In the era of digitalisation, many customers are shifting from retail market to online Platforms like Flipkart, Amazon, Snapdeal , Myntra, Zomato, medlife, Pharmeasy etc for their requirements and availing the services at their doorstep.

Market is Customer centered, so the businessmen are also shifting from retail market to online platforms. And after shifting to online platform, businessman is required to fullfill some compliances. E-Commerce has transformed the way of doing business and trade throughout the world. Considering the population and demand, India is big market for E-Commerce. In this article we will discuss the same.

And also The Government of India has announced various initiatives to support the growth of E-commerce business such as Digital India, Start-up India, Skill India, Make-in-India, Innovation Fund Etc.

| Table of Content |

How to set-up an E-Commerce entity in India:

Incorporation:

Every Business Entity must get registred in the Ministry of Corporate Affairs as per applicable laws. It must be registered either in Companies Act 2013 as Indian company or as foreign company, and have an branch /agency outside India owned or controlled by a person resident in India.

It is mandatory to have Entity physically located in India.

Payment Gateway:

Payment gateway is necessary to process the customer payments in the E-commerce website business. It provides customers, to accept the debit cards and credit cards and net banking payments etc. from different banks and credit cards issued by the companies. Every e-commerce business must have a payment gateway to accept online payments. By payment gateway, the amount receive from the customers is transferred to the bank account of the Company.

Mandatory GST Registration:

As per GST Act, if you want to sell your products through online E-Commerce Platforms like Amazon, Flipkart, Snapdeal, etc then, in that case GST Registration is mandatory. Firstly, you have to take GST registration and then you can apply for listing of your products with these E Commerce Platforms. And there is no threshold exemption limit is allowed in case of sale through E-Commerce Platforms.

Bank Account

All E-commerce businesses must have to open a bank account with any bank in India in the official name of the entity to operate their business.

Legal Documentation:

Drafting and Execution of various Legal agreements & contracts such as Website Term User Agreement, Employment Agreement etc.; Memorandum of Association, Articles of Association, Website Privacy Policy, and other related documents.

Data Protection

E-commerce industry in India must ensure maintenance, privacy protection, data security, cyber security, confidentiality etc. And must comply with laws related to data protection.

Cyber Law Due Diligence

All E-commerce businesses must ensure cyber laws must comply in India.

Competition Issues

The entity must comply with the competition laws of India, while entering into any arrangements with the relevant parties.

Applicability of Other Laws

As per new guidelines, issued by government of India related to transactions done through E Commerce portals like mentioning of origin country detail of products imported from other country, and in case of perishable goods, date of expiry etc must be followed to avoid any legal action by customer, E Commerce platform and government department side.

Information Technology Act 2000:

E-commerce entity based outside India requires to appoint a person /individual resident in India to ensure compliance with the Consumer Protection Act, 2019 and Consumer Protection Rules, 2020 even though such entity may not have an office / place of business in India.

Compliances under Income Tax Act & GST for E-Commerce Business:

Filing of GST TDS/TCS Returns:

As per GST Act, every electronic commerce operator is required to collect TCS @ 1% of net value of taxable supplies made through it by other suppliers where the consideration is collected by the operator. Mostly, dealers are not aware about this provision. After filling the return by dealer, then the deducted amount will be credited to their cash ledger which can be utilised by them for making payment of their GST dues.

Filing of GST Returns:

In Case , dealers who got GST registration for selling their products online do not file GSTR-1 and GSTR-3B due to which there GST registration will be cancelled after 6 Months on suo-motto basis. So, as per the GST Provisions, filing of GST return after registration is mandatory irrespective of sales turnover.

Deduction of TDS U/s 194 of Income Tax Act:

Every E-Commerce operator is required to deduct TDS at the time of credit of:- 1)amount of sale of goods/services to the account of an e-commerce participant or 2)at the time of payment by e-commerce participant through any mode, whichever is earlier. If TDS is deducted as per provision, then dealer is required to file Income Tax return to claim the respective TDS Amount.

Deduction of TDS by dealer:

In case, turnover of the dealer is more than Rs.1 Crore during the previous year then TDS registration is mandatory and dealer is required to deduct TDS under applicable provisions. In some cases, dealer is also required to deduct TDS u/s 194C, and 194 H on fees and commission paid to E-Commerce platforms. Wrong deduction may create problems for dealer so, dealer has to take some precautions.

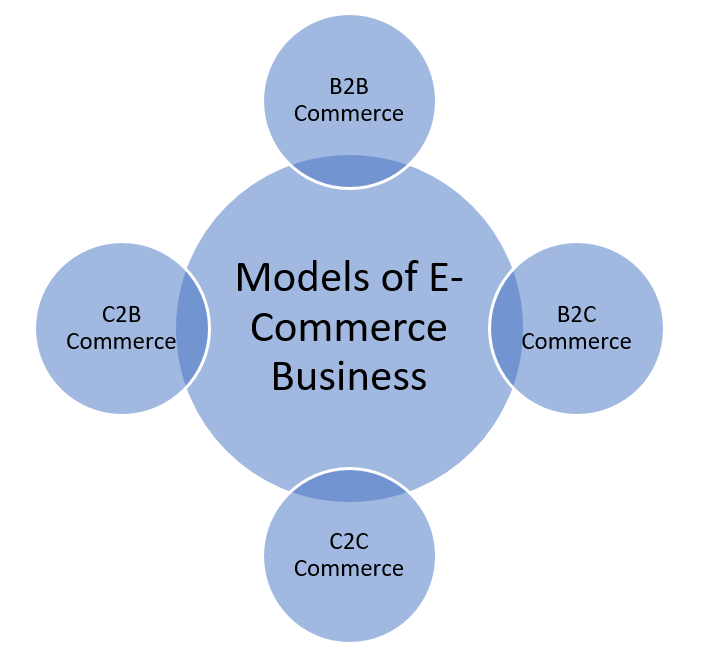

Models of E-Commerce Business: