With the implementation of GST, businesses across the country are required to do specific compliance procedures to ensure smooth operations and tax transparency. One significant aspect of GST compliance is the filing of GSTR-3B under GST laws, a monthly return that serves as a temporary measure until the introduction of the comprehensive return filing system. In this article, we will provide a simple introduction to GSTR-3B under GST laws and its significance under the GST laws. We will explore its purpose, filing requirements, and the information it encompasses.

| Table of Content |

What is GSTR-3B under GST Laws?

GSTR-3B meaning is a monthly summary return that needs to be filed by registered taxpayers under the Goods and Services Tax (GST) laws in India. It serves as a temporary return designed to simplify the transition into the GST regime. GSTR-3B requires taxpayers to provide a summary of their outward supplies, inward supplies, and tax liability for a particular tax period.

Unlike other return forms such as GSTR-1 (for outward supplies) and GSTR-2 (for inward supplies), which provide detailed invoice-level information, GSTR-3B offers a consolidated view of the taxpayer’s tax liabilities and input tax credits. It streamlines the return filing process by reducing the compliance burden and allowing businesses to report their tax liability efficiently.

GSTR-3B contains various sections where taxpayers need to provide information related to their sales, purchases, and taxes. These sections include details such as total sales, details of inward supplies liable for the reverse charge, input tax credit claimed, tax liability, and payment of taxes. Additionally, taxpayers need to reconcile the figures reported in GSTR-3B with the figures in their books of accounts to ensure accuracy and compliance.

Who should file GSTR-3B under GST Laws?

- Regular taxpayers: Any business or individual with a GST registration, involvement in the supply of goods or services, is required to file GSTR-3B. This includes manufacturers, traders, service providers, e-commerce operators, and more.

- Composition scheme taxpayers: Taxpayers registered under the composition scheme, which allows for a simplified tax structure for small businesses, are also required to file GSTR-3B. However, the information required in the return may differ based on the specific rules applicable to composition scheme taxpayers.

- Input Service Distributors (ISDs): ISDs, which are entities that receive invoices for input services and distribute the input tax credit to other registered entities within the same organization, are required to file GSTR-3B.

- Non-resident taxpayers: Non-resident taxpayers who are registered under GST and are involved in taxable supplies within India must also file GSTR-3B.

Necessary documents required to file GSTR-3B under GST Laws

Here are some of the necessary documents required to file GSTR-3B under GST Laws are:

- Sales invoices: Maintain copies of all sales invoices issued during the tax period covered by the GSTR-3B return. These invoices should contain details such as invoice number, date, customer’s GSTIN (if applicable), description of goods or services, quantity, value, and tax amount.

- Purchase invoices: Keep copies of all purchase invoices received during the tax period. These invoices should include details such as invoice number, date, supplier’s GSTIN (if applicable), description of goods or services, quantity, value, and tax amount.

- Receipts and payment vouchers: Maintain records of receipts and payment vouchers related to business transactions during the tax period. These vouchers should provide details of the mode of payment, the amount, and the purpose of the transaction.

- Credit and debit notes: If any credit or debit notes are issued or received, ensure that you have copies of these documents. Issuance of credit notes requires reduction in the value or quantity of supplies, while issuance of debit notes for an increase in the value or quantity of supplies.

- Bank statements: Keep copies of bank statements or transaction details that show the inflow and outflow of funds. Those are related to the business transactions during the tax period.

- Input tax credit (ITC) documents: Maintain records of all documents related to claiming an input tax credit. Such as tax invoices, debit notes, and any other supporting documents specified under the GST laws.

- E-way bills: If applicable, maintain records of e-way bills generated for the movement of goods during the tax period covered by the GSTR-3B return.

