GST refunds can be claimed for excess cash balance in the electronic cash ledger, for taxes paid in error, or for ensued input tax credits (ITC) that cannot be used for tax payments due to zero GST rate or inverted tax structure. However, the refund of amounts paid more than the amount in the electronic cash book can be requested by an application in form RFD-01. Therefore, the steps or processes differ depending on the type of GST refund. This article offers a detailed guide on how to apply for various types of GST export refund, providing step-by-step instructions.

Table of Contents

Overview

To claim a GST refund, the taxpayer must adhere to certain procedures, which involve following a set of instructions, submitting necessary paperwork, and providing a declaration to the appropriate GST authorities. The rebates under GST can include returning the surplus cash balance deposited in the electronic cash ledger, repaying taxes paid in error, or compensating for the accumulated Input Tax Credit (ITC) that could not be used for tax payments due to zero-rated sales or an inverted tax structure.

The method of claiming a GST refund differs depending on the specific type of refund being requested. For example, the reimbursement of Integrated Goods and Services Tax (IGST) for exports (with tax payment) can only be claimed by providing specific information in the GSTR-1 and GSTR-3B reports. Nonetheless, individuals can request a reimbursement for any extra cash paid through the electronic cash ledger by completing form RFD-01. Hence, the procedure for receiving a GST refund depends on the specific type.

Meaning of Export as per GST Act

The definition of export according to the IGST Act, 2017 is the act of transporting goods or services from India to a destination outside of India. According to the legislation, products, and services that are sent to other countries are categorized as “supplies with zero-rated tax”. Individuals or entities that are liable for taxation and export goods and services can also request reimbursements for the GST (Goods and Services Tax) they have paid. Hence, exports are exempt from the Goods and Services Tax with a 0% rate.

Exporting goods and services without any payment made for the Integrated Goods and Services Tax (IGST).

An exporter has the option to request a refund on the unused input credit. If the export refund under GST is requested for the duty that has already been paid, it is processed promptly and typically approved within two weeks. The exporter is required to submit the GST Return GSTR-1 and 3B return in addition to filing the export general manifest. There is no need for a separate application since the Shipping Bill is treated as the application itself. The shipping bill for goods exported outside of India is submitted by the exporter. The application will be recognized as submitted only when the exporter, Custom House Agent, or the responsible party for the shipment has filed the export report or manifest, which includes the date and shipping bill number.

Exporting goods and services with payment made for the Integrated Goods and Services Tax (IGST).

Exports are classified as transactions that have no tax applicability under the GST system. Thus, the exporter can request a refund for the tax paid, including IGST and cess if applicable. Due to the large number of transactions performed by exporters, the GST portal streamlines the process of GST refunds, making it more convenient.

- There is no need to submit a separate application using form RFD-01 for this situation. Nevertheless, the exporter must meet specific requirements to qualify for a GST refund.

- Begin with, it is imperative to complete Table 6A in GSTR-1 with the necessary information about shipping bills about export transactions (where tax has been paid), and then submit it within the specified deadline.

- Additionally, the specific information in question needs to be included under section 3.1 (b) of GSTR-3B when providing the summary details.

- The applicable tax must be paid and the obligation to file the GST export return by the deadline set by GST legislation must be fulfilled.

- The export invoice data, found in Table 6A of Form GSTR-1, should include the full shipping bill number, shipping bill date, and port code information.

- Please consider that any export transactions completed within a specific period of taxation must be documented in both GSTR-1 and GSTR-3B for that same period.

- Additionally, it is important to ensure that the combined IGST and cess amounts stated in Table 3.1 of GSTR-3B are either equivalent to or exceed the values found in Table 6A and Table 6B of GSTR-1.

- The authority responsible for Goods and Services Tax (GST) views the shipping bill as a form of refund application. The export information stated in GSTR-1 is transmitted by the GST portal to ICEGATE.

- In addition, a notification is sent to confirm that the GSTR-3B has been filed for the appropriate tax period.

- The Customs system cross-references the data from GSTR-1 with the details on the shipping bill and Export General Manifest (EGM) and subsequently proceeds with the reimbursement.

- Once the taxpayers’ accounts have been credited with the refund payment, the ICEGATE system will transmit payment information to the GST portal. Taxpayers will receive information from the GST portal through SMS and e-mail.

Documents required for GST Export refund application

To avail of the GST Refund on export, the Exporter must have the following documents in case of deemed export of Goods:

- Exporter must have an Import/Export Code (IEC).

