Considering the complicated outline of the world’s financial markets, Non-Banking Financial Companies (NBFCs) are crucial. In the non-bank financial company (NBFC) industry, share buybacks, or companies purchasing back their own shares from shareholders, are becoming more and more popular. This article explores the crucial regulations and application procedures that control NBFC share buybacks, revealing this complex system that affects both business dynamics and investor sentiment.

Table of Content |

Meaning of Buy Back of Shares

The buyback of shares pertains to the company action wherein a company repurchases its own shares from its existing shareholders. Frequently, companies employ this approach as a strategic move to get a portion of their existing shares either through open market transactions or by directly engaging with shareholders. The primary objectives of a share repurchase program encompass increasing the ownership percentage of current shareholders, multiplying the worth of remaining shares, raising stock prices, and indicating assurance in the financial well-being and growth potential of the organization. There are different procedure for NBFC share buybacks, such as procedure for buy back of shares in private company will be different from public one. Buybacks can additionally offer an effective mechanism for companies to employ surplus cash and enhance crucial financial ratios.

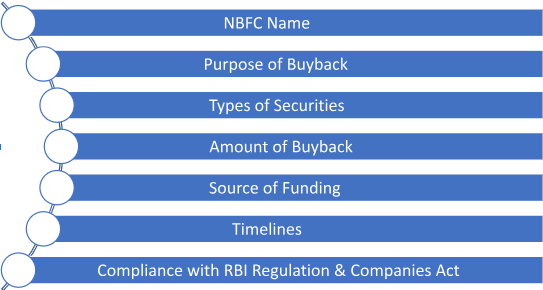

Buy Back of Shares Application Contents

The Buy Back of shares application must include the following information:

- NBFC Name: The Name of the NBFC should be mentioned in the Application to RBI.

- The purpose of Buyback: An NBFC buys back shares to increase shareholder value, strengthen capital structure, reassure the market, and effectively use surplus money.

- Types of Securities for Buyback: In accordance with regulatory requirements, NBFCs may buy back equity shares, fully paid preference shares, and other permitted securities. Total

- Amount of Buyback: The total amount of the buyback must not exceed 25% of the total of the paid-up capital and free reserves, among other regulatory restrictions.

- Sources of Funding: Resources for the buyback may include securities premium, accumulated free reserves, and earnings from a recent share issuance.

- Compliance with RBI Regulations: To ensure financial stability and regulatory adherence, NBFC buyback procedures must adhere to Reserve Bank of India (RBI) rules and regulations.

- Compliance with the Companies Act: Regarding the repurchase procedure, NBFCs are required to adhere to the regulations of the Companies Act, including shareholder approvals and reporting to the Registrar of Companies.

- Timelines: According to regulatory regulations, the full buyback procedure must be finished within a certain amount of time, usually 3 to 4 months from the time the board approves it until it is finalized.

Buy Back of Share Procedure

Compliance with the relevant rules and directives established by the Reserve Bank of India (RBI) is a requirement of the buy-back process for an NBFC (Non-Banking Financial Company). An overview of the general steps in the Companies buy-back rules and procedure is provided below:

- Board Resolution: The NBFC company list Board of Directors must first discuss and adopt the securities buy-back plan. The buy-back should be authorized by a board resolution and overseen by a committee.

- Shareholder Approval: A special resolution at a general meeting may be needed to buy back securities, as per the provisions of the Companies Act, 2013.

- RBI Approval: The NBFC in India needs RBI approval for the buy-back. The RBI Regional Office where the NBFC is registered should receive an RBI-formatted application.

- RBI Regulation Compliance: It is vital to ascertain that the suggested repurchase adheres to the regulations set forth by the Reserve Bank of India (RBI), encompassing the RBI (Shareholding Pattern and Capital Adequacy Norms for Non-Banking Financial Companies) Directions, as well as any other pertinent circulars or recommendations.

- Public Announcement & Disclosure: The NBFC is required to make a public announcement regarding the buy-back, detailing the offer, the number of securities to be repurchased, the buy-back price, and the timeframe for completion.

- Open offer period: The duration of the open offer period, within which shareholders are permitted to submit their securities for repurchase, should span a minimum of 15 days and a maximum of 30 days after the public announcement.

- Payment of consideration: The shareholders whose stocks are accepted for buy-back must receive the buy-back consideration within 7 working days of the open offer period.

- Filing with RBI: The NBFC should notify the buy-back to the RBI within 20 working days of completion, detailing the number and quantity of securities bought back.

- Compliance & Requirement: NBFCs must comply with RBI reporting standards and file and disclose all necessary documents with the Registrar of Companies

Prior Approval steps for share buyback of NBFC

- Non-Banking Financial Companies (NBFCs) are required to apply, using the official company letterhead, to get prior authorisation from the Bank.

- Details regarding the proposed directors and shareholders obtained from the Annex must be attached with the application

- The sources of funds for the prospective shareholders seeking to acquire shares in the Non-Banking Financial Company (NBFC) must be mentioned in the application.

- The proposed directors/shareholders hereby declare that they possess no connection with any unincorporated entity engaged in the acceptance of deposits.

- The proposed directors/shareholders must declare that they are not associated with any company whose Certificate of Registration (CoR) application has been rejected by the Reserve Bank,

- The proposed director must declare that they have no criminal cases against them and provide a Bankers’ Report.

Applications must be made to the Regional Office of the Department of Non-Banking Supervision that oversees the NBFC’s Registered Office. This document can only be submitted physically. Keep an acknowledgement and one set of submitted documents for future reference.

Prior approval before public notice

The Reserve Bank’s prior clearance is required in order to move through with the sale, transfer, or takeover of shares. Furthermore, before conducting such transactions—regardless of whether they entail the sale of shares or the transfer of control—a public notice of at least 30 days must be given.

Non-Banking Financial Companies (NBFCs), the other party, or all parties together may facilitate the issuance of such a public notice, provided that the Reserve Bank has given its prior approval.

Information about the intended sale or transfer of ownership or control, the transferee’s details, and the reasons for the sale or transfer of ownership or control should all be included in the public notice. The notice must be published in both the local newspaper serving the area where the registered office is located and a well-known national daily.

Takeaway

To get through the complicated process of share buybacks in the NBFC sector, you need to know a lot about the rules and regulations that apply. As NBFCs share buybacks think about this strategy tool, it becomes very important that they follow the application process exactly as it is written. NBFCs share buybacks can use share buybacks to their advantage by combining the ideas of openness, compliance, and strategic purpose in a way that keeps the balance between company growth and shareholder value.