The right issue is an invitation to existing shareholders to purchase additional company shares in proportion to their existing company shares by sending a letter of offer. This article highlights the right issue under the Companies Act, 2013.

|

Table of Contents- |

Concept of the Right Issue under the Companies Act 2013

- ‘Right Issue’ means to give existing members shares in proportion to their existing share. The basic idea is to raise new capital.

- The right issue is usually acquired by small companies where the power to own shares rests with the company’s shareholders.

- It can also be defined as the “pre-emptive right” a shareholder has in the company in lieu of an outsider.

- Any company can go for the right issue as a private, public, listed, or unlisted company.

- With these rights, shareholders can buy new shares at a discounted market price

Conditions for Right Issue of shares under the Companies Act, 2013

Procedure for Right Issues of shares

| Step no. | Details |

| Step 1 | Prepare a draft offer letter for the issuance of shares on a valid basis and a share application form and a letter of withdrawal to be attached to the application letter. |

| Step 2 | Prepare a list of existing shareholders and details of the shares, and verify the number of shares they may receive based on the right issue. |

| Step 3 | A Board meeting will be held by sending notice seven days in advance to all directors of the company. |

| Step 4 | Hold a Board meeting to approve the decision

|

| Step 5 | File MGT-14 Form and ROC within 30 days of the Board meeting, in the case of public limited entities |

| Step 6 | The offer notice (no prescribed format) needs to be sent by registered or speed post or in electronic mode to all existing shareholders at least 3 days before the issue is opened.

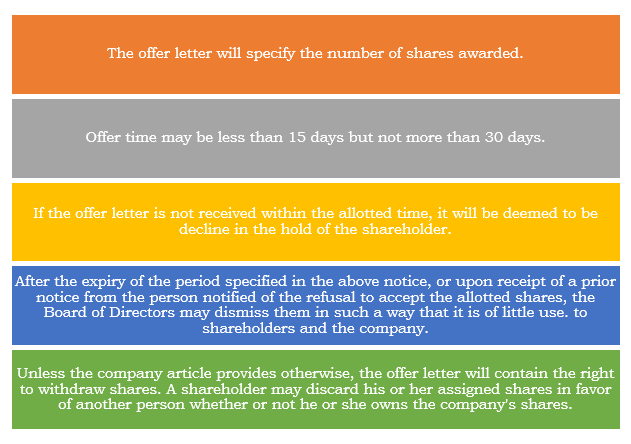

The offer letter will specify the number of shares awarded and the offer will be open for a minimum of 15 days to a maximum of 30 days. (A period of 3 days and 15 to 30 days may be shorter if 90% of shareholders give their short-term notice of approval in the event of a private limited company). |

| Step 7 | Make a receipt of share and application of money. |

| Step 8 | After closing the offer, prepare a list of shareholders by:

|

| Step 9 | Share allotment will be made. |

| Step 10 | Conduct a board meeting within 60 days from the date of receipt of the application fee (if the company fails to distribute the securities, it must return the application fee to the subscribers within 15 days from the expiration date of the 60 days and if possible) as will the allocation of shares will be made within such time; for

|

| Step 11 | Issue share certificates (SH-1) under the provisions of section 46 read with Rule 5 of Companies (Share Capital and Debentures) Rule, 2014. |

| Step 12 | Submit the e-Form PAS-3 with the attachments to the Registrar of Companies within 30 days of the allotment of shares. |

| Step 13 | Make the required entries in the membership register (Form MGT-1) within seven days after the resolution of the share is passed in the board decision. |

Penalty for failure to comply with the provision of the right issue

If any company and directors fail to comply with the provision of the right issue, no specific penal provision is imposed on the governing provision. However in terms of section 450 of the Companies Act, 2013 where no specific penalty or punishment is prescribed in the Act, the company and all company executives who break the law as defined under section 2 (60) or that person will be penalized with a fine of up to Rs.10, 000/- and an additional fine of up to Rs.1, 000/- each day after the first during which breach continues.

Final words

The right issue of shares benefits the existing shareholder and gives them the benefit of applying for shares at a reduced price and retaining their voting rights. A company may increase a significant amount of share capital by turning to the issue of share rights. As the company grows, it looks for ways to increase revenue, so the company turns to the issue of share. Instead of allocating shares to the general public, which will create inequality in the voting rights of existing shareholders, the company is turning to issue additional shares to existing shareholders in proportion to its current shares. This, therefore, solves the purpose of additional funding while allowing existing shareholders to retain their voting rights.