agreements, or contracts related to the TDS deductions.

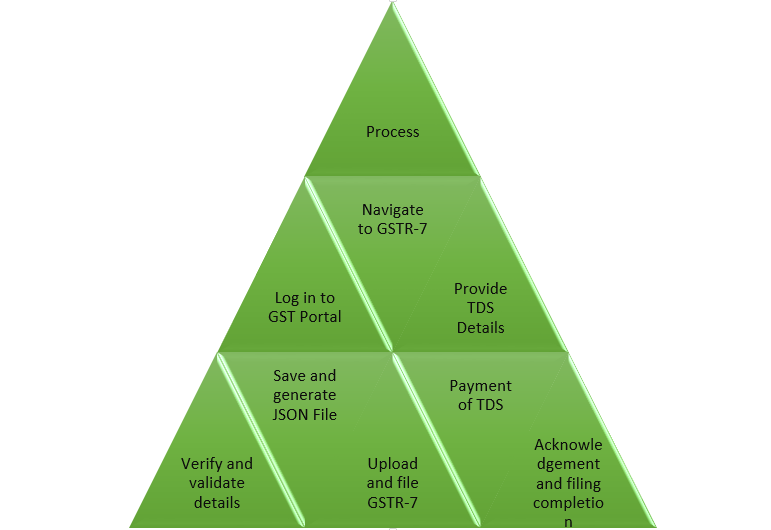

Step-by-Step guidance in the GSTR-7 Return Filing process under GST

The process of filing a GSTR-7 return under the GST system in India involves several steps. Here is a general overview of the GSTR-7 return filing process:

- Log in to the GST Portal: Visit the official GST portal and log in using your credentials (username and password).

- Navigate to GSTR-7: Once logged in, navigate to the “Returns Dashboard” section. Then select the financial year and the tax period for which you want to file the GSTR-7 return.

- Provide TDS Details: In the GSTR-7 return form, you need to furnish the details of the TDS deducted, paid, and any adjustments made during the specified period. This includes the GSTIN of the deductee, the amount of TDS deducted, and the amount of TDS deposited.

- Verify and Validate Details: Review the information provided in the GSTR-7 return form for accuracy and completeness. Ensure that all the necessary fields are filled in correctly.

- Save and Generate JSON File: After verifying the details, save the GSTR-7 return form and generate the JSON file. This file will be used for uploading the return data to the GST portal.

- Upload and File GSTR-7: Upload the generated JSON file on the GST portal and submit the GSTR-7 return. Once submitted, a success message and an acknowledgement will be displayed.

- Payment of TDS: If there is any outstanding TDS amount, make the payment through the appropriate mode of payment. Such as net banking, debit card, or credit card. After the payment is successfully made, update the payment details in the GSTR-7 return.

- Acknowledgement and Filing Completion: Once the successful accomplishment of GSTR-7 return filing. Along with that the payment details are up to date; an acknowledgement receipt will be generated. This serves as proof of filing the return.

Advantages of GSTR-7 Return Filing

- Compliance with TDS Provisions: GSTR-7 enables businesses and entities required to TDS to fulfil their compliance obligations under the GST regime. By accurately reporting and depositing the TDS amounts, businesses ensure compliance with the TDS provisions of GST laws.

- Transparent TDS Process: GSTR-7 promotes transparency in the TDS process by capturing and documenting details of TDS deductions, payments, and adjustments made during a specific period. This enhances accountability and helps establish a clear trail of TDS transactions between deductors and deductees.

- Streamlined TDS Reconciliation: Filing GSTR-7 facilitates the reconciliation of TDS amounts between the deductor and the deductee. The deductee can verify the TDS deductions made by the deductor and reconcile them with their records. This reduces discrepancies and promotes smoother transactions between the parties involved.

- Seamless ITC Claim: Deductees can claim an ITC for the TDS amounts deducted and reported in GSTR-7. By Simplifying GSTR-7 Return Filing accurately, deductees can ensure the proper claim of ITC. That helps offset their overall GST liability and reduces the cost of doing business.

- Improved Compliance Management: GSTR-7 return filing contributes to better compliance management for businesses and entities involved in TDS. It allows for the timely and accurate reporting of TDS-related information. Like reducing the risk of penalties, interest, or other consequences of non-compliance.

- Integration with GST Network (GSTN): GSTR-7 return filing is seamlessly integrated with the GSTN, the IT backbone of the GST system in India. This integration enables efficient data processing, validation, and verification, ensuring accurate reporting and facilitating smooth tax administration.

Takeaway

Through the above-mentioned information, we can say that Simplifying GSTR-7 Return Filing plays a crucial role in the GST compliance framework, specifically for entities required to TDS. By adhering to the GSTR-7 filing process and requirements, businesses can experience several benefits. Firstly, GSTR-7 ensures compliance with TDS provisions, enabling businesses to fulfil their obligations under the GST regime. It promotes transparency in the TDS process by capturing and documenting details of deductions, payments, and adjustments, fostering accountability between deductors and deductees.