- If you wish to export without paying IGST, you will need to submit a LUT or deposit.

- Orders related to export operations The exporter must issue a tax invoice containing the following information: – Indicating whether the export was made with or without payment of comprehensive tax Exporter’s address, name, GSTIN Invoice number and date Recipient’s name and address, country of destination and shipping address Harmonized Nomenclature (HSN) product code with description Number of units shipped Size and Quantity of Good

- Total Breakdown of All Goods Prices and Cost Per Unit Signature of Exporter or Authorized Signatory Shipping Invoice with Details Matching Tax Invoice

- Submitted A shipping invoice will be treated as a refund request if the following conditions are met: An exporter carrying out an export submits an export manifest.

- File Form GSTR-3 or GSTR-3B in the appropriate manner.

To avail of the GST Refund Exporter must have the following documents in case of export of Services:

- If the supply of services is an export under Section 2(6) of the IGST Act, 2017, the services exporter shall consider the following factors: For the export of services without payment of IGST, a contract or bond must be submitted. Exporters should ensure that they have relevant service contracts that can be attached.

- The exporter must issue a tax invoice containing the following information: Note explaining whether the shipment is for export with or without payment of integrated tax Name, address, and GSTIN of exporter Invoice number and date Name and address of recipient, HSN code of service Total service value and stepwise breakdown or milestones (if any), Signature of exporter or exporter’s authorized signatory, Receipt of converted foreign exchange

- Exporter must submit bank conversion certificate Documents such as documents and foreign remittance certificates must be retained for a specified period (usually one year from the date of export).

- If the exporter fails to do this, GST will apply.

Steps to submit a pre-claim application for a refund

Refund Advance Application is a form that taxpayers must fill out to provide information about their company, Aadhaar number, income tax details, export dates, expenses, investments, etc. The taxpayer must submit this advance claim form for all kinds of GST refunds. The form after submission cannot be edited and it requires no signature. Therefore, users should be careful when entering data. There are two steps to submit the GST refund advance request form.

- Login to the account in the GST Portal and choose the Refund option from the service section. From there, click on the ‘Refund pre-application form’ to proceed.

- Complete the required fields and select ‘Submit’ on the ‘Refund pre-application form’ screen. The screen will show a message confirming the submission.

The process to file a Refund Application in RFD-01

- Login to the account in GST Portal choose the Refund option from the service section and select the Request a Refund option.

- Select the reason for your refund, and the type of refund, and click Create Refund Request.

- The period for which you would like to request a refund must be selected then select Yes or No.

- In the “If you request a non-zero refund” dialog box, If the refund claim is zero, the taxpayer can check the return and proceed with filing through DSC or EVC.

- This step does not apply to types of refunds such as excess cash balances on the general ledger, intrastate shipments that are subsequently held as interstate shipments, and vice versa, appraisals or preliminary appraisals, appeals, or other orders.

- Enter the details on the appropriate page that appears based on the refund type you selected in the previous step.

Types of Refund

- Excess cash balance in electronic cash ledger: When you have more cash in your digital cash account than needed, you can claim a refund by specifying the amount.

- Excess tax paid through GSTR-3B: By providing the details of the excess tax paid in GSTR -3B return one can claim a refund of the excess tax paid as per GSTR- 3B return.

- Accumulated ITC due to exports of goods and services without tax payment: You can get a refund, If you have Input Tax Credit (ITC) accumulated from exporting goods and services without paying tax, This involves entering export invoice details, generating a JSON file, and inputting turnover and credit information for the refund calculation.

- Accumulated ITC due to supplies made to SEZ unit/SEZ developer without tax payment: This is for businesses supplying goods or services to Special Economic Zones (SEZ) without tax. You can claim a refund by ensuring you’ve filed GSTR-1 and GSTR-3B for the relevant period and submitting Statement 5 (CSV file).

- ITC accumulated due to inverted tax structure: If you’ve paid more tax on inputs than you’ve collected on outputs (inverted tax structure), you can apply for a refund. Follow a process like Type 3 but use Statement 1A and provide details about turnover, tax payable, and credit.

- Refund by the recipient of deemed exports: Recipients of supplies classified as “deemed exports” can request a refund for the tax they’ve paid on those supplies. This follows the Type 3 process, using Statement 5B and including the net input tax credit and the refund amount.

- Tax paid on supplies made to SEZ unit/SEZ developer with tax payment: Businesses that have paid taxes on supplies to SEZ units or developers can claim a refund. The process is like Type 3, using Statement 4, with the refund amount auto-populated based on the uploaded statement.

