The procedure of incorporating a subsidiary in India is organized to help foreign businesses conduct business operations more smoothly. By registering as a subsidiary, a foreign firm in India can function with the same rights and obligations as a domestic company and become a legal entity under Indian law. Following regulatory procedures, securing the required approvals, and complying with the Companies Act, 2013 are among the prerequisites for a foreign firm to establish an Indian subsidiary. This procedure not only promotes global corporate expansion but also fortifies foreign companies’ worldwide footprint in the booming Indian market.

| Table of Content |

Meaning of Subsidiary Company

A minimum of fifty percent or more of an Indian subsidiary must be owned by the parent firm. A wholly-owned or completely owned subsidiary is one in which the parent business owns all of its shares. The primary distinction between a foreign parent company and its subsidiary is that the former is a distinct legal entity and must adhere to the laws and regulations of the nation in which it is registered or has its headquarters.

Advantages of Opening Indian Subsidiary

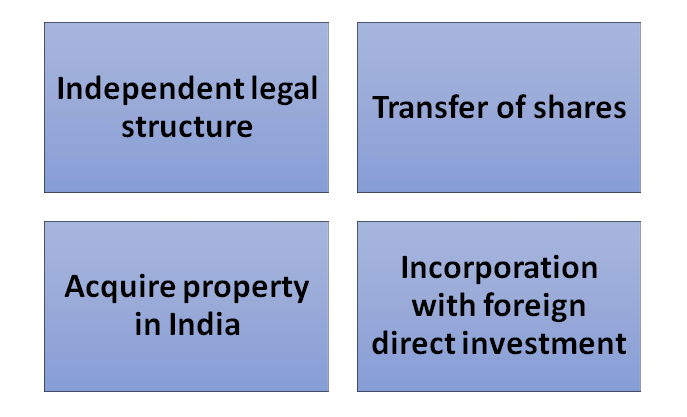

For forming an Indian subsidiary company there was various advantages in the business compliances in the case of the Indian subsidiary the following advantages will apply.

-

- Independent legal structure—The Indian subsidiary is an independent or separate legal structure from its parent company and it is regulated under the Indian commercial legislation.

- Transfer of shares: – The shares purchased by a shareholder can be simply transferred or exchanged to another party or person, after signing a share transfer form and a share certificate.

- Acquire property in India: – As the subsidiary is an independent structure, it is allowed to acquire properties in India.

- Incorporation with foreign direct investment: – as mentioned above, Foreign Direct Investment is widely allowed to Indian subsidiary companies and this applies to most of the economic activities that are available in those country.

Types of subsidiaries in India as per detailed defined under the revised Companies Act 2013, a Indian subsidiary is defined as a company in which a foreign legal entity owns at least 50% of the total share capital. The definition will explain that foreign company having legal rights and authorities on the structure of the board of directors of the subsidiary company.

Procedure to incorporation

For Incorporation of Company, it is required to file form SPICE+ (Simplified Proforma for Incorporation of company electronically) Spice+ would have two parts viz.:

Part A – Name Approval B

Part-B- Incorporation of Company

STEP – I: Spice PART A-for Name reservation for new companies.

Before application for name approval, foreign Company have to choose the name on basis of Rule 8A of (Companies Incorporation) Rules under Companies Act, 2013.

-

- In case of Subsidiary, foreign Company may use coin word of its name as coin word for Incorporation of Company in India to take the Benefit of Its goodwill in foreign County.

- Foreign Company can apply the same name (name in foreign country) in India by using word “India” in its name.

- If foreign Company having any registered Trade Mark then it can use such trademark for Incorporation of Company in India.

- Any other name as decided by the Foreign Company.

A. Login on MCA Website

An application for reservation of name shall be made through the Web Service available at www.mca.gov.in by using web service on MCA V3 Portal through web form Spice+ Part A (Simplified Proforma for Incorporating Company Electronically). Applicants have to login into their account on MCA Website (Business User or Register User). (Pre-existing users can use earlier account or new users have to create a new account.)

(i) Choose File (Any attachment)

You have the option to upload PDF documents. Attaching additional documents is only necessary if a name requires approval from a Sectoral Regulator or NOC, as per Companies (Incorporation) Rules, 2014. It is important to note that only one file is permitted. If you have multiple files, it is recommended to scan them into a single document.

STEP – II: Once the name is approved, the applicant must move forward with the Company Incorporation process within 20 days of name approval (unless an extension is requested by paying an additional fee).

For Incorporation of Company as mentioned above, applicant have to file Spice+ Part B on MCA Website. Before start to fill Spice+ Part – B applicant should arrange the following documents and prepare the following documents:

Preparation of Documents for Incorporation of Company: Once the name is approved, the applicant must prepare the documents listed below.

-

- Digital Signature of all the Indian Subscribers and Directors. If they do not have Digital Signature, then immediately apply for the same.

- Proof of registered office address (Conveyance/ Lease deed/ Rent Agreement etc. along with rent receipts), if any.

- Copy of the utility bill of registered office. It should not be older than two months. (Electricity Bill, Water Bill, Gast Bill, Telephone Bill etc.)

- NOC from the owner of the property. (on plain paper and NOC from the person whose name mentioned on utility bill)

- In case of subscribers/ Director does not have a DIN, it is mandatory to attach Proof of identity and residential address of the subscribers/ Directors

B. Fill the Information in Spice+ Part B:

Once all the above-mentioned documents is available. Applicant has to fill the information in the e-form “Spice+ part B”.

C. Fill details of GST, EPFO, ESIC, BANK Account in AGILE PRO-S:

After proper filing of SPICE+ Part B, applicant has to move on to filling out information in the AGILE PRO form Dashboard Link. All the information which are common in PART-B and AGILE PRO shall be auto fill in AGILE Pro. It is also web based form.

D. Fill details of INC-9:

INC-9 shall also be generated web-based for the Indian Director/ Subscribers or in case if foreign subscriber/ director holds DIN.

E. Download PDF of all the web-based forms-:

Once the user clicks on the save button for all the forms such as Spice Part B, Agile Pro, and INC-9, they will need to download these forms in order to obtain digital signatures from the director and professionals.

F. Filing of forms with MCA-:

Once all the above-mentioned forms are completed by the applicant and have been digitally signed, they can be uploaded as linked forms on the MCA website. The payment for these forms can then be made.

Conclusion

In conclusion, forming a wholly owned subsidiary of a foreign business in India is a smart strategic choice that has several benefits, such as total operational control and alignment with the worldwide goals of the parent company. This procedure guarantees that foreign companies can enter the Indian market with ease and adhere to local laws. Foreign businesses can take advantage of India’s dynamic economic climate to spur growth and innovation by complying with the extensive legal framework. The establishment of a successful Indian subsidiary demonstrates a dedication to sustained investment and a presence in one of the most promising economies globally.