Through the time of Goods and Services Tax (GST), there is huge significant changes have been seen in the way of businesses and individuals pay taxes. One essential concept that every taxpayer should grasp is the “Point of Taxation.” This pivotal aspect determines the moment when the liability to pay GST arises, shaping the calculation of applicable taxes. In this article, we will delve into the concept of the point of taxation under GST, exploring its significance and how it influences tax obligations for goods and services. Whether you’re a business owner, professional, or simply curious about GST, understanding the point of taxation is crucial for navigating the tax landscape effectively.

| Table of Content |

What is the “Point of Taxation” under GST?

Under the Goods and Services Tax (GST) system, the point of taxation refers to the point in time when a liability to pay tax arises. It determines the time at which goods or services are considered to be supplied and becomes the basis for calculating the applicable GST.

In simple terms, the point of taxation is the event or occasion that triggers the liability to pay GST. It is crucial because it determines the period for which the GST is applicable, as well as the rate of tax and the person liable to pay it.

How to determine the Point of taxation under GST?

Determining the point of taxation under the GST system involves considering specific criteria based on the type of supply, whether it’s goods or services. Here’s a step-by-step guide on how to determine the point of taxation:

For Goods:

- Date of issue of the invoice: The point of taxation for goods is the earliest of the following dates:

- The date when the supplier issues the invoice for the goods, or

- The last date by which the invoice should have been issued.

- Date of receipt of payment: If the invoice is issued before the supply of goods, the point of taxation will be the date when the supplier receives payment for the goods.

- Date of recipient’s book entry: If neither the invoice nor the payment has occurred, the point of taxation will be the date when the recipient enters the goods in their books of accounts.

For Services:

- Date of issue of the invoice: Similar to goods, the point of taxation for services is the earliest of the following dates:

- The date when the supplier issues the invoice for the services, or

- The last date by which the invoice should have been issued.

- Date of receipt of payment: If the invoice is issued before the supply of services, the point of taxation will be the date when the supplier receives payment for the services.

- Date of recipient’s book entry: If neither the invoice nor the payment has occurred, the point of taxation will be the date when the recipient enters the services in their books of accounts.

When does the GST Tax Sale point arise?

The point at which GST tax sale arises, also known as the point of supply, varies depending on the type of transaction involved. Here are the scenarios that determine when the GST tax sale point arises:

- Goods: In the case of goods, the GST tax sale point arises when there is a transfer of title or ownership of the goods. This typically occurs when the goods are delivered to the recipient or when the recipient takes possession of the goods.

- Services: For services, the GST tax sale point arises after the provision of services. It is important to note that the completion of services may not necessarily align with the payment or the issuance of an invoice.

