In the dynamic landscape of corporate entities, the conversion of a Section 8 Company into another form of company opens doors to new possibilities and operational flexibility. A Section 8 Company, primarily formed for charitable or nonprofit objectives, can undergo a transformational process known as “Conversion.” This process enables it to transition into various other company types with distinct features and purposes. This article provides a simplified insight into the conversion of a Section 8 Company into any company, exploring the steps involved and the potential benefits that arise from this transformation. Let’s delve into the key aspects of this conversion journey, shedding light on how a Section 8 Company can evolve and adapt to the changing needs of its stakeholders and the broader business environment.

| Table of Content |

Brief Explanation of Section 8 Companies

A Section 8 Company, established under the Companies Act, is a nonprofit entity aiming to promote charitable, scientific, artistic, educational, or social welfare causes. Unlike profit-driven firms, it operates for societal benefit, channeling generated income back into its objectives. Section 8 Companies are prohibited from distributing dividends to members and maintain limited liability. They enjoy tax benefits, making them appealing for philanthropic efforts. These companies play a pivotal role in addressing social issues, leveraging resources and efforts to create a positive impact. Registration involves adhering to specific guidelines, and compliance ensures continued nonprofit status. In essence, Section 8 Companies combine business principles with altruism to drive meaningful change and betterment in diverse sectors.

Types of Companies for Conversion

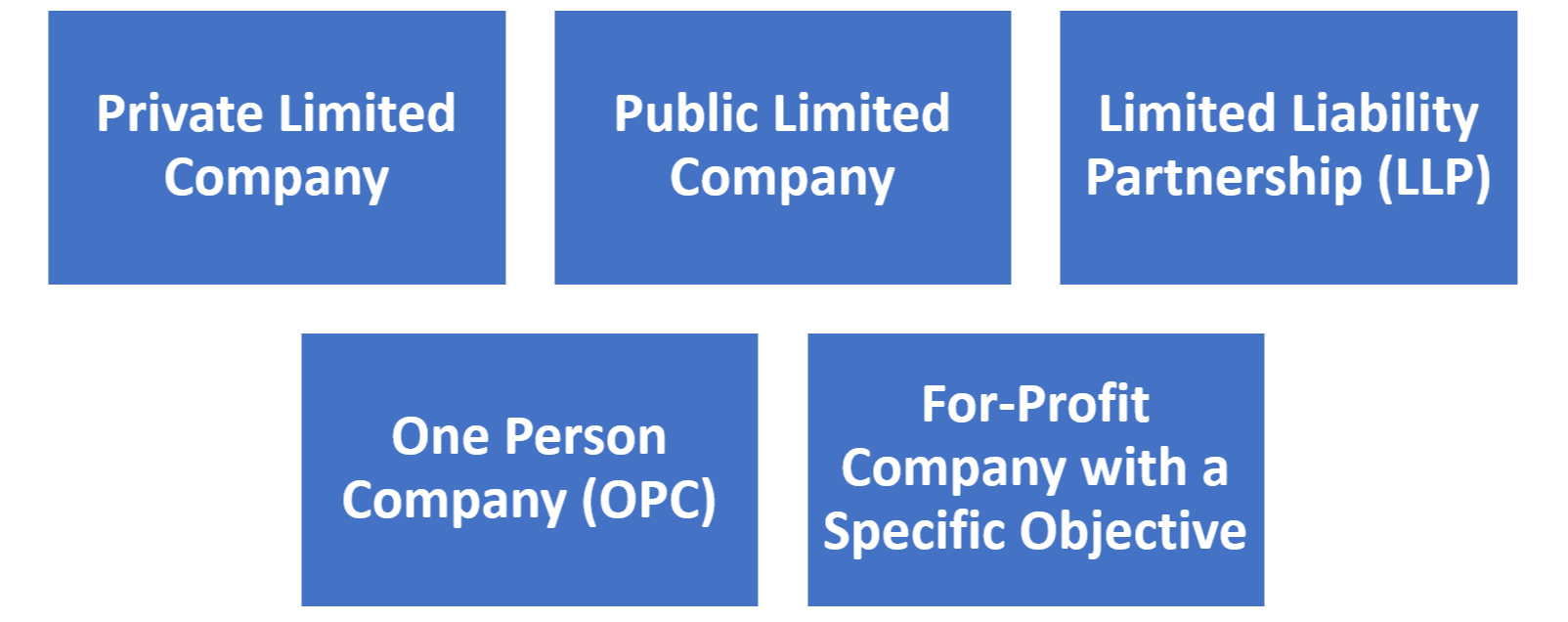

When a Section 8 Company seeks to undergo conversion, it can transition into various types of business entities based on its new objectives and operational requirements. Here are some of the common types of companies into which a Section 8 Company can be converted:

- Private Limited Company: A private limited company offers limited liability to its members and can have a minimum of two and a maximum of 200 members. It can raise capital by issuing shares and has the flexibility to engage in a wide range of business activities. The conversion process involves altering the company’s memorandum and articles of association to align with the new structure.

