In the picturesque city of Udaipur, nestled amid the breath-taking landscapes of Rajasthan, a unique avenue for financial empowerment awaits individuals and communities. Enter the realm of Nidhi Companies, a distinctive form of financial institution that catalyses savings, mutual benefit, and credit accessibility. With a traditional touch and future vision, Nidhi Companies embody the spirit of cooperative banking, collective progress, and fostering a sense of belonging. Through this article, we offer a journey of the Nidhi Company Registration in Udaipur and its remarkable advantages bring to individuals and communities alike.

| Table of Content |

What do you mean by Nidhi Company Registration?

Nidhi Company registration refers to the process of incorporating a Nidhi Company, which is a specific type of non-banking financial institution in India. Nidhi Companies are formed with the primary objective of cultivating the habit of saving and thrift among their members and providing them with loans and advances for their mutual benefit.

The registration process involves legally establishing the Nidhi Company as a separate legal entity, distinct from its members. It entails complying with the regulations and requirements set forth by the Ministry of Corporate Affairs (MCA) and the Companies Act, 2013.

Nidhi Company registration establishes the legal framework and structure for the Nidhi Company to operate as a financial institution, accepting deposits from its members and providing them with loans and advances. It also ensures compliance with the regulations and guidelines set forth by the regulatory authorities, enabling the Nidhi Company to operate transparently and lawfully.

It is important to note that Nidhi Company registration is subject to specific eligibility criteria and regulatory requirements, which must be met to ensure compliance with the applicable laws and regulations.

Eligibility Criteria of Nidhi Company Registration in Udaipur

To be eligible for Nidhi Company registration in Udaipur, certain criteria must be met. Here are the eligibility criteria for Nidhi Company registration:

- Minimum Number of Members: A minimum of seven individuals must come together to form a Nidhi Company. These individuals will become the first shareholders and promoters of the company.

- Member Requirements: All members of the Nidhi Company must be individuals and not entities or corporate bodies. They should be Indian citizens and residents.

- Minimum Capital Requirement: Nidhi Companies are required to have a minimum paid-up equity capital of Rs. 5 lakhs. This capital must be maintained throughout the existence of the company.

- Nidhi Status: The primary objective of the company should be to cultivate the habit of saving and thrift among its members and provide loans and advances to them for their mutual benefit. The company should operate on the principles of a mutual benefit society.

- Name Requirements: The proposed name of the Nidhi Company should be unique and should not resemble the name of any existing company. It must also comply with the naming guidelines and rules set forth by the MCA.

- Directors and Designated Partners: A Nidhi Company must have at least three directors, out of which one-third should be independent directors. It is also required to have at least two designated partners who hold a valid Director Identification Number (DIN).

- Registered Office: The company must have a registered office address in India to which all official communications and notices can be sent. This address must be declared during the registration process.

- Compliance with Regulations: Nidhi Companies must comply with the provisions of the Companies Act, 2013, and the rules and regulations set forth by the MCA. They are subject to regular filing and compliance requirements such as annual financial statements, returns, etc.

Documents required for Nidhi Company registration in Udaipur

To register a Nidhi Company in Udaipur, you need to gather and submit several documents along with the application. The specific documents required may vary depending on various factors, such as the type of entity and the specific requirements of the MCA. However, here is a general list of documents typically required for Nidhi Company registration:

- Identity Proof of Directors and Members:

- PAN card (Permanent Account Number) of directors and members

- Aadhaar card or any other government-issued identity proof

- Address Proof of Directors and Members: Passport, Voter ID card, driving license, or any other government-issued address proof.

- Passport-sized Photographs: Recent passport-sized photographs of all directors and members.

- Registered Office Proof:

- Proof of registered office address, such as the sale deed, rent agreement, or lease agreement.

- Utility bills (electricity bill, water bill, etc.) or a No Objection Certificate (NOC) from the property owner.

- Memorandum of Association (MOA) and Articles of Association (AOA): Drafted and signed MOA and AOA of the company.

- Declaration and Affidavit: Directors’ declaration and affidavit stating compliance with the provisions of the Companies Act, 2013.

- Director Identification Number (DIN) and Digital Signature Certificate (DSC):

- Shareholders’ List: List of shareholders along with their shareholdings in the proposed Nidhi Company.

- Bank Account Details: Bank account details of the company, including a copy of the bank statement or cancelled cheque.

The step-by-step process for obtaining Nidhi Company registration in Udaipur

Here is a step-by-step procedure for Nidhi Company registration in Udaipur:

- Step 1: Obtain Digital Signature Certificate (DSC): Apply for Digital Signature Certificates for all the proposed directors of the Nidhi Company. DSC serves as an electronic signature for online filing.

- Step 2: Obtain DIN: Each director must obtain a DIN from the MCA. It can be obtained by filing an online application along with the necessary documents.

- Step 3: Name Reservation:

- Choose a unique name for your Nidhi Company and check its availability on the MCA portal.

- File Form INC-1 to reserve the name of the company. Ensure the name complies with MCA naming guidelines.

- Step 4: Draft Memorandum and Articles of Association (MOA and AOA): Prepare the MOA and AOA of the Nidhi Company. These documents define the objectives, rules, and regulations of the company.

- Step 5: Incorporation Application:

- File Form SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) with the MCA. This form includes the application for incorporation, MOA, AOA, and other necessary documents.