- Tax paid on an intrastate supply later held as interstate supply and vice versa: If the nature of supply changes from intrastate to interstate or vice versa, you can claim a refund. Follow the Type 3 process, using Statement 6, and the refund amount will be auto-calculated.

- Refund by the supplier of deemed exports: Suppliers of “deemed exports” can request a refund for the tax they’ve paid. The process mirrors Type 3, using Statement 5B, with the refund amount auto-populated based on the statement.

- Refund of IGST paid on export of services with tax payment: If you’ve paid IGST on exported services, you can seek an IGST refund. The process is akin to Type 3, using Statement 2, and the refund amount is auto-calculated.

- Refund on ‘any other ground’: For refunds not covered by the above categories, you can specify the reason and details for the claim.

These refund types correspond to different scenarios where businesses or individuals can seek a refund of GST in India, following specific procedures set by the tax authorities.

What happens after the GST Export Refund is applied?

When an individual or a business applies for a GST refund, their application is reviewed by a tax officer or refund processing officer. These officers examine the application and all the accompanying documents to ensure its accuracy. To track claim progress, claimants can use the “Track Claim Status” feature in the Refunds section. After thorough examination and approval from the GST authorities, the approved refund amount will be transferred to the applicant’s bank account.

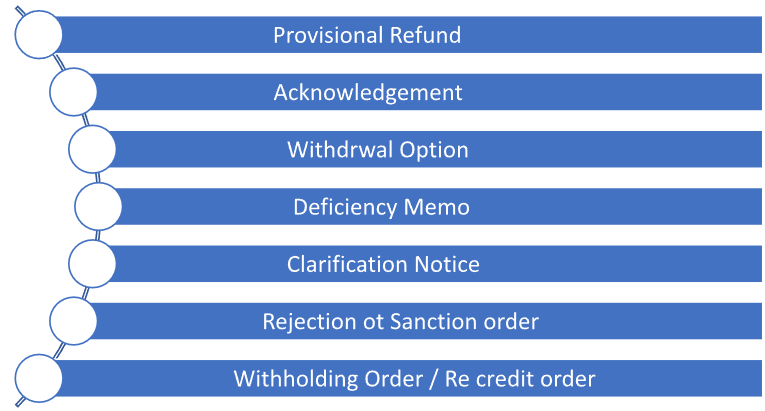

The following are the actions that can be performed by the agent during the process:

- Provisional Refund (RFD-04): In certain cases, the officer may issue a provisional refund using form RFD-04. This provisional refund, typically covering at least 90% of the requested refund, should be provided within 7 days from the date of acknowledging the application

- Acknowledgement (RFD-02): An acknowledgment in the form RFD-02 is issued within 15 days of the application submission, provided that the application is complete and in order.

- Withdrawal Option (RFD-01W): If the applicant decides to withdraw their refund application, they can do so by using form RFD-01W. Any refund amount debited from their electronic credit or cash ledger during the application process will be credited back to them.

- Deficiency Memo (RFD-03): When there are deficiencies in the application, the officer can issue a deficiency memo using form RFD-03. If the refund amount has been debited from the ledger, it will be automatically re-credited, and the applicant will need to submit a new application with the necessary corrections.

- Clarification Notice (RFD-08): If the application is rejected or if a refund was mistakenly granted, the officer may issue a clarification notice using form RFD-08. In response, the applicant is required to reply within 15 days using form RFD-09.

- Sanction or Rejection Order (RFD-06): The officer will issue a sanction or rejection order using form RFD-06. In cases of sanction, a payment order (RFD-05) is issued. There are instances when RFD-05 is issued after RFD-04.

- Withholding Order (RFD-07 – Part B): In specific situations, the officer might issue an order to withhold a sanctioned refund using form RFD-07 (Part B). In such cases, RFD-05 is not issued.

- Re-Credit Order (PMT-03): If the refund is rejected or if a provisional refund was granted, the officer can issue an order (PMT-03) to re-credit the refund from the taxpayer’s electronic cash or credit ledger.

These steps and forms are integral parts of the GST refund process, with each form serving a specific role to ensure that refunds are managed accurately and efficiently.

Takeaway

When a business exports goods or services and pays GST on them, they can apply for a GST refund. This means they get back the GST they paid. The refund process involves applying for a refund, which is reviewed by tax authorities. Once approved, the refunded amount is credited to the business’s bank account, ensuring that they don’t pay GST twice on exported items.