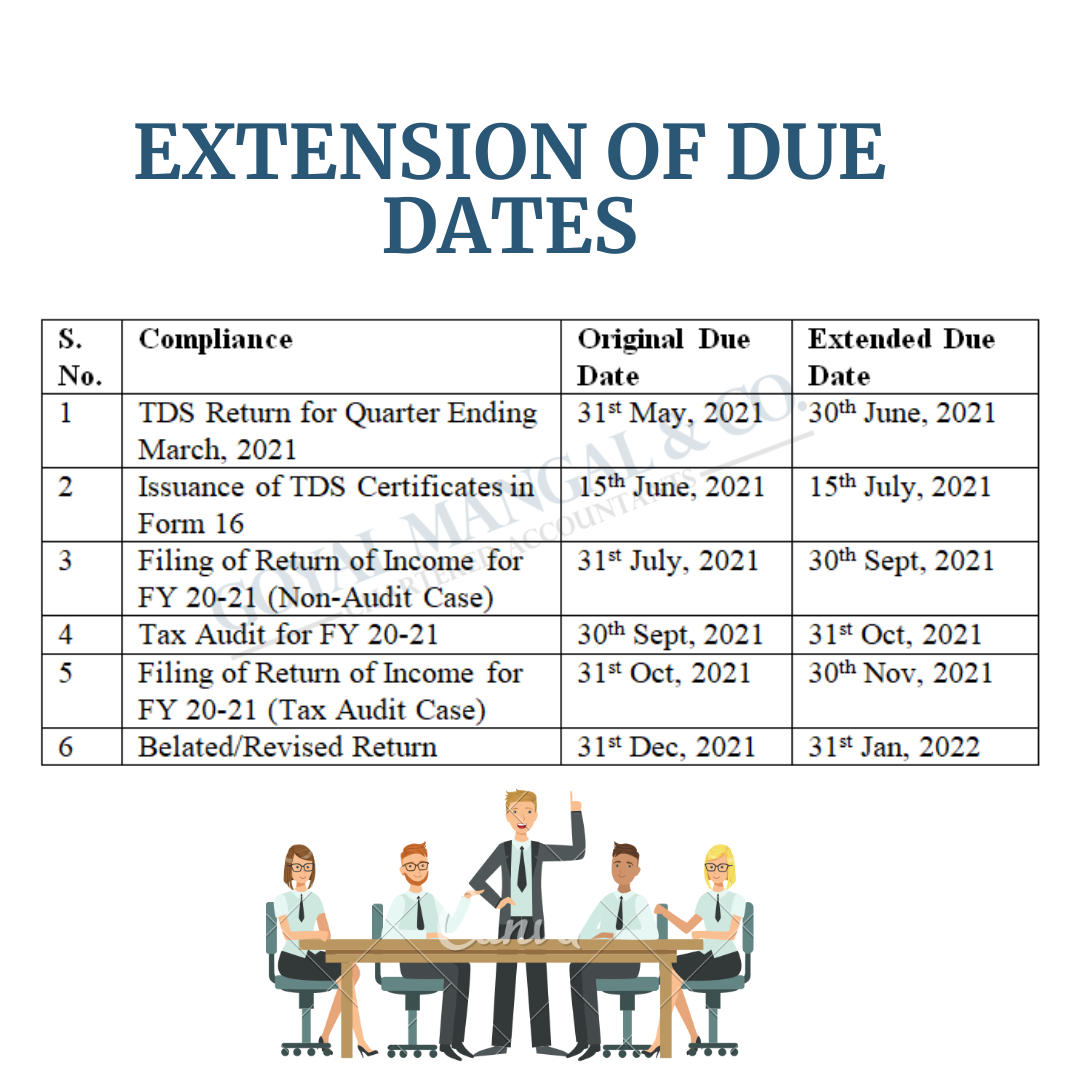

Central Board Of Direct Taxes (CBDT) in exercise of its power Under Section 119 Of Income Tax Act, 1961 has extended the time limits of certain compliance to provide relief to the taxpayers in the view of this severe pandemic (COVID 19) for FY 20-21 and AY 21-22

RELAXATION PROVIDED BY INCOME TAX DEPT

In the context of filling income tax return (ITR) some relaxation are provided are as under:

| PARTICULARS | Original Due Dates | Extended Due Dates |

| Due date of Furnishing return of income for AY-2021-22 U/s 139(1) | 31st July 2021 | 30TH September 2021 |

| Due date of Furnishing of report of audit for py-2020-21 | 30TH September 2021 | 31st October 2021 |

| Due date of Furnishing report from an accountant by persons entering into international transaction or specified domestic transaction U/s 92 E for PY-2020-21 | 31st October 2021 | 30th November 2021 |

| Due date of Furnishing return of income for AY-2021-22 U/s 139(1) | 31st October 2021 | 30th November 2021 |

| Due date of Furnishing return of income for AY-2021-22 U/s 139(1) | 30th November 2021 | 31st December 2021 |

| Due date of furnishing belated or revised return of income for AY-2021-22 U/s 139(4)or 139(5) | 31st December 2021 | 31st January 2022 |

2) In the context of TDS AND TCS some relaxation are provided are as under:

| PARTICULARS | Original Due Dates | Extended Due Dates |

| For furnishing Statement of deduction of tax for the last quarter of FY-2020-21 under Rule 31A | On or before 15TH JUNE 2021 | On or before 15TH JULY 2021 |

| For furnishing TDS/TCS book adjustment statement in Form No 24G for May 2021 under Rule 30 and Rule 37CA | On or before 15TH JUNE 2021 | On or before 30th June 2021 |

| For furnishing Statement of deduction of tax from contributions paid by the trustees of an superannuation fund for FY- 2020-21 under Rule 33 | On or before 31st May 2021 | On or before 30th June 2021 |

3)Some other miscellaneous relaxation are also provided are as under:

| PARTICULARS | Original Due Dates | Extended Due Dates |

| For furnishing The Statement Of Financial (SFT) for FY-2020-21 under Rule 114E | On or before 31st May 2021 | On or before 30th June 2021 |

| For furnishing The Statement of Reportable account for calendar year 2020 under Rule 114G | On or before 31st May 2021 | On or before 30th June 2021 |

| For furnishing The Statement Of Income paid or credited by an investment fund to its unit holder in Form No.64 D for PY- 2020-21 under Rule 12CB | On or before 15TH June 2021 | On or before 30th June 2021 |

| For furnishing The Statement Of Income paid or credited by an investment fund to its unit holder in Form No.64 C for PY- 2020-21 under Rule 12CB | On or before 15TH June 2021 | On or before 30th June 2021 |

Conclusion

With a view of the crises and pandemic situation in the country the govt. has extended the due dates for filing Income Tax Return and various other due dates.

[/column]