Starting a new business is an exciting and scariest thing at the same time, as filled with boundless possibilities and dreams of success. Registration for Small and Medium-sized Businesses (SMBs) are a significant step in bringing life to company registration. Registering your business not only provides you with legal recognition but also gives various benefits that we are going to discuss in this article. Furthermore, we will explore the procedure of company registration for SMBs. Whether you are a budding entrepreneur or a business owner looking to formalize your operations, understanding the fundaments of company registration for SMBs will empower you to navigate the process with confidence.

|

Table of Content |

Short note on SMBs

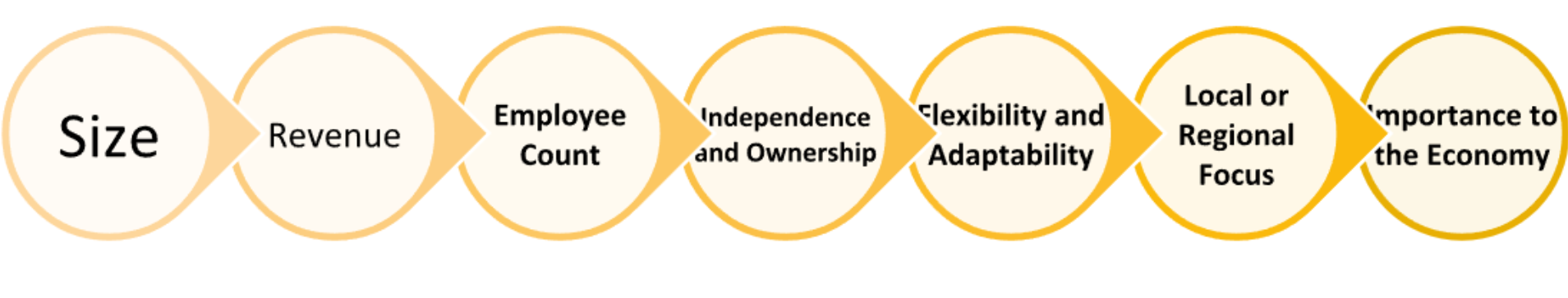

Small and medium-sized businesses (SMBs), also commonly referred to as small and medium-sized enterprises (SMEs), are businesses that fall within a certain size range in terms of their annual revenue, employee count, or other relevant factors. Here are some general characteristics of small and medium sized company include:

Eligibility Criteria for Company Registration for SMBs

Here are some common factors to consider when determining eligibility for small and medium enterprises:

- Business Structure: SMBs can choose from various business structures, such as sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its eligibility requirements, such as the number of owners, the level of liability protection desired, and the availability of capital. Research and understand the requirements associated with each structure to determine which one best suit your business goals and circumstances.

- Legal Age and Capacity: Generally, the individuals involved in the registration process, such as the business owners or directors, must be of legal age (18 years or older) and have the legal capacity to enter into contracts.

- Name Availability: Choose a unique business name that is not already registered by another entity within your jurisdiction.

- Registered Address: SMBs must provide a registered business address or a physical location for legal and official correspondence.

- Documentation and Information: Prepare the necessary documents and information required for registration.

- Compliance with Regulations: SMBs must comply with local laws, regulations, and licensing requirements relevant to their industry or business activities. This may involve obtaining specific permits, licenses, or certifications before or after company registration.

Necessary documents for Company Registration for SMBs

Here are some common documents that are usually required in registration for small and medium-sized businesses (SMBs):

- Identification Documents:

- Valid identification (such as a passport or driver’s license) of all business owners, partners, or directors involved in the company.

- Social Security numbers or Tax Identification Numbers (TIN) for each individual.

- Proof of Address: Residential or business address proof for all business owners, partners, or directors. This can be in the form of utility bills, bank statements, or lease agreements.

- Articles of Association:

- This document outlines the key details of the company, including its name, registered address, business purpose, ownership structure, and share distribution (if applicable).

- The specific requirements for this document may vary based on the chosen business structure, such as a memorandum and articles of association for a corporation or a partnership agreement for a partnership.

- Business Name Availability: Documentation proving that the chosen business name is available and not already registered by another entity. This may include a name availability search or reservation certificate issued by the relevant registration authority.

