Do you know about ITC Provisions for Fresh Registrations ?In the dynamic landscape of taxation, the implementation of the Goods and Services Tax (GST) has revolutionized the way businesses operate in India. In the GST system, one of the essential features is the Input Tax Credit (ITC), which holds significant importance for businesses. With ITC, businesses can offset the tax they paid on inputs against their tax liabilities. This helps in preventing the cascading effect of taxes, making the tax process smoother. Understanding the provisions of ITC is crucial for businesses starting their journey under GST. It allows them to optimize their tax liabilities, streamline operations, and increase profitability. It’s important to know which input tax credit is eligible and which is ineligible, as this knowledge can greatly impact a business’s financial efficiency. So, learning about GST input credit will be beneficial for businesses in the long run. By comprehending the nuances of ITC provisions, businesses can ensure compliance with the GST laws, maintain proper documentation, and maximize their tax benefits. This understanding empowers them to make informed decisions regarding the procurement of goods and services, input tax recovery, and overall tax planning strategies.

| Table of Contents Top of Form |

Understanding ITC: An Overview

Input Tax Credit (ITC) is a fundamental concept in the Goods and Services Tax (GST) system. It allows businesses to claim a credit for the tax paid on inputs, such as raw materials, goods, or services used in their business activities. By offsetting the tax paid on inputs against their tax liabilities, businesses can avoid double taxation and reduce their overall tax burden. ITC plays a vital role in promoting a seamless tax chain and ensuring the fair and efficient taxation of goods and services. Businesses need to grasp the basics of ITC to optimize their tax management and compliance under the GST regime.

Example Input Tax Credit – Imagine a scenario where Company A is a manufacturer of electronic devices, and Company B is a retailer that sells these devices to end consumers.

- Purchases by Company A: Company A buys raw materials like electronic components worth $10,000 from its suppliers. On this purchase, the supplier charges a GST of 18%, which amounts to $1,800 (18% of $10,000).

- Sales by Company A: After manufacturing the electronic devices, Company A sells them to Company B at a price of $20,000. On this sale, Company A charges a GST of 18%, amounting to $3,600 (18% of $20,000).

- Purchases by Company B: Company B purchases the electronic devices from Company A for $20,000. Since Company B is a retailer, it cannot claim GST input credit on its purchases for resale. So, the GST paid by Company A is not eligible for ITC for Company B.

- Sales by Company B: Company B sells the electronic devices to end consumers for $25,000. On this sale, Company B charges a GST of 18%, amounting to $4,500 (18% of $25,000).

Now, let’s calculate the Input Tax Credit for Company A:

Company A’s GST liability on sales to Company B: $3,600 Company A’s GST paid on raw material purchases: $1,800

Input Tax Credit (ITC) for Company A: ITC = GST paid on purchases – GST liability on sales ITC = $1,800 – $3,600 ITC = -$1,800 (Note: Negative value indicates that there is no GST liability left to offset)

In this example, Company A’s ITC is negative, meaning it has already fully offset its GST liability against the GST paid on its raw material purchases. This prevents double taxation and ensures that the tax burden is not passed on at each stage of the supply chain.

Top of Form

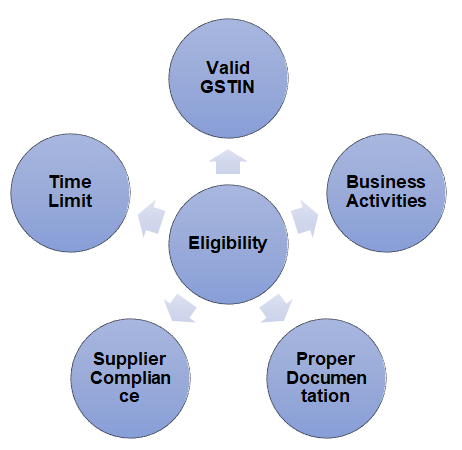

Eligibility for ITC for Fresh Registrations

Businesses that have freshly registered under the Goods and Services Tax (GST) regime need to fulfill certain criteria to be eligible for claiming Input Tax Credit (ITC). Here are the key points to consider:

- Valid GSTIN: To claim ITC, it is essential to have a valid Goods and Services Tax Identification Number (GSTIN) obtained through the GST registration process.

- Business Activities: The business must be engaged in taxable supplies of goods or services. It is important to note that certain goods and services may be exempted or ineligible for ITC claims.

- Proper Documentation: Maintaining accurate and complete records of invoices, bills, and other supporting documents is crucial. These documents should reflect the details of input supplies, tax paid, and compliance with GST regulations.

- Supplier Compliance: The suppliers from whom goods or services are procured must also comply with GST provisions. This includes ensuring that the supplier has filed their GST returns and paid the tax due to the government.

- Time Limit: ITC can only be claimed within a specified time frame. Generally, the time limit for claiming ITC on inputs, capital goods, and input services is within the earlier of the following: one year from the date of the invoice or the due date for filing the annual return for the financial year in which the supply was made.

By meeting these eligibility criteria, businesses can avail themselves of the benefits of ITC, reduce their tax liability, and enhance their competitiveness in the GST landscape. It is advisable for fresh registrants to stay updated with any changes or amendments to ITC provisions to ensure compliance and maximize their tax benefits and check https://www.cagmc.com/about/ for more updates.

Time Limit for Availing ITC

To avail Input Tax Credit (ITC) on inputs, capital goods, and input services under the Goods and Services Tax (GST) regime, businesses need to be aware of the time limits prescribed by the GST laws. Here’s an overview of the time limits and their relevance:

- Inputs and Input Services: Businesses can claim ITC on inputs and input services in the same tax period in which the corresponding invoice or debit note is recorded in their books of accounts. However, there is a time limit for availing ITC on inputs and input services, which is the earlier of the following:

- The due date for filing the monthly or quarterly return for the relevant tax period of September following the end of the financial year to which the invoice pertains.

- The date of filing the annual return for the financial year to which the invoice pertains.

It is crucial to avail ITC within this time limit to avoid any potential loss of credit.

- Capital Goods: The time limit for availing ITC on capital goods, such as machinery, equipment, or furniture, is different. Businesses can claim ITC on capital goods in the same tax period in which they receive the capital goods. There is no specific time limit for availing ITC on capital goods.

Conditions and Restrictions for ITC Claims

While Input Tax Credit (ITC) allows businesses to offset tax paid on inputs against their tax liabilities under the Goods and Services Tax (GST) regime, there are certain conditions and restrictions that businesses need to adhere to when making ITC claims. Here are some key points to consider:

- Eligible Supplies: ITC can only be claimed on inputs, capital goods, and input services that are used or intended to be used in the course of business for making taxable supplies. Goods and services used for non-business purposes or for supplies that are exempted under GST are not eligible for ITC claims.

- Proper Documentation: Maintaining proper records of invoices, bills, and other supporting documents is essential. The ITC claim should be supported by valid tax invoices issued by the supplier, containing all the prescribed details as per GST regulations.

- Timely Payment to Suppliers: Businesses claiming ITC must ensure that they have paid the supplier for the input supplies within 180 days from the date of the invoice. Failure to make the payment within this timeframe can lead to the reversal of claimed ITC.

- Supplier Compliance: ITC claims are contingent upon the compliance of the suppliers. It is important to ensure that the supplier has filed their GST returns and paid the tax due to the government. If the supplier does not comply, it may impact the eligibility of the recipient to claim ITC.

- Reversal of ITC: There are certain scenarios where the ITC claimed needs to be reversed or reduced. This includes instances where the recipient fails to pay the supplier within 180 days, or if the goods or services for which ITC was claimed are subsequently found to be ineligible or used for non-business purposes.

- Blocked Credits: GST laws also specify certain items for which ITC claims are not allowed. These are referred to as “blocked credits.” For example, ITC is generally not available for goods and services used for personal consumption, employee benefits, motor vehicles (unless they fall under specific exceptions), etc.

- Compliance with Tax Invoice Rules: ITC claims are subject to compliance with the tax invoice rules as per GST regulations. Businesses must ensure that the invoices received from suppliers meet the prescribed criteria, such as proper issuance, details of the supplier and recipient, GSTIN, HSN or SAC codes, etc.

ITC Reconciliation and Compliance

Reconciling Input Tax Credit (ITC) claims and ensuring compliance with Goods and Services Tax (GST) regulations is essential for businesses. Here are some key aspects related to ITC reconciliation and compliance:

- Reconciliation of ITC : Reconciling ITC involves matching the ITC claimed by a business with the details provided by its suppliers. It helps identify any discrepancies or mismatches between the ITC claimed and the ITC eligible as per the supplier’s returns. The reconciliation process typically involves cross-verifying invoices, verifying tax payments made by suppliers, and rectifying any errors or omissions.

- Timely Filing of GST Returns: To ensure ITC reconciliation and compliance, timely filing of GST returns is crucial. Businesses must file their returns accurately and within the prescribed due dates. This includes regular filing of GSTR-1 (outward supplies), GSTR-2A (inward supplies), and GSTR-3B (summary return) to maintain consistency and accuracy in ITC claims.

- Matching ITC with GSTR-2A: GSTR-2A is an auto-generated statement that reflects the inward supplies reported by the supplier. Businesses should compare their own ITC claims with the details available in GSTR-2A. Any discrepancies should be addressed through communication with the suppliers, seeking rectification if required.

- Rectifying Discrepancies and Correcting Errors: If any discrepancies or mismatches are identified during the reconciliation process, businesses should take necessary steps to rectify them. This may involve communicating with suppliers to rectify invoices, updating the information in their own returns, and ensuring accurate reporting of ITC in subsequent returns.

- Record Keeping and Documentation: Maintaining proper records and documentation is crucial for ITC reconciliation and compliance. Businesses should keep records of invoices, debit notes, credit notes, and other relevant documents to support their ITC claims. These records should be preserved for the prescribed duration as per GST regulations.

- Compliance with Anti-Profiteering Measures: Businesses should ensure compliance with anti-profiteering measures under GST. Anti-profiteering provisions aim to ensure that businesses pass on the benefits of reduced taxes and ITC to customers through lower prices.

Conclusion

In conclusion, understanding the provisions of Input Tax Credit (ITC) is paramount for businesses registering under the GST regime. It enables them to maximize tax benefits, reduce the tax burden, and enhance profitability. By complying with ITC provisions, such as maintaining proper documentation, timely filing of returns, and reconciling ITC claims, businesses ensure compliance with GST laws and avoid penalties. Additionally, staying updated with any changes or amendments to ITC provisions is crucial for businesses to adapt and maximize their tax benefits effectively. Embracing a thorough understanding of ITC provisions empowers businesses to navigate the complexities of GST and optimize their tax management strategies.