The implementation of the Goods and Services Tax (GST) in many countries has brought about significant changes to the taxation system, streamlining and unifying indirect taxes. One of the critical aspects of GST is the seamless transfer of tax credits across the supply chain. To facilitate this process, a Credit Transfer Document (CTD) has been introduced, providing a transparent and efficient mechanism for transferring tax credits between taxpayers. The CTD serves as a proof of input tax credit (ITC) eligibility, allowing taxpayers to transfer the unutilized ITC to their suppliers. It simplifies the process by eliminating the need for physical goods transfer and offers a streamlined documentation process, reducing administrative burdens. In this article, we will explore about the Credit Transfer Document under GST.

| Table of Content |

What do you mean by Credit Transfer Document under GST?

The CTD under the GST refers to a document that facilitates the transfer of tax credits between taxpayers in the GST system. GST is a comprehensive indirect tax levied on the supply of goods and services in many countries. One of the key features of GST is the ITC, which allows taxpayers to claim credits for the taxes paid on their purchases.

The Credit Transfer Document serves as a proof of eligibility for input tax credits, allowing taxpayers to transfer the unutilized credits to their suppliers. It simplifies the process by eliminating the need for physical goods transfer and offers a streamlined documentation process. The CTD is generated and exchanged electronically, containing essential details such as the GSTIN (Goods and Services Tax Identification Number) of the supplier and recipient, invoice details, and the amount of tax credit being transferred.

Key features of the Credit Transfer Document under GST

- Electronic Format: The CTD is generated and exchanged electronically between the supplier and recipient, eliminating the need for physical paperwork and reducing manual errors.

- Unique Identification Number (CTD Number): Each Credit Transfer Document is assigned a unique identification number, providing traceability and authenticity to the document.

- Validity and Time Limits: The CTD has a specified validity period within which the recipient can utilize the tax credit. It ensures timely utilization of credits and avoids hoarding or misuse.

- Information and Verification: The CTD contains essential details such as the supplier’s and recipient’s GSTIN, invoice details, and the amount of tax credit being transferred. This information helps in verification and reconciliation during audits.

- Audit Trail: The CTD maintains an audit trail of credit transfers, allowing tax authorities to track the flow of credits and ensure compliance.

What are the conditions to Issue Credit Transfer Documents under GST?

The conditions to issue CTDs may vary based on the specific regulations and guidelines of the GST system. Here are general conditions that are typically associated with issuing CTDs:

- Eligibility for Input Tax Credit (ITC): The supplier must be eligible to claim input tax credit on the goods or services supplied. This means that the supplier should have valid tax invoices or other prescribed documents supporting the ITC claim.

- Valid GST Registration: Both the supplier and recipient of the goods or services must be registered under the GST system and possess valid GSTIN (Goods and Services Tax Identification Number).

- Documented Transaction: There must be a valid business transaction between the supplier and recipient, supported by proper documentation such as tax invoices, delivery challans, or other relevant documents prescribed by the GST authorities.

- Compliance with Time Limits: The transfer of tax credits through CTDs is subject to certain time limits or validity periods. The supplier should issue the CTD within the specified time frame to the recipient to enable the transfer of tax credits.

- Accurate Information: The CTD should contain accurate and complete information about the supplier, recipient, GSTIN, invoice details, and the amount of tax credit being transferred. It is crucial to ensure that the CTD reflects the correct and verifiable information to maintain transparency and compliance.

- Electronic Generation and Exchange: CTDs are typically generated and exchanged electronically to streamline the process. Compliance with the prescribed electronic format and technical requirements is necessary for issuing CTDs.

Necessary documents needed to be filed

The necessary documents that may need to be filed when dealing with CTDs under the GST system. Here are some common documents that are mainly associated with CTDs:

- Tax Invoices: Tax invoices are essential documents that provide details of the goods or services supplied, including the GSTINs of the supplier and recipient, description of the goods or services, quantity, value, and applicable taxes. Tax invoices are generally required to support the CTDs and the transfer of tax credits.

- Credit Transfer Document (CTD): The CTD itself is an important document that needs to be filed. It contains details such as the supplier’s and recipient’s GSTIN invoice details, and the amount of tax credit being transferred. The CTD serves as proof of the transfer of tax credits and should be maintained for future reference and audit purposes.