- Business Plan (optional): A detailed business plan outlining the company’s goals, target market, products or services, marketing strategies, and financial projections. While not always mandatory, a business plan can be beneficial for demonstrating the viability and potential of your

- Licenses and Permits: Depending on the nature of your business activities, you may need to provide copies of any required licenses, permits, or certifications. Examples include professional licenses, health and safety permits, or specific industry-related permits.

- Additional Documentation: Some jurisdictions may have additional requirements, such as a statutory declaration, certificate of good standing (if transferring a business from another jurisdiction), or specific forms provided by the registration authority.

Step-by-Step Procedure of Company Registration for SMBs

The step-by-step procedure for company Registration for Small and Medium-sized Businesses (SMBs):

- Determine the Business Structure: Choose the most suitable business structure for your SMBs, such as sole proprietorship, partnership, limited liability company (LLC), or corporation. Consider factors like liability protection, tax implications, and ownership structure when making your decision.

- Choose a Business Name: Select a unique and memorable name for your company that complies with the naming guidelines of your jurisdiction. Search to ensure the name is available and not already registered by another entity.

- Gather the necessary documents based on the chosen business structure

- Complete the Application Forms: Fill out the registration application forms provided by the relevant government authority. Provide accurate and up-to-date information about your business, including the chosen business structure, registered address, directors’ details, and share distribution (if applicable).

- Pay Registration Fees: Pay the required registration fees associated with the company registration process. The fees can vary depending on the jurisdiction and the type of business structure chosen.

- Submit the Application: Submit the completed application forms and supporting documents to the registration authority. Ensure that all required information is provided and all documentation is accurate and complete.

- Wait for Processing: The registration authority will review your application and documents. The processing time can vary depending on the jurisdiction. Some authorities offer expedited processing options for an additional fee.

- Receive the Certificate of Incorporation/Registration: Once the application is approved, you will receive a certificate of incorporation or registration. This document serves as proof that your company is officially registered and legally recognized.

- Register for Taxes and Obtain Licenses (if applicable): After company registration, you may need to register for tax purposes and obtain any necessary licenses or permits required for your specific business activities. Consult with the relevant tax authorities and regulatory bodies to understand the specific requirements in your jurisdiction.

Why Company Registration is crucial for SMBs?

Company registration is crucial for SMBs for several compelling reasons:

- Legal Recognition and Compliance: Registering your business provides it with legal recognition as a separate entity from its owners. This distinction is crucial for protecting personal assets and liabilities.

- Brand Protection: Registering your company name, logo, and other intellectual property assets as trademarks help safeguard your brand identity. It prevents others from using similar names or marks that could confuse customers and dilute your brand’s value. By securing exclusive rights to your brand, you can build a strong market presence and differentiate yourself from competitors.

- Access to Financial Resources: Registered businesses are eligible to apply for loans, credit facilities, and grants offered by financial institutions and government agencies. Investors and lenders often prioritize businesses that are legally registered, as it signifies a commitment to transparency and accountability.

- Facilitates Business Transactions: Registering your company allows you to enter into official transactions with customers, suppliers, and other businesses. It establishes your legitimacy as a commercial entity, instils confidence in potential partners, and enables you to negotiate favourable contracts.

- Tax Compliance and Benefits: Company registration helps SMBs meet their tax obligations in a structured and legal manner. It ensures compliance with tax laws and regulations, preventing potential penalties or legal complications.

- Enhances Business Reputation: Being a registered company adds a level of professionalism and credibility to your business. It signals to customers, suppliers, and stakeholders that you are serious about your operations and are committed to maintaining ethical business practices.

Takeaway

In conclusion, company registration is a crucial step for Registration for Small and Medium-sized Businesses (SMBs) . By officially registering their businesses, SMBs gain legal recognition, brand protection, and access to financial resources. Compliance with regulations and tax obligations becomes streamlined, enhancing credibility and reputation in the market. Additionally, company registration enables SMBs to engage in official transactions and cultivate strategic partnerships. By embarking on the journey of company registration, SMBs solidify their legal status, foster credibility, and position themselves for long-term success. It empowers them to access new opportunities, comply with legal requirements, and build a strong foundation for growth.