The Budget 2020 as introduced by Finance Minister Nirmala Sitharaman brought a new income tax regime for individual taxpayers. The new tax regime 2020 has been proposed with lower income tax slab rates upto Rs. 15 Lakhs but in order to opt for such concessional tax regime requires the taxpayer to forego certain specified deductions which you could claim under various provisions of Income Tax, 1961.

These include standard deduction of Rs 50,000, deduction under section 80C of Rs 1.50 lakh and interest on self-occupied property of Rs 2 lakh, deductions which are availed by most taxpayers and many other deductions as available. As a result, the concessional tax regime may not always be beneficial.

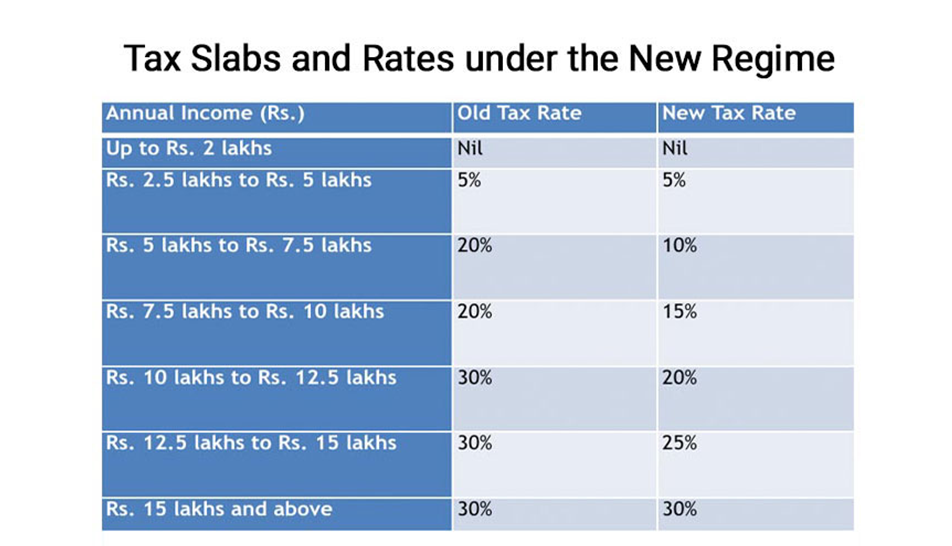

Let us go through the comparative income tax slab rate:

Based on the illustrative table below, it is evident that the maximum benefit that can be availed under the new tax regime (in case no investments are made) is Rs 75,000 in terms of tax savings. As a result, unlike the corporate tax concessional tax rate regime which reduces tax rates across income levels, the concessional tax rate has limited application and will benefit persons in the lower income brackets. The highest personal tax rate, which is 42.7 per cent, will continue to be a majorchallenge for high net worth individuals (HNIs).

A comparative table reflecting the existing and personal tax regime rates is provided below under different income tax slabs:

NOTE:-

** No tax up to Rs.500,000 taxable income, as Rebate under section 87A is available

*Basic exemption income slab in case of a resident individual of the age of 60 years or more (senior citizen) and resident individual of the age of 80 years or more (very senior citizens) at any time during the previous year, continues to remain the same at Rs 3 lakh and Rs 5 lakh, respectively, in the existing tax regime.

Advantages and Disadvantages of Opting New Tax Regime

The advantages of opting new tax regime are as follows:

- The individual will have an advantage to invest as per the choices i.e. there will be a flexibility in making choice of investments.

- The individuals can invest in instruments having less complex norms i.e. lock in period, interest rates. There won’t be any restriction to invest in any particular scheme like PPF, NSC.

- As you can see the tax burdens are comparatively lowered in comparison to earlier tax rates.

- The reduced tax rate and choice of investments will give more liquidity in the hands of taxpayer.

Talking about the disadvantage in the new tax regime the taxpayer will not be eligible for any deductions if he has already made any investments.

Also the govt. schemes which gave the culture of savings and investing in schemes like SukanyaSamriddhi Scheme will not be given preference and the savings will decrease.

Making The Best Choice – Which scheme is better

In light of the above and considering the new income tax regime wherein certain deductions and exemptions would not be applicable if taxpayers opt for the concessional new tax regime, they may evaluate both the regimes. Any taxpayer who is looking for flexibility in investment choices and does not want to invest in the specified eligible instruments, may consider opting for the new tax regime. However, it is advisable to do a comparative evaluation under both regimes, before opting to continue with the old one or opting for the new one.

It is notable that the choice can be exercised every year and any regime which is beneficial can be adopted by the individual (except for those who have income from business or profession). Individuals who have income from business or profession cannot switch between the new and old tax regimes every year.If they opt for the new taxation regime, such individuals get only one chance in their lifetime to go back to the old regime. Further, once switched back to existing tax regime, they will not be able opt for new tax regime unless their business income ceases to exist.

It is important to note that the income tax department has brought out a tax comparison utility, which is available on their web portal and in which, an individual taxpayer can evaluate which option is better for him/her.