Rules 30 of The Companies (Incorporation) Rules, 2014 and Section 13(4) of the Companies Act, 2013 provide provisions and guidelines about moving the registered office from one state to another.After detailed analysis of provisions of law and practical procedures we have given the following process for shifting of registered office from one state to another. It may be noted that shifting of registered office from one state to another state also involves shifting from jurisdiction of one ROC to another ROC except the case where two states have common ROC example Delhi & Haryana.

| Table of Content |

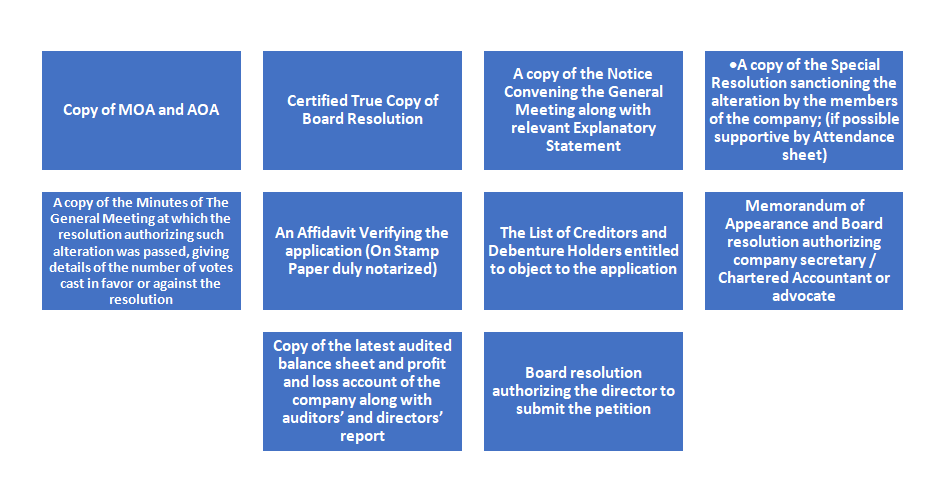

Checklist to Shift Registered Office from One State to Other

Following is the checklist for changing Registered Office from one state to another.

Process of Shifting of Registered office from One State to Another as per Companies Act, 2013

Step 1: Conduct a Board Meeting to pass the following resolutions: –

-

- Transferring the Registered Office to a Different State

- Modification of Clause II of the Company’s Memorandum of Association (MOA)

- Set the date, time, and location of the general meeting so that shareholders can approve the aforementioned two agenda items.

Step 2: Call an extraordinary general meeting.

Accompanying approval of both agendas, which include changing the office and amending Clause II of the MOA as special resolutions, file E-form MGT-14 with the accompanying documents/attachments to the Registrar of Companies within 30 days of the general meeting. –

Adds by > Special Resolution(s) copy(s) and explanatory statement copy under section 102 > Modified MOA.

Step 3: Compile a list of all creditors and debenture holders, if any, no later than one month before the application date (INC-23). This list should include the following details:

-

- The company’s creditors’ names and addresses; the types of debts, claims, and obligations owed to them, together with the corresponding sums owed:

- The list should be properly validated through an affidavit and validated by the company’s Statutory Auditors. Additionally, the List will always be available for viewing at the Registered Office.

Step 4: Publicize a notice in Form No.INC.26 in the primary vernacular newspaper of the district where the company’s registered office is located, as well as one in English in an English newspaper (with broad circulation) in the state where the company’s registered office is located.

Following publication, a copy of the advertisement must be served by registered post to the Central Government (now the RD office) and the following parties, with an acknowledgement due:

-

- An individual notice in accordance with Rule 30(5)(b) must be sent to invite objections from creditors and debenture holders, if any, no later than 30 days prior to filing of INC-23;

- A notice together with the copy of application/petition as per Rule 30(5)(c) to the RoC, SEBI [If applicable], Chief Secretary of the concerned State Government and any other concerned regulatory authority not more than 30 days before filing of INC-23.

Step 5: The application or petition must be sent in e-form GNL-1 to the ROC along with the following attachments and documents: –

-

- The comprehensive application or petition, which needs to be serially numbered.

- evidence that the application was served to the Chief Secretary.

Step 6: Within a month after receiving the list of creditors, file E-form INC-23 for application to R.D. with the accompanying attachments and documents:

-

- A copy of the association’s memorandum;

- A certified true copy of the special resolution endorsing the modification;

- A copy of the general meeting minutes containing the resolution approving the modification;

- A board decision, power of attorney, or vakalatnama;

- An affidavit attesting to the fact that no employees have been laid off;

- A copy of newspaper advertisements;

Completing INC-22 and INC-28 Forms

After obtaining a certified copy of the order verifying the change of registered office, the applicant has thirty days to submit an E form INC-28 with the registrar for the order registration passed by the Regional Director.

Within 15 days of the new registered office’s confirmation, the notification of change of registered office in E Form INC-22 must be sent, along with the following supporting documentation and any necessary fees:

-

- A document attesting to the registered office’s location.

- A lease or rental agreement under the company’s name accompanied by a notarized rent receipt.(less than a month old)

- Use of the space as the registered office requires the owner’s NOC.

- The property’s utility statement.

Conclusion

Under the Companies Act of 2013, changing the registered office involves the government, the firm, and a drawn-out documentation process that must be finished before the change in registered office may take place. As a result, the process can be complicated and time-consuming. A Special Resolution needs to be passed by the company at the EGM in order to transfer the registered office from one state to another and modify the business’s articles of association. The registered office and the MOA will be changed, and Form MGT-14 must be filed to the ROC within thirty days of the Special Resolution’s adoption.