- Public Limited Company: A public limited company can raise capital from the public by issuing shares on stock exchanges. It requires a minimum of seven members, and there is no upper limit on the maximum number of members. The conversion involves complying with stringent regulatory requirements and fulfilling the conditions for a public offering.

- Limited Liability Partnership (LLP): An LLP combines the features of a partnership and a company, offering limited liability to its partners. It is suitable for professionals and businesses engaged in collaborative activities. The conversion involves transferring assets and obligations and updating the company’s structure to meet LLP regulations.

- One-Person Company (OPC): An OPC is a unique type of company that allows a single individual to form and manage a company, providing limited liability protection. It is ideal for sole entrepreneurs. The conversion requires appointing a nominee and altering the company’s constitution to comply with OPC regulations.

- For-Profit Company with a Specific Objective: Depending on the new business objectives, a Section 8 Company can convert into a regular for-profit company with a specific commercial purpose. The conversion process involves changing the company’s memorandum and articles of association to reflect the new activities.

Documents Required for conversion

The specific documents required for the conversion of a Section 8 Company into another type of company can vary based on the jurisdiction and the type of company you are converting to. However, here is a general list of documents that might be required for the conversion process:

- Application for Conversion: A formal application for conversion, typically addressed to the Registrar of Companies (RoC), outlining the intent to convert the Section 8 Company into the desired type of company.

- Altered Memorandum and Articles of Association: Updated and altered versions of the company’s Memorandum of Association (MoA) and Articles of Association (AoA) reflect the new objectives, activities, and structure of the converted company.

- Consent of Members/Shareholders: Written consent or approval from the existing members or shareholders of the Section 8 Company for the proposed conversion.

- Director’s Report: A report prepared by the company’s directors explaining the reasons and benefits of the conversion, the impact on stakeholders, and the plans of the converted company.

- Statement of Accounts: Financial statements, including balance sheets, profit and loss statements, and other relevant financial reports of the Section 8 Company.

- Income Tax Returns: Copies of income tax returns filed by the Section 8 Company for the previous financial years.

- No Objection Certificates (NOCs): NOCs from regulatory bodies, if applicable, depending on the industry or sector in which the company operates.

- Approval from Regulatory Authorities: If the Section 8 Company was engaged in activities requiring specific licenses or approvals, documentation indicating the approval or clearance from the relevant authorities.

- List of Members/Shareholders: An updated list of current members or shareholders of the company.

- List of Assets and Liabilities: A detailed list of the company’s assets and liabilities, along with their valuation, as of the conversion date.

- Board Resolution: A board resolution of the company’s directors approving the conversion and authorizing the necessary actions.

- Affidavits and Declarations: Affidavits and declarations from directors and members confirm compliance with conversion requirements and regulations.

- Proof of Payment: Evidence of payment of conversion fees and other charges to the regulatory authorities.

Procedure for Conversion

Here is a generalized outline of the steps involved in the conversion process:

- Preparation Phase: Conduct a thorough analysis of the reasons for conversion and the type of company that best aligns with the new objectives.

- Approval from Members/Shareholders: Obtain approval from the members or shareholders of the Section 8 Company through a special resolution. A certain percentage of votes may be required for approval.

- Draft Altered Memorandum and Articles of Association: Prepare the altered Memorandum of Association (MoA) and Articles of Association (AoA) to reflect the new structure, objectives, and activities of the converted company.

- Application for Conversion: Prepare and submit a formal application for conversion to the Registrar of Companies (RoC) or relevant regulatory authority. This application typically includes the altered MoA and AoA, along with other required documents.

- Clearance and Verification: The RoC reviews the application and associated documents for compliance with legal requirements. They may request additional information or clarification during this stage.

- Advertisement and Objections: In some jurisdictions, the conversion may need to be advertised in newspapers, allowing objections from