- Attach the required documents, such as the registered office address proof, identity proof, address proof of directors, etc.

- Step 6: Payment of Fees: Pay the prescribed fees for incorporation based on the authorized share capital of the company. The fee can be paid online through the MCA portal.

- Step 7: Verification and Approval:

- Once the application is submitted, it will be reviewed by the Registrar of Companies (ROC).

- The ROC may seek additional information or documents if required.

- If the application is found to comply with the rules, the ROC will issue the Certificate of Incorporation.

- Step 8: Post-Incorporation Compliances: After obtaining the Certificate of Incorporation, complete the post-incorporation compliances, including the following:

- Obtain the company’s PAN from the Income Tax Department.

- Apply for the company’s Tax Deduction and Collection Account Number (TAN), if required.

- Open a bank account in the name of the Nidhi Company.

- Register for Goods and Services Tax (GST), if applicable.

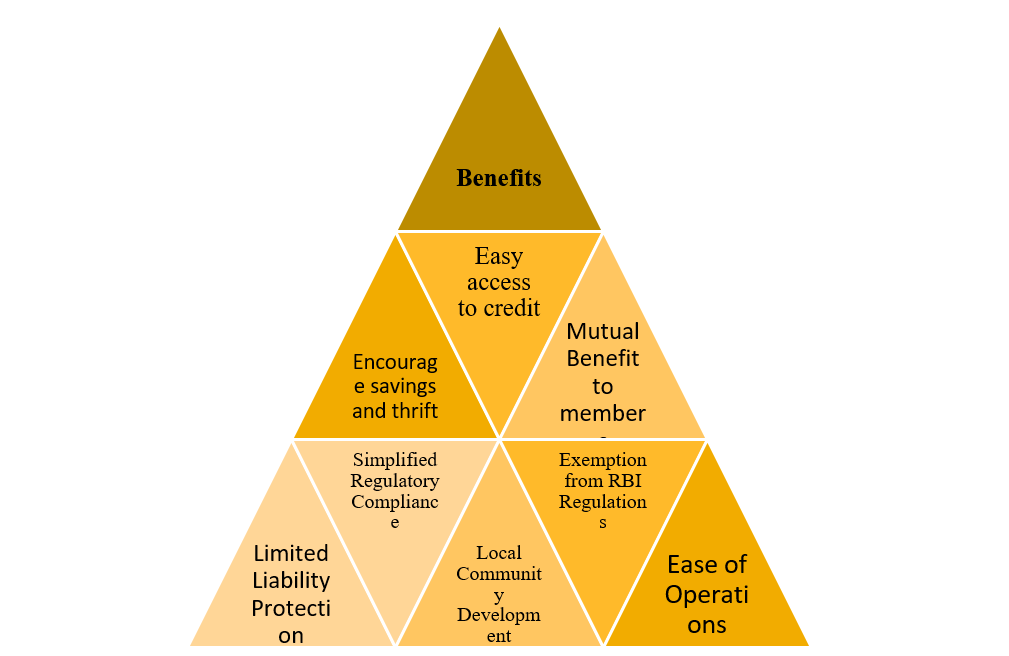

Benefits of Nidhi Company registration

Here are the key benefits of Nidhi Company registration:

- Easy Access to Credit: Nidhi Companies can accept deposits from their members and provide loans and advances to them at reasonable rates. This enables members to have easy access to credit facilities for their personal or business needs.

- Encourages Savings and Thrift: Nidhi Companies promote the habit of saving and thrift among their members. By providing a platform for members to deposit their savings and earn interest, Nidhi Companies foster a culture of financial discipline.

- Mutual Benefit to Members: Nidhi Companies are formed for the benefit of their members. The profits earned by the company are shared among the members in the form of dividends or other benefits. This fosters a sense of ownership and shared prosperity among the members.

- Limited Liability Protection: Similar to other forms of companies, Nidhi Companies offer limited liability protection to their members. The liability of the members is limited to the extent of their shareholdings, ensuring their assets are safeguarded.

- Simplified Regulatory Compliance: Nidhi Companies have less stringent regulatory requirements compared to other financial institutions such as banks or NBFCs. This simplifies the compliance process and reduces the burden on the company.

- Local Community Development: Nidhi Companies primarily operate at the local level and cater to the financial needs of their members within the community. By providing credit facilities and promoting savings, they contribute to the overall economic development of the local community.

- Exemption from RBI Regulations: Nidhi Companies are exempted from the rigorous regulations imposed by the Reserve Bank of India (RBI) on non-banking financial companies (NBFCs). This exemption provides operational flexibility and reduces the compliance burden for Nidhi Companies.

- Ease of Operations: Nidhi Companies can be easily incorporated and operated. The registration process is relatively simpler compared to other financial institutions, and they can be managed by the members themselves without the need for external management.

Takeaway

Through the article, it can be concluded that the Nidhi Company registration in Udaipur opens the door to a world of financial empowerment, mutual benefits, promoting savings, and credit accessibility. Through a streamlined registration procedure, aspiring entrepreneurs and savers can embark on a journey towards prosperity, guided by the principles of cooperation and thrift. As Udaipur embraces the financial revolution facilitated by Nidhi Companies, individuals and communities stand to gain. By harnessing the power of collective effort, Udaipur can unlock its full economic potential, empowering its residents and driving sustainable growth.