In the realm of employee welfare and financial security, the term “PF” stands prominently, referring to Provident Fund. PF, managed by the Employee Provident Fund Organization (EPFO), serves as a crucial financial safety net for employees in India. It’s a savings scheme that mandates a portion of an employee’s salary to be set aside each month, building a corpus for their post-retirement life or in times of financial need. When it comes to accessing these funds, individuals often seek clarity on the status of their PF claims. This is where the EPFO Claim Status feature plays a pivotal role. As employees submit claims for withdrawals, transfers, or settlements, they can track the progress and status of their applications through the EPFO Claim Status portal. Understanding this process ensures that you can make well-informed decisions about your financial future.

| Table of Content |

What is a Provident Fund (PF)?

A Provident Fund (PF) is a savings scheme designed to provide financial security to employees. Managed by organizations like the Employee Provident Fund Organization (EPFO), PF involves regular contributions from an employee’s salary, accumulating over time. This fund serves as a safety net, ensuring post-retirement stability and aiding during emergencies. PF offers individuals a way to build a corpus for their future, enhancing their financial well-being.

Understanding EPFO Claim Status

Keeping tabs on your PF claim status, whether for withdrawals, transfers, or settlements, is vital for ensuring a seamless financial process. The EPF Claim Status system offers a transparent and accessible way to monitor the progress of your requests. By utilizing this platform, you can easily stay informed about the status of your EPF claim, making it simpler to manage your financial affairs. Stay empowered with real-time updates through the EPFO Claim Status portal, ensuring a hassle-free experience for all your PF-related transactions.

Steps to Check PF Claim Status

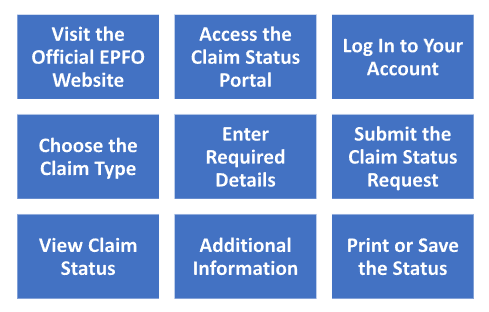

Checking your PF claim status has become remarkably convenient with the introduction of the EPFO Claim Status portal. Here’s a detailed guide on how to navigate the process:

- Visit the Official EPFO Website: Open your web browser and navigate to the official EPFO website (www.epfindia.gov.in).

- Access the Claim Status Portal: Look for the “Our Services” section or a similar tab on the homepage. Click on it to find the “For Employees” option. Under this, you’ll typically find a link to the “Know Your Claim Status” or “EPF Claim Status” page.

- Log In to Your Account: On the EPFO Claim Status page, you’ll be prompted to log in. Use your Universal Account Number (UAN) and associated password to access your account. If you haven’t registered yet, ensure you complete the registration process first.

- Choose the Claim Type: Once logged in, you’ll see a list of different types of claims, such as full withdrawal, partial withdrawal, or transfer. Select the appropriate claim type you want to track.

- Enter Required Details: Fill in the necessary details related to the claim you are tracking. This may include your UAN, PF account number, and establishment code.

- Submit the Claim Status Request: After entering the required details, click on the “Submit” or “Search” button. The system will process your request and fetch the relevant information.

- View Claim Status: The system will then display the status of your claim. This could include details like a claim received, under process, approved, rejected, or settled.

- Additional Information: You may also find other details associated with the claim, such as the claim submission date and the current processing stage.

- Print or Save the Status: If needed, you can print or save the claim status for your records.

Benefits of Using EPFO Claim Status Portal:

- Real-time Updates: The EPFO Claim Status portal offers real-time information on the progress of your PF claims. This ensures that you are always aware of the current status of your application, whether it’s under process, approved, rejected, or settled.

- Transparency and Clarity: The portal promotes transparency by providing clear and detailed information about your claim status. This transparency builds trust and eliminates confusion, allowing you to make well-informed decisions regarding your PF-related matters.

- Convenient Access: Instead of making physical visits or contacting EPFO offices for updates, the portal allows you to check your claim status from the comfort of your home or workplace. This convenience saves you time, effort, and unnecessary hassles.

- Self-reliance: By using the EPFO Claim Status portal, you become self-reliant in tracking your PF claims. You don’t need to rely on intermediaries or agents for updates, empowering you to manage your financial matters independently.

- Timely Resolution of Issues: In case there are any discrepancies or delays in your claim processing, the portal allows you to identify these issues promptly. You can then take appropriate actions or contact EPFO for necessary corrections, leading to faster resolution.

- Secure and Confidential: The portal is designed with security measures to protect your personal and financial information. Your login credentials and claim details are kept confidential, ensuring a safe online experience.

Conclusion

In conclusion, the EPFO Claim Status portal stands as a transformative tool in the realm of Provident Fund management. With the ability to effortlessly PF online claim status check, it offers a host of advantages that empower individuals in their financial journey. The portal’s user-friendly interface ensures that you remain well-informed about the progress of your claims, be it a withdrawal, transfer, or settlement. The convenience of tracking your PF claim status under process from the comfort of your device saves you time and eliminates unnecessary stress. Whether you’re awaiting approval, facing a delay, or your claim is set to be processed, the EPFO Claim Status portal ensures that you’re in the loop every step of the way. Embrace this innovative platform to streamline your PF-related activities and embark on a journey of enhanced financial management.