This blog unveils the procedure for transferring company shares in a private limited company. Procedure For Transfer Of Shares Whether you’re a shareholder looking to transfer shares or an aspiring investor, understanding this process is vital. In simple terms, share transfer involves changing ownership. In this blog, we’ll provide a concise and informative guide on how this works within a private limited company, ensuring you’re well-informed and prepared for any share transfer scenarios. Let’s embark on this insightful journey.

| Table of Contents |

Meaning of Share transfer

A Procedure For Transfer Of Shares transfer refers to the process of transferring ownership of shares from one individual, entity, or shareholder to another. In the context of a company, shares represent ownership interests or equity in the company. When a share transfer occurs, the ownership rights associated with those shares are moved from the transferor (the one transferring the shares) to the transferee (the one receiving the shares).

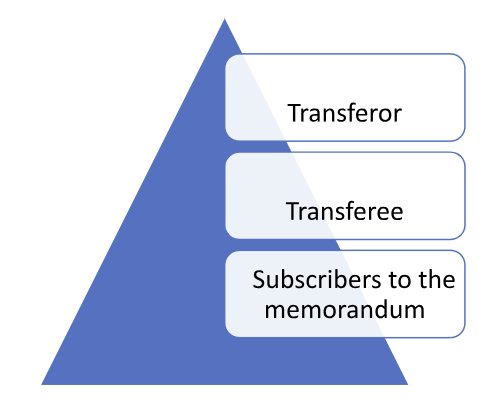

People who engage in Share Transfer process in case of private limited company are as follows-

Benefits of Share transfer

For a private limited company, share transfers offer several specific benefits:

- Ownership Transition: Share transfers enable the transition of ownership within a private limited company. Founders, investors, or shareholders can exit the company by transferring their shares to others, allowing for smooth changes in ownership over time.

- Succession Planning: Share transfers facilitate succession planning for private limited companies. Founders and older shareholders can transfer shares to younger family members or successors, ensuring the continuity of the business.

- Fundraising: Private limited companies can raise capital by transferring shares to new investors or stakeholders. This injection of funds can be used for business expansion, innovation, or meeting working capital requirements.

- Employee Participation: Share transfers enable the implementation of Employee Stock Option Plans (ESOPs). This provides employees with the opportunity to become shareholders and align their interests with the company’s growth.

- Enhanced Governance: Share transfers allow strategic investors or professionals to join the company’s board of directors, contributing their expertise and guidance to the business.

- Value Realization: Existing shareholders can realize the value of their investment by transferring shares to interested buyers. This liquidity option is particularly important in private companies, where selling the entire business might not be feasible.

- Flexibility in Ownership: Share transfers provide flexibility in adjusting the ownership structure of the company. This can be crucial for accommodating changing business needs, partnerships, or market dynamics.

- Dividend Distribution: Shareholders who are no longer actively involved in the company can still benefit from dividend distributions when they transfer their shares to investors who continue to hold the shares.

- Mergers and Acquisitions: In the case of mergers or acquisitions, share transfers can facilitate the integration of two private limited companies, enabling the consolidation of resources and operations.

- Capital Restructuring: Share transfers can be used as a tool for capital restructuring, allowing the company to reorganize its share capital, issue new shares, or consolidate existing shares.

- Tax Efficiency: Share transfers can offer tax planning opportunities, such as minimizing capital gains taxes or optimizing the tax implications for shareholders.

- Unlocking Value: Share transfers can help unlock the dormant value within a private limited company by bringing in new investors, fresh ideas, and potentially expanding market reach.

Procedure For Transfer Of Shares transfers provide private limited companies with the means to adapt, grow, and optimize their ownership structure, all while maintaining the company’s status as a closely held entity.

Restriction in share transfer in Private Limited Company

Articles of Association typically restrict the transfer of shares in two ways, which are discussed below:

- Pre-emption right: If a shareholder wishes to sell a portion or all his shares, they must be offered to the other members of a private limited company at a price determined by the Auditor or Director. The method specified in the company’s AOA or Articles of Association may be used to determine the value of each share. If no existing member is willing to purchase the shares, they can be transferred to a third party.

- Director’s power to restrict – The Articles of Association or AoA of a private limited company may allow the Director to restrict the registration of Transfer of Shares in certain circumstances. Only the restrictions specified in the Articles of Association are considered legally binding.Procedure For Transfer Of Shares Any agreement between the two shareholders is not in the best interests of the company or the shareholders. Only a Private Limited Company’s Articles of Association can restrict the Transfer of Shares.

Documents Required for Share Transfer in a Private Limited Company

- Certificates of stock ownership

- Board resolution confirming the Transferor’s notice

- Notice from the transferor to the company

- Offer letter sent

- Letter of objection from existing shareholders

- Share transfer agreement form along with the stamp duty returned

- Board resolution to transfer shares

Process of Transfer of Shares in a Private Limited Company

The actions listed below must be taken to start the procedure for Transfer of Shares in Private Limited Company procedure:

- Before beginning the Transfer of Shares, the Articles of Association or AOA must be analysed, and any restrictions specified must be noted.

- The directors must get written notice from the shareholders. Information on the aim of the share transfer must be included in the notice.

- According to the Articles of Association, the share transfer price must be specified. The company’s current shareholders are first presented with the shares at the price specified.

- Existing shareholders of the company are made aware of the shares that are available for purchase, the last date to buy them, and the prices at which they are priced.

- The shares are sold to current shareholders who might be interested in buying them. Shares are made available to people outside the company if no present shareholders are interested in the purchase or if there are additional Procedure For Transfer Of Shares .

Final steps for transfer of shares

The steps listed below must be taken to transfer shares in a private limited company:

- The directed form of the share transfer deed must be obtained.

- Both the transferor and the transferee must approve the share transfer agreement after it has been fully filled out.

- The share transfer agreement must be stamped in accordance with the State’s current stamp statute and stamp work details.

- The Transferor is required to obtain a witness’ name, signature, and address on the share transfer agreement.

- The transfer deed must be accompanied by an allotment letter or share certificate that is delivered to the corporation.

- A new share certificate is issued in the transferee’s name once the company validates and examines the paperwork.

Final Words

In conclusion, mastering the share transfer procedure in a private limited company brings clarity to a significant aspect of ownership dynamics. By following these steps diligently, shareholders can ensure smooth transitions while upholding legal and regulatory requirements. Whether it’s passing on shares, welcoming new investors, or planning, a clear understanding of the process ensures the company’s stability and growth.