What is Corporate Insolvency?

A Company is declared insolvent if it is unable to pay its debts to its creditors whether whole or any part or installment, when due and payable. Following test are there to check for corporate insolvency:

- The Cash-Flow Test: Is the Company currently or in future will it be unable to pay its debts

- The Balance Sheet Test: Is number of its liabilities exceeds value of Company’s assets after considering uncertain liabilities

Applicability of Insolvency and Bankruptcy Code, 2016:

The code extends to the Whole of India. Section 2 of the code states that the provisions of the code shall apply to the following person:

- Any Company incorporated under the Companies Act, 2013 or any other previous law

- Limited Liability Partnership incorporated under Limited Liability Partnership Act, 2008

- Partnership Firms and Proprietorship Firms

- Any Individual Person

- Such other body incorporated under any law for the time being in force, as the Central Government may by notification specify on this behalf.

Introduction to Corporate Insolvency Resolution Process

Corporate Insolvency Resolution Process is the process of resolving the corporate insolvency of corporate debtors in accordance with the provisions of the code and it can be said it is the recovery mechanism for creditors.

Who can initiate the Corporate Insolvency Resolution Process?

The corporate insolvency resolution process can be initiated by defaulting debtor by the following parties:

- Financial Creditor: Under sec 7 of Insolvency and Bankruptcy Code, Financial Creditor who can initiate insolvency proceedings is Individual money lender, banks, NBFC etc.

- Operational Creditor: Under sec 9 of Insolvency and Bankruptcy Code, Operational Creditor who can initiate insolvency proceedings is supplier of goods or/and services.

- Corporate Debtor: Under sec 10 of Insolvency and Bankruptcy Code, Corporate debtor includes a Company/LLP who owes debt to any person.

Note:- Meaning of Financial Creditor– Any person to whom a financial debt is owed and includes a person to whom such debt has been legally assigned or transferred to.

Meaning of Operational Creditor:- Any person to whom an operational debt is owed and includes any person to whom such debt has been legally assigned or transferred.

Meaning of Corporate Debtor:- Any corporate person who owes a debt to any person. In simple terms, who accepted/took a money loan from any person.

Time Limit within which Corporate Insolvency Resolution Process should be completed

CIRP shall be completed within a period of 180 days from the date of admission of such application to initiate CIRP. One time extension of 90 days may be granted by the adjudicating authority. 330 days is the maximum time limit within which CIRP has to be mandatorily completed, including any extension or litigation period.

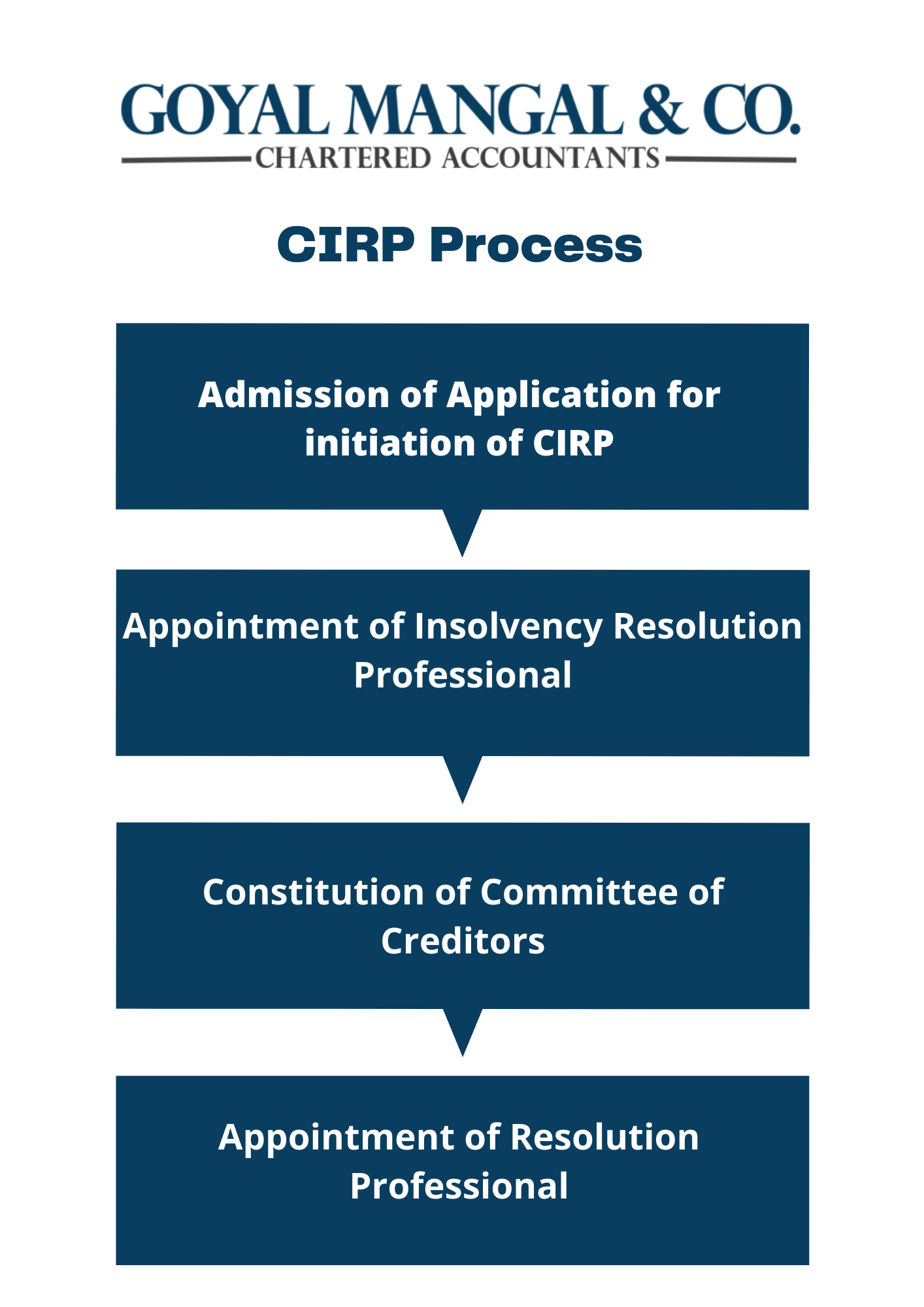

Corporate Insolvency Resolution Process