Filing annual returns with the Registrar of Companies (ROC) is a crucial compliance requirement for businesses. In the period from August to November of the financial year, several businesses will face deadlines for submitting their annual filings. These filings help the government maintain an updated record of a company’s financial health and ensure transparency in business operations. Failure to meet these deadlines can lead to penalties and legal complications, so it’s essential for companies to stay informed and follow to the specified due dates. In this article we will get to know about these ROC Filing Due Dates Aug-Nov 2023.

| Table of Content |

Overview

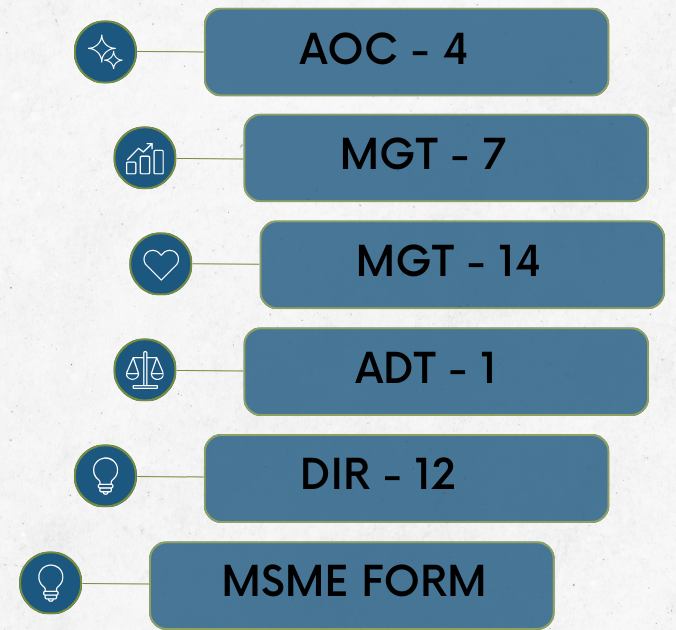

The different types of companies in India need to submit various documents and forms with ROC as per the Companies Act, 2013. Below mentioned are the common ROC findings of different types of Companies:

- AOC-4: Form for filing financial statements and other documents with the ROC.

- MGT-7: Form for filing the annual return with details of the company and its shareholders.

- ADT-1: Form for intimating the ROC about the appointment of an auditor.

- MGT-14: Form for filing resolutions and agreements to the ROC.

- DIR-12: Form for appointment of directors and key managerial personnel.

- Form MSME: MSME form is for Half-yearly return for outstanding payments to Micro or Small Enterprises.

- Form CRA-2: Form of intimation of appointment of cost auditor by the company to Central Government.

- Form CRA-3: Form for Cost Audit Report

- Form PAS-6: Form for Reconciliation of Share Capital Audit Report

- Form DIR-3 KYC (Web/Form): Verification of Director’s KYC Details

ROC Filing Due Dates for September

The below mentioned filing need to be done in month of September of the financial year:

- The OPC need to file Form AOC-4 , the purpose of this form is for filing of financial statement up to 27th September of the financial year. So, ROC Filing date for AOC-4 in case of OPC is 27th September of the F.Y.

- The companies on which cost audit is applicable need to file CRA-2 that is form for appointment of Cost Auditor up to 28th September of the Financial Year. The CRA-2 due date is 180 days from 1st April or 30 days from Board Meeting whichever is earlier.

- The CRA-3 also need to be submitted that is submission of Report by the cost auditor of the company must be done by 28 September 2023. The cost audit report needs to be submitted by cost auditor within 180 days from end of Financial Year, so ROC filing last date for the cost audit report IS 28TH September of the F.Y

- All the DIN Holders must submit DIR-3 KYC (Web/Form) Form till 30th September of the financial year, which is KYC of person holding DIN as on March 31st

ROC Filing Due Dates for October

The below mentioned filing need to be done in month of October of the financial year

- The One Person Company need to file ADT-1 for appointment of auditor by 11th of October of the Financial Year. The company’s other than One person Company need to file ADT-1 on appointment of Auditor by 14th of October of the Financial Year. The ADT-1 need to be file with ROC within 15 days from date of AGM.

- All companies need to file AOC-4, the purpose of it is filing of financial statement by 29th October of the financial year

- The companies that need to regularize the additional director requires to file Form DIR-12 by 29th October of the financial year, the purpose of DIR-12 is the regularization of additional director.

- Limited liability partnerships (LLPs) needs to file LLP-8 that is for the purpose of statement of account & solvency by 30th October of the financial year.

- All the companies need to file Form MSME by 31st Oct of financial year that is the details of pending payment to MSME Vendor.

ROC Filing Due Dates for November

The below mentioned filing need to be done in month of November of the financial year

- The One Person Company need to file MGT-7A by 26th November of the financial year for the purpose of Annual Return filing, So ROC annual return due date is 26th of November.

- The company’s other than One Person Company need to file MGT-7, and MGT-7A, as the case may be by 26th November of the Financial Year for the purpose of Annual Return..

- The Unlisted Public Company should file PAS-6 by 29th November of the Financial Year for the reconciliation of share capital audit.

Takeaway

In conclusion, keeping track of ROC filing due dates from August to November month of the F.Y is vital for businesses of all sizes. So, people should keep them updated regarding ROC Filing Due Dates Aug-Nov 2023. It ensures that they remain in good legal standing and avoid unnecessary fines or legal hassles. Timely and accurate filings with the ROC contribute to maintaining a transparent and well-regulated corporate environment, benefiting both the businesses and the government. Therefore, it’s crucial for companies to mark these dates on their calendars and fulfil their annual filing obligations promptly.