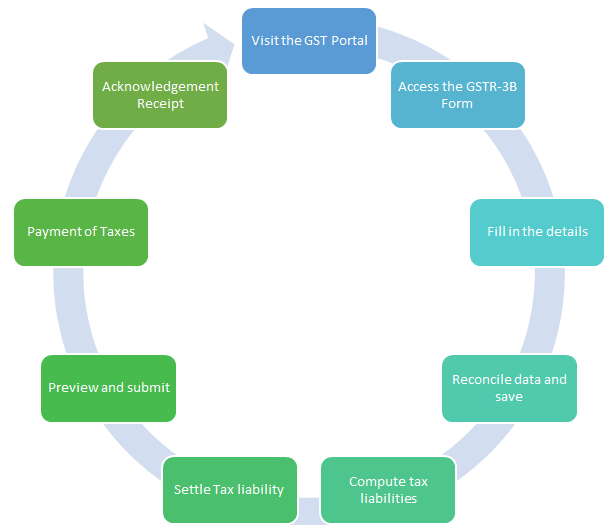

A step-by-step guide to filing GSTR-3B on GST Portal

Filing GSTR-3B on the GST Portal involves several steps. Here is a step-by-step guide to help you navigate the process:

- Step 1: Visit the GST Portal: Go to the official GST Portal website. Then log in using your valid credentials (GSTIN, username, and password).

- Step 2: Access the GSTR-3B form: Once logged in, navigate to the “Returns Dashboard” section on the portal. Under the “Monthly Returns” tab, locate and select GSTR-3B.

- Step 3: Fill in the details: In the GSTR-3B form, you will find various sections and fields that require specific information. Such as total sales, details of inward supplies liable for the reverse charge, input tax credit claimed, and tax liability. Ensure accuracy and completeness of the data entered.

- Step 4: Reconcile data and save: Reconcile the figures reported in GSTR-3B with the figures in your books of accounts to ensure accuracy. Once you have filled in the required details, save the form to preserve the entered data.

- Step 5: Compute tax liabilities: The portal will automatically compute the tax liabilities based on the data entered in the form. It will calculate the total tax payable and the input tax credit available.

- Step 6: Settle tax liability: After the tax liabilities are computed, proceed to settle the tax liability. The portal will prompt you to enter the payment details. Such as tax amount, Integrated GST (IGST), Central GST (CGST), and State/UT GST (SGST/UTGST). You can select from the available payment options. Likewise electronic cash ledger, electronic credit ledger, or a combination of both, to settle the tax liability.

- Step 7: Preview and submit: Before submitting the form, review the details entered in GSTR-3B for accuracy. Make any necessary corrections or modifications if required. Once you are satisfied with the form, click on the “Preview” button to generate a summary of the form. Verify the summary and ensure that all the information is correct. Finally, click on the “Submit” button to file the GSTR-3B return.

- Step 8: Payment of taxes: After filing the GSTR-3B return, proceed with the payment of taxes, if any tax liability exists. You can make the payment online through the available payment modes on the GST Portal.

- Step 9: Acknowledgement receipt: Once the return is successfully filed and the tax payment is made. An acknowledgement receipt with a unique reference number will be generated. You can download and save the acknowledgement receipt for your records.

When is GSTR-3B required to be filed under GST Laws?

Under the GST laws in India, GSTR-3B is a monthly return that needs to be filed by registered taxpayers. It provides a summary of outward supplies, inward supplies, and the tax liability of the taxpayer for a particular tax period. The due date for filing GSTR-3B is usually the 20th of the following month.

Government introduces the GSTR-3B is a temporary return to ease the transition to the GST regime. It serves as a summary return until the full-fledged return forms. Such as Implementation of GSTR-1 (for outward supplies) and GSTR-2 (for inward supplies).

Takeaway

Through the above-mentioned information, we can say that GSTR-3B holds significant importance under the GST laws in India. It serves as a monthly summary return that registered taxpayers must file to report their tax liabilities and input tax credits for a specific tax period. Although GSTR-3B is a temporary return, it plays a crucial role in streamlining the transition to the comprehensive return filing system. By filing GSTR-3B accurately and on time, businesses can ensure compliance with GST regulations, avoid penalties, and maintain transparency in their tax transactions.