- Records of CTD Issuance and Receipt: It is advisable to maintain a record of all CTDs issued and received. This includes details such as the CTD numbers, dates of issuance, names of the parties involved, and amounts of tax credits transferred. These records help in maintaining an audit trail and facilitating reconciliation during audits.

- Compliance Reports: Depending on the specific requirements of the GST system, businesses may be required to file periodic compliance reports related to CTDs and the transfer of tax credits. These reports help the tax authorities track and monitor the flow of tax credits within the supply chain.

- Other Relevant Supporting Documents: In addition to the above, there may be other supporting documents that need to be filed, such as delivery challans, purchase orders, payment receipts, and any other prescribed documents specific to the GST system in your jurisdiction.

Process for issuing a CTD under GST

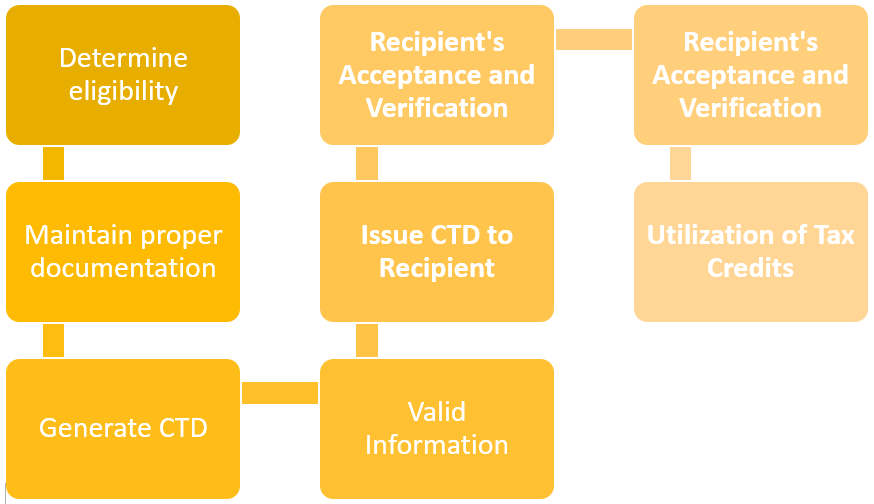

The process for issuing a CTD under GST system typically involves the following steps:

- Determine Eligibility: The supplier must assess their eligibility for claiming ITC on the goods or services supplied. This involves ensuring that they have valid tax invoices or other prescribed documents supporting their ITC claim.

- Maintain Proper Documentation: The supplier should maintain all relevant documentation related to the business transaction, such as tax invoices, delivery challans, or other prescribed documents as required by the GST authorities.

- Generate CTD: Using the electronic systems or software approved by the GST authorities, the supplier generates the Credit Transfer Document. The CTD is typically in an electronic format and contains details such as the supplier’s and recipient’s GSTIN, invoice details, and the amount of tax credit being transferred.

- Validate Information: The supplier ensures that all the information provided in the CTD is accurate and complete. This includes verifying the GSTINs, invoice details, and tax credit amounts.

- Issue CTD to Recipient: Once the CTD is generated, the supplier electronically sends the CTD to the recipient of the goods or services. The recipient should receive the CTD within the specified time frame to enable the transfer of tax credits.

- Recipient’s Acceptance and Verification: Upon receiving the CTD, the recipient verifies the information contained therein, including the supplier’s GSTIN, invoice details, and tax credit amounts. If the recipient finds any discrepancies or issues, they may communicate with the supplier to resolve them.

- Utilization of Tax Credits: The recipient can utilize the tax credits received through the CTD for offsetting their tax liabilities. The CTD serves as proof of eligibility for claiming the tax credits.

Takeaway

Credit Transfer Document (CTD) under GST system has significantly simplified the process of transferring tax credits between taxpayers. By leveraging electronic formats, unique identification numbers, and defined time limits, the CTD ensures seamless credit flow, transparency, and accountability. This mechanism not only reduces administrative burdens but also minimizes disputes and enhances compliance. The CTD plays a crucial role in streamlining the GST system and fostering a conducive environment for businesses to claim and utilize their eligible tax credits efficiently.