Welcome to our informative blog, in which we we will explain you about the guide to check income tax notice online, an essential step in the digital era. Income tax notices are vital communications from the tax authorities, requiring immediate attention and action. The process has been streamlined in the digital age, allowing taxpayers to access and respond to notices online with ease. In the following sections, we will instruct you on how to verify your income tax notices via online platforms. Whether you are an individual taxpayer or a business entity, understanding this procedure enables you to manage your tax affairs with greater efficiency and promptness. Stay tuned for insightful guidance on navigating the digital tax compliance.

Meaning of Income tax notices

Income tax notices are official written communications issued by tax authorities to individual taxpayers or organizations to convey various important messages or requests regarding their income tax matters. These notices can cover a range of topics, including discrepancies in tax returns, requests for additional information or documentation, reminders about upcoming tax payments or deadlines, notifications of audits or assessments, and more.

The purpose of income tax notices is to ensure compliance with tax laws and regulations, clarify doubts or inconsistencies, and facilitate effective communication between taxpayers and tax authorities. It is important for recipients to carefully read and understand the contents of these notices and take appropriate actions or respond within the specified timeframe to avoid potential penalties or legal consequences.

Importance of Income Tax Notice

The Income Tax Notice is a crucial document for Indian taxpayers, as it alerts them to any problems with their tax returns and reminds them to take the necessary steps. The significance of the Notice of Income Tax can be summed up as follows:

- Observance of Tax Laws: The Income Tax Notice reminds taxpayers to comply with India’s tax laws and regulations. It is crucial that taxpayers consider the notice seriously and respond within the specified timeframe.

- Conflict Resolution: The Income Tax Notice may be issued if there is a discrepancy in the taxpayer’s tax returns. The notification affords taxpayers the opportunity to resolve the issue and avoid penalties or legal action.

- Payment of Overdue Taxes: A Notice of Deficiency in Payment of Check Income Tax may be issued for non-payment of taxes. It is crucial that taxpayers consider the notice seriously and make the required payment within the specified time frame.

- Clarity about Tax Obligations: The Income Tax Notice clarifies for taxpayers their tax obligations and the actions necessary to satisfy them. It assists taxpayers in determining their tax liability and taking appropriate action.

- Avoiding Punishments and Legal Action: It is essential to respond to the Income Tax Notice within the specified time frame to avoid penalties and legal action. It is crucial that taxpayers consider the notice seriously and respond quickly.

Advantages of Online Income Tax Notice Verification

You can access the income tax notice online from the comfort of your own home, making it a convenient and straightforward process.

- You receive timely updates regarding your tax information, and you can check at any time for any notices or communications from the Income Tax Department.

- The online system provides greater transparency, and you can view all your tax-related data in a specific location.

- Rapid and Effective: The online system is rapid and effective, allowing you to rapidly respond to notices and resolve any issues.

How to Check Income Tax Notice Online?

- Go to the e-filing portal for income tax at www.incometax.gov.in. Under ‘Quick Links’ on the homepage, click ‘Authenticate notice/order issued by ITD’.

- You can verify your identity using: PAN, document type, assessment year, date of issue, and mobile number (only for notices/orders/letters issued in AY 2011-12 and subsequent years) or Document Identification Number and mobile phone number (for all assessment years).

- If you wish to authenticate by PAN, document type, assessment year, issue date, and mobile number, choose the corresponding option and input the required information.

- After entering your information, you will receive an OTP. Enter the OTP that was sent.

- Once the OTP has been validated, the issued notice’s DIN and date will be displayed.

- If the notice is not issued by the Income Tax Department, the system will display the following message: No records found matching the provided criteria.

What is management of Income Tax Notices?

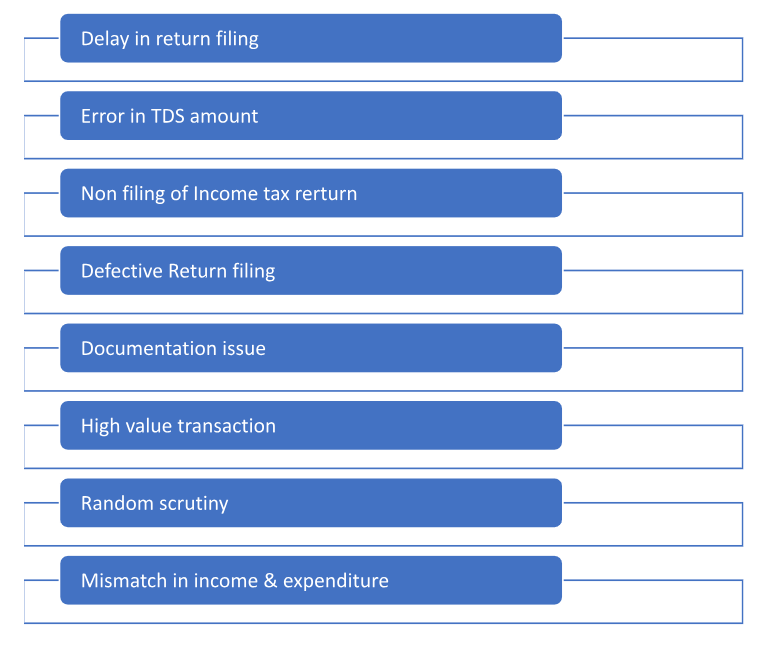

The administration of notices from the Income Tax Department (ITD) is known as income tax notice management. This includes responding to notices, paying any taxes that are due, and submitting any necessary paperwork. The ITD may send you a notice for a number of reasons, such as discrepancies in your tax return, failure to submit a return, or unpaid taxes. To avoid any penalties or interest charges, it is crucial to respond to notices promptly and accurately.

If you receive a notice, you should first review it to determine the notice’s purpose and any required action. You might be able to remedy the issue without taking any additional steps. If you owe taxes, you must pay the amount immediately to avoid incurring penalties and interest charges. You may pay online, by mail, or in person at your local tax office.

How to Respond to an Income Tax notice?

If you have received an income tax notice in India, you must respond without delay. The initial stage is to determine the cause of the notice. This information is in the ‘Reasons for Issuance of Notice’ section. Once you have determined the reason, you can begin formulating your response.

If the notice is for failure to file tax returns, you must submit your returns immediately. This can be completed online through the Income Tax Department’s website.

If you have already submitted your returns, you may respond to the notice by submitting a copy of the acknowledgment of return filing. If the notice pertains to discrepancies in your tax returns, you will be required to provide supporting documentation for the claims made on your tax return. If you claimed a deduction for medical expenses, for instance, you would need to submit invoices and receipts.

Once you have acquired the necessary materials, you may respond to the notice by submitting them online or by mail. Importantly, you should never disregard a notice of income tax. If you do not respond to the notice, the tax department may take disciplinary action against you, such as fining you or sending you a notice for the collection of unpaid taxes.

Income Tax Department Notices

A notice is a formal document issued by the Income Tax Department to a taxpayer, requesting answers to specific inquiries or the submission of specific documents or information.

- A notice may be issued under the Income Tax Act for several reasons, including:

- To file an income tax return

- To provide documents or information regarding his or her income or tax affairs

- Appear before the Income Tax administration for an investigation. Require payment of a tax debt

- Initiate proceedings for the collection of tax arrears

- Assess a penalty against the assessee for noncompliance with the provisions of the Income Tax Act.

A notice under the Income Tax Act must be delivered to the taxpayer in accordance with the regulations. The taxpayer must respond to the notice within the allotted time frame. If the taxpayer does not comply, the Internal Revenue Service may take appropriate action against him or her.

Checklist for response to Income Tax Notification

Typically, the reply for income tax notice is used to respond to the action rescinded. The format is typically straightforward and comprises the following:

- The taxpayer’s full name and address.

- Notification number

- Date of the notification

- Tax amount owed

- Motive for the tax liability

- Date of settlement

- Form of payment

- The letter should be addressed to the Department of Income Tax and sent via registered mail.

Types of Notices

Income tax notices can vary based on the purpose and intent of communication between tax authorities and taxpayers. Here are some common types of income tax notices:

- Intimation Under Section 143(1): This is an automated notice generated after the processing of the income tax return, informing the taxpayer about any discrepancies or adjustments made by the tax department.

- Notice for Scrutiny Assessment (Under Section 143(2)): This notice is sent to initiate a detailed scrutiny of the taxpayer’s return. It requires the taxpayer to provide supporting documents and attend hearings if necessary.

- Notice for Assessment Under Section 148: This notice is issued when the tax department believes that the taxpayer’s income has escaped assessment. It is a reopening of assessment for a specific assessment year.

- Notice for Non-Filing of Return (Under Section 142(1)): This notice is sent if the tax department believes a person is liable to file a return but has not done so.

- Notice for Non-Disclosure of Income (Under Section 142(1)): This notice may be issued if the tax department suspects that the taxpayer has not fully disclosed their income.

- Notice for Tax Demand (Under Section 156): This notice is sent to demand payment of outstanding taxes, penalties, or interest.

- Notice for Penalty Proceedings (Under Section 274): This notice is issued if the tax officer believes there is a case for imposing a penalty on the taxpayer.

- Notice for Survey or Search (Under Section 133A or 132): These notices are issued when the tax department conducts surveys or searches to gather information about the taxpayer’s financial affairs.

- Notice for Exemption or Deduction Clarification (Under Section 10(23C) or 80G): These notices are issued to clarify or verify the taxpayer’s eligibility for certain exemptions or deductions.

- Notice for Foreign Income or Assets (Under Section 148 or 139): These notices are issued in cases of suspected undisclosed foreign income or assets.

It is important to carefully read and understand any income tax notice received and take appropriate action within the specified timeframe.

Takeaway

Wrap up, the ability to check income tax notice online has revolutionized the relationship between taxpayers and tax authorities. Digital platforms’ convenience and accessibility have enabled individuals and businesses to promptly respond to notices and ensure timely compliance. By following the basic steps outlined in this blog, taxpayers can manage their tax affairs proactively, avoid penalties, and maintain a smooth tax journey. As technology continues to reshape taxation processes, adopting these digital tools not only streamlines administrative duties but also promotes taxpayer transparency and tax authority accountability.