| Table of Content |

Income tax return filing is a process which has to be filed every taxpayer every year. The income tax return filing is mandatory for individuals, NRIs, partnership firms, LLPs, companies and Trust. Individuals and NRIs are mandatorily required to file income tax return, if the income exceeds Rs.2.5 lakhs for a financial year. Proprietorship firms, partnership firms, companies and LLP are required to file income tax return – irrespective of amount of turnover/income or profit/loss.

Due Date to File Income Tax Return

| Category of Taxpayer | Due Date for Tax Filing – FY 2019-20 |

| Individual | 31st August, 2020 |

| Hindu Undivided Family (HUF) | 31st August, 2020 |

| Body of Individuals (BOI) | 31st August, 2020 |

| Association of Persons (AOP) | 31st August, 2020 |

| Businesses (Requiring Audit) (Companies, LLP etc.) | 30th September 2020 |

| Businesses (Requiring TP Report) | 30th November 2020 |

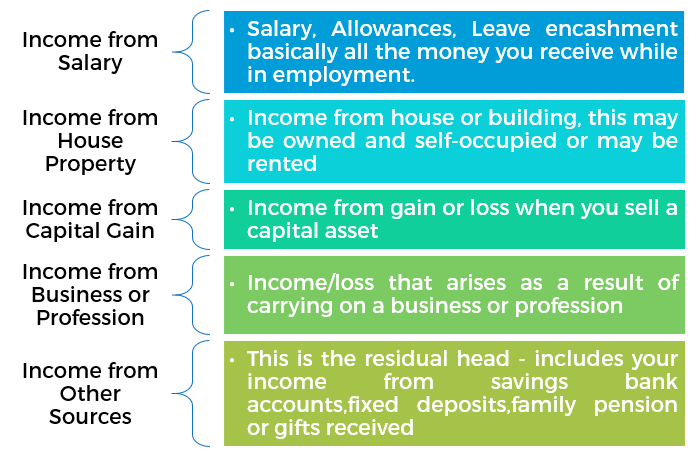

Sources of Income

Documents Required for ITR Filing

- The income tax taxpayers have to arrange the documents related to income statement, investments, assets, bank accounts and other documents like Permanent Account Number (PAN) or Aadhaar number

- Further the documents like income other than salary, like capital gains, rental income, and divided income etc. are also needed while filing the return.

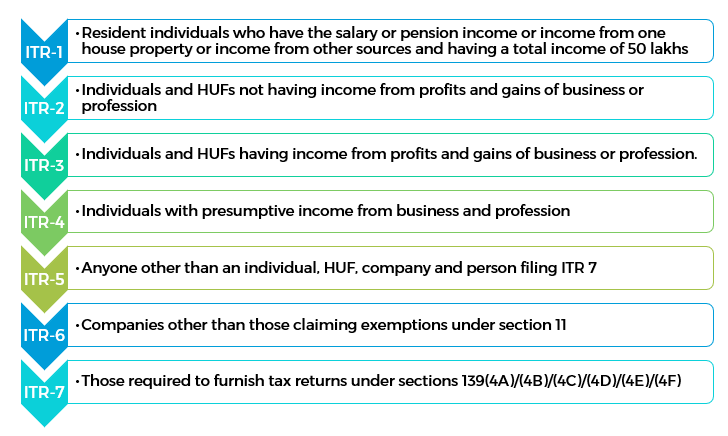

Various ITR Forms and their Applicability

Standard Deductions while calculating income (Section 80)

In order to calculate the taxable income, the standard deductions allowed by the Income tax Act have to be deducted from the gross total income. The deductions allowed under the Act for FY 2019-20 are as follows:

| S.No. | Section | Deductions | Allowed Limit |

| 1 | 80C |

|

80CCC |

| 3 | 80CCD(1) | Employee’s contribution to NPS account | Rs. 1,50,000 |

| 4 | 80CCD(2) | Employer’s contribution to NPS account | Maximum up to 10% of salary |

| 5 | 80CCD(1B) | Additional contribution to NPS | Rs. 50,000 |

| 6 | 80TTA(1) | Interest Income from Savings account | Maximum up to 10,000 |

| 7 | 80TTB | Exemption of interest from banks, post office, etc. Applicable only to senior citizens | Maximum up to 50,000 |

| 8 | 80GG | For rent paid when HRA is not received from employer | Least of : – Rent paid minus 10% of total income – Rs. 5000/- per month – 25% of total income |

| 9 | 80E | Interest on education loan | Interest paid for a period of 8 years |

| 10 | 80EE | Interest on home loan for first time home owners | Rs 50,000 |

| 11 | 80CCG | Rajiv Gandhi Equity Scheme for investments in Equities | Lower of – 50% of amount invested in equity shares; or – Rs 25,000 |

| 12 | 80D | Medical Insurance – Self, spouse, children Medical Insurance – Parents more than 60 years old or (from FY 2015-16) uninsured parents more than 80 years old |

– Rs. 25,000 – Rs. 50,000 |

| 13 | 80DD | Medical treatment for handicapped dependent or payment to specified scheme for maintenance of handicapped dependent – Disability is 40% or more but less than 80% – Disability is 80% or more |

– Rs. 75,000 – Rs. 1,25,000 |

| 14 | 80DDB | Medical Expenditure on Self or Dependent Relative for diseases specified in Rule 11DD – For less than 60 years old– For more than 60 years old |

– Lower of Rs 40,000 or the amount actually paid – Lower of Rs 1,00,000 or the amount actually paid |

| 15 | 80U | Self-suffering from disability : – An individual suffering from a physical disability (including blindness) or mental retardation. – An individual suffering from severe disability |

– Rs. 75,000

– Rs. 1,25,000 |

| 16 | 80GGB | Contribution by companies to political parties | Amount contributed (not allowed if paid in cash) |

| 17 | 80GGC | Contribution by individuals to political parties | Amount contributed (not allowed if paid in cash) |

| 18 | 80RRB | Deductions on Income by way of Royalty of a Patent | Lower of Rs 3,00,000 or income received |

File your income tax return with the help of a professional so that you can claim the maximum benefits and make your returns on time.