Incorporation of Section 8 company in Delhi through the MCA V3 portal is a significant step for individuals and organizations looking to promote charitable and non-profit activities. Section 8 companies are specially designed for social welfare and not for making profits. The MCA V3 portal rationalize the process, making it easier for individuals to establish an entity with a focus on giving back to society. This blog will help us in gaining knowledge regarding Section 8 Company Registration in Delhi incorporation through MCA V3 Portal.

Table of Contents

Overview

The Ministry of Corporate Affairs (MCA) has recently transferred several E-forms for companies and limited liability partnerships (LLPs) from the V2 portal to the V3 platform. The MCA V3 portal can be understood as an enhancement of the existing portal, referred to as V2. The primary objective of the V3 repetition is to improve the user interface of the MCA portal and facilitate seamless submission of E-forms. As of January 23rd, 2023, all forms pertaining to incorporation have been transferred to the V3 portal.

Meaning of Section 8 Company

A Section 8 corporation is a distinct form of entity The primary objective of formation of Section 8 Company Registration in Delhi is to contribute positively to society rather than prioritize financial gains. These companies are engaged in many sectors such as education, charitable giving, social welfare, and other related areas. One approach to addressing these problems involves the collection of financial and material resources. The generated revenues, if existent, are not allocated to the proprietors; rather, they are reinvested to further promote positive outcomes. This approach can be considered a legitimate means of establishing a non-profit entity with the purpose of aiding individuals or communities in need.

Process of incorporation of Section 8 Company through MCA V3 Portal

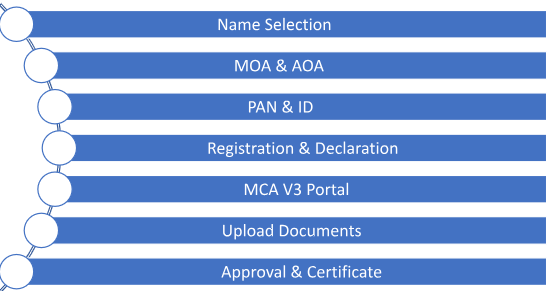

Certainly, incorporating a Section 8 company in Delhi through the MCA V3 portal means starting a non-profit organization. The procedure for incorporation of section 8 company is:

- Name Selection: First, choose a name for your organization. Make sure it includes words like “Foundation” or “Association” as required for Section 8 companies.

- Memorandum and Articles: Prepare the Memorandum of Association (MOA) and Articles of Association (AOA) if you haven’t already. These documents outline the purpose and rules of your organization.

- PAN and ID: Ensure that the people involved have PAN (Permanent Account Number) and proper identification.

- Registered Office: You’ll need a registered office for your organization. Make sure you have a notarized rent agreement, a No Objection Certificate (NOC) from the property owner, and a recent utility bill for the Section 8 Company Registration in Delhi premises.

- Declarations: Prepare a declaration (Form INC 15) from all the directors and a declaration (Form INC 14) from a Chartered Accountant. These are important for the incorporation process.

- MCA V3 Portal: Visit the MCA (Ministry of Corporate Affairs) V3 portal. It’s an official government website for company-related matters.

- Upload Documents: There are section 8 company incorporation documents Create an account on the portal and upload all the necessary documents, including the MOA, AOA, declarations, and other required information.

- Approval: Once you’ve submitted everything, your application will go through a review process. If everything is in order, the authorities will approve your Section 8 company.

- Certificate: After approval, you’ll receive a Certificate of Incorporation, which officially recognizes your Section 8 company.

Changes done in SPICe + PART A in MCA V3 Portal

- The NIC code of 2008 was implemented to provide the option of selecting three business activities using a five-digit code.

- To ensure compliance with The Companies (Incorporation) Rules of 2014.Various checks, business rules, and trademark validations have been implemented at the field office level

Changes done in SPICe + PART B in MCA V3 Portal

- The introduction of electronic Memorandum of Association (e-MOA) and electronic Articles of Association (e-AOA) for section 8 corporations has been a significant development in the corporate sector.

- The INC-3 form has been developed, and it is mandatory to provide the Digital Signature Certificate (DSC) of the nominee.

- The capital will be divided into various classes.

- A checkbox should be placed next to the data entry section in the form at the Field Office (FO) level. This checkbox is necessary for fields that require attachments such as proof of identity, proof of residence, etc.

- This measure aims to improve the processing of Business Operations (BO).

- The inclusion of the INC-14 attachment requirement can be eliminated by incorporating it within the ‘Declaration by Professional’.

- The inclusion of INC-15 as an attachment might be eliminated by incorporating it into the ‘Declaration by all subscribers and directors’.

- The relocation of the necessity to include the attachment ‘Resolution of unregistered firms in case of Chapter XXI (Part I) companies’ from SPICe+ Part B to the attachment section of URC1 is proposed.

- The necessity of including the attachment ‘Attachment – Part A’ when SPICe+ Part A is approved independently will be eliminated.

- The attachments have been extracted and the relevant data has been converted into a format that can be processed by a machine.

Changes done in URC-1 in MCA V3 Portal

- In the SPICe+ Part B form, there used to be a requirement to attach the resolution for unregistered companies in Chapter XXI (Part I). Now, this requirement has been moved to the attachment section of the URC1 form.

- Some attachments like ‘Consent of majority of members,’ ‘Consent of at least three-fourth of members for registration,’ ‘Declaration from all members about compliance with certain sections of the Act,’ and details of the company’s objectives have been removed. Instead, these have become declarations in the INC-9 form.

- Attachments like ‘Declaration of two or more directors verifying member/partner details’ and ‘Undertaking by proposed directors for following Indian Stamp Act requirements’ have been taken out and are now declarations in the URC-1 form.

- The attachment ‘Certificate from a CA/CS/CWA certifying compliance with Stamp Act provisions’ has been removed and is now included as a declaration under ‘Declaration professional’ in the URC-1.

- Additionally, there are now new fields in the form to record the publication of advertisements according to certain rules.

Changes done in URC-1 in MCA V3 Portal

- You no longer need to attach INC-15 separately. It’s now included within the ‘Declaration by all subscribers and directors.’

- Attachments like ‘Consent of most members,’ ‘Consent of at least three-fourths of members for registration under this part,’ ‘Declaration from all members about following certain rules,’ and details about the company’s goals have been removed. Instead, these are now included as declarations in the INC-9 form.

Changes done in E-MOA & E-AOA in MCA V3 Portal

- Section 8 companies will now use e-MOA and e-AOA, just like other types of companies.

- Information about the purpose of the company, the people involved, and the capital will be automatically filled in from SPICe+ Part A and Part B.

What is the purpose of Part A in the web form SPICe+ and is it possible to submit this section independently?

SPICe+ Part A is where you enter all the details to reserve a name for a new company. You can use it just for name reservation or submit it together with SPICe+ Part B for both name reservation and to start the process of incorporating the company and using other integrated services.

What are the services provided within Part B of SPICe+?

In Part B of SPICe+, you can do the following:

- Apply for a Corporate Identification Number (CIN) or register your company with the Registrar of Companies.

- Apply for a license (applies only to Section 8 companies).

- Apply for Director Identification Number (DIN) or register a director.

- Apply for PAN (Permanent Account Number) or TAN (Tax Deduction and Collection Account Number).

- Apply for a GSTIN (Goods and Services Tax)

What is the procedural step for uploading connected forms to SPICe+?

In Part B of SPICe+, you can do the following:

- Apply for a Corporate Identification Number (CIN) or register your company with the Registrar of Companies.

- Apply for a license (applies only to Section 8 companies).

- Apply for Director Identification Number (DIN) or register a director.

- Apply for PAN (Permanent Account Number) or TAN (Tax Deduction and Collection Account Number)

- Apply for a GSTIN (Goods and Services

What is the extent of applicability of SPICE + Form for Linked Filing?

- For SPICe+ Part A: Use it for all cases.

- For SPICe+ Part B: Use it for all cases.

- For eMOA: Use it if you have 7 or fewer subscribers. If you have more than 7 subscribers or if some subscribers are outside India or don’t have the right visa, include the MOA in the SPICe+ form. Make sure to get notarized or legally certified signatures and addresses.

- For eAOA: Use it if you have 7 or fewer subscribers. If you have more than 7 subscribers or if some subscribers are outside India or don’t have the right visa, include the AOA in the SPICe+ form. Get notarized or legally certified signatures and addresses.

- For Agile Pro S: Use it in all cases

- For URC-1: Use it only for Part 1 companies, as stated in the ‘Type of Company’ field in SPICe+ Part A

- For INC-9: Use it if you have 20 or fewer Directors and Subscribers, and they all have DIN/PAN. If you have more than 20 Directors and Subscribers or if any of them don’t have DIN/PAN, include INC-9 in the SPICe+ form.

Some questions related to Incorporation of Section 8 company through MCA V3 portal

Can I use an approved name from SPICe+ Part A with a different Applicant ID for SPICe+ Part B?

No, you should use the same User ID for both parts when reserving and filing a company name.

What’s the process to fill out Part B after name approval in SPICe+ Part A?

Click on ‘Mini Dashboard’ next to your SPICe+ Part A SRN on the dashboard. This will let you start filling out Part B, making the incorporation process smoother.

Which companies get ‘Zero Filing Fee’ for incorporation through SPICe+?

Companies with an Authorized Capital up to INR 15,00,000 enjoy ‘Zero Filing Fee.’ They only need to pay applicable stamp duty fees.

Do subscribers and directors need a Digital Signature Certificate (DSC) at the time of incorporation?

Yes, if there are up to twenty subscribers and/or directors with DIN/PAN, each one must have a DSC.

How many DINs can I apply for using SPICE+?

For most companies, up to 3 individuals without DIN can apply for it using SPICE+. In the case of a Producer company, up to 5 directors can apply for DIN.

Which banks are integrated with SPICe+ for opening bank accounts?

You can use SPICe+ to open a bank account with Punjab National Bank, ICICI Bank, SBI, Kotak Mahindra Bank, Bank of Baroda, HDFC Bank, INDUS IND Bank, UBI bank, and Axis Bank.

How is INC-9 (Declaration by all Subscribers and first Directors) generated?

INC-9 is automatically generated in PDF format and must be submitted electronically in most cases. Exceptions are when there are more than 20 subscribers and/or directors, or if some of them lack DIN/PAN.

Can physical copies of MoA/AoA be used, or is it mandatory to use eMoA and eAoA?

You must use eMoA (INC-33/INC-13) and eAoA (INC-34/INC-31) for companies with up to 7 subscribers in specific cases. Physical copies can be used if non-individual first subscribers are based outside India or if individual foreign subscribers lack a valid business visa.

Can a Section 8 Company have words like “Micro Finance” or “Credit” in its name or object during incorporation?

No, Section 8 Companies cannot include such words.

Is filing INC-12 mandatory to incorporate a Section 8/Part I Section 8 Company?

No, you don’t need to file INC-12 for obtaining a license for a new Section 8 company since 15th February 2020.

What words must be included in the name of a Section 8 Company?

The proposed name of a Section 8 Company Registration in Delhi must include words like Foundation, Forum, Association, Federation, Chambers, Confederation, Council, Electoral Trust, etc.

Which NIC code should be selected in SPICe+ PART-A for Section 8 Company incorporation?

For Section 8 Company Registration in Delhi, you should select NIC code 86 (Health and Social Work) or 94 (Activities of Membership Organizations) in SPICe+ PART A based on the company’s objectives.

What is the requisite paperwork for the incorporation of a Section 8 Company?

When you’re incorporating a Section 8 Company Registration in Delhi, you’ll need these documents:

- The name you want for your company (it must include words like Foundation, Association, etc.)

- A description of what your company will do (your main objectives)

- For the SPICE+ form, which is the Application for Incorporation Certificate, you’ll need:

- Memorandum of Association if you didn’t submit it in INC-13 (Linked Filing)

- Articles of Association if you didn’t submit it in INC-31 (Linked Filing)

- PAN (Permanent Account Number) of the subscribers (the first directors of the company)

- Proof of ID and address for the subscribers

- A notarized rent agreement for the registered office

- A No Objection Certificate (NOC) from the owner to use the premises

- A utility bill for the premises, not older than the last 2 months

- A declaration (Form INC 15) from all the directors, which is part of INC-9

- A declaration (Form INC 14) from the Chartered Accountant, which is included in the Spice+ Form as part of the Declaration process.

Takeaway

In conclusion, the act of registering a Section 8 Company Registration in Delhi on the MCA V3 platform in Delhi can be regarded as a creditable effort. The establishment of an organization focused on social issues and charity can be helped by this approach, thereby simplifying the legal procedures involved. Through the utilization of this platform, both people and groups could actively contribute towards the enhancement of society, thereby having a beneficial influence on their own communities.