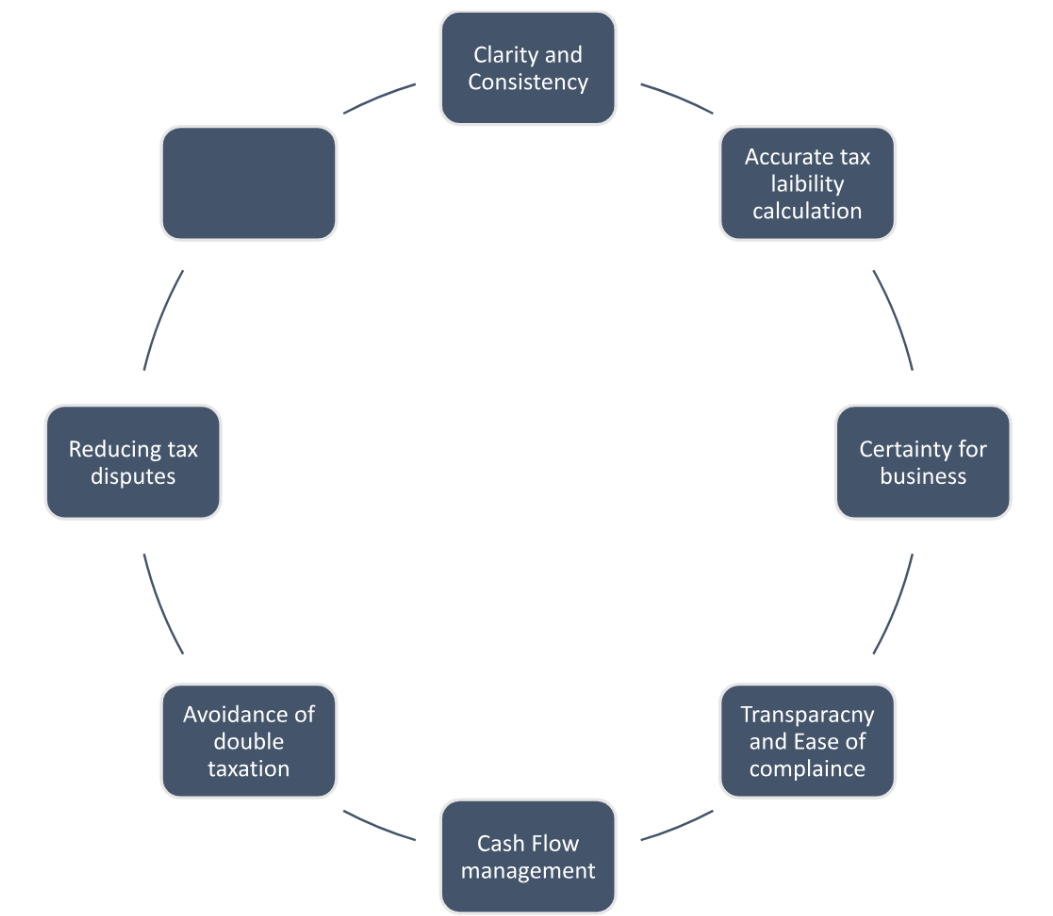

Benefits of Point of Taxation under GST

The concept of the POT under the GST system offers several benefits to both taxpayers and the government. Here are some of the key advantages of the Point of Taxation under GST:

- Clarity and Consistency: The Point of Taxation rules provide clarity on the timing of tax liability. It establishes a consistent framework for determining when the liability to pay GST arises, ensuring uniformity in tax calculations across different transactions.

- Accurate Tax Liability Calculation: By identifying the specific event or milestone that triggers the tax liability, taxpayers can accurately calculate the GST amount payable. This helps in proper compliance with tax regulations and avoids any underpayment or overpayment of taxes.

- Certainty for Businesses: The Point of Taxation rules bring certainty for businesses by clearly defining the point at which they become liable to pay GST. This allows businesses to plan their cash flows, budgeting, and pricing strategies accordingly.

- Transparency and Ease of Compliance: Determining the Point of Taxation helps in maintaining transparency and ensuring ease of compliance with GST regulations. It enables businesses to correctly charge and collect GST from their customers, avoiding confusion or disputes regarding tax liabilities.

- Cash Flow Management: The Point of Taxation rules help businesses manage their cash flows effectively. By knowing when the tax liability arises, businesses can plan their finances and allocate funds for tax payments accordingly.

- Avoidance of Double Taxation: The Point of Taxation rules prevent instances of double taxation by clearly establishing the taxable event and the applicable tax rate. This ensures that goods or services are not subjected to GST multiple times during the supply chain.

- Reducing Tax Disputes: Clarity regarding the Point of Taxation reduces the potential for tax disputes between taxpayers and tax authorities. Having clear rules and guidelines minimizes disagreements and provides a common reference point for resolving any issues.

Takeaway

Through the above-mentioned article, we can say that the concept of the “Point of Taxation” plays a crucial role in the GST system. It determines the moment when the liability to pay GST arises for goods or services supplied. By identifying the point of taxation, taxpayers can accurately calculate their tax obligations and ensure compliance with GST regulations. Understanding the point of taxation helps businesses and individuals determine the applicable tax rates and the person liable for paying GST. It allows for consistency and clarity in tax calculations, ensuring a streamlined approach to taxation under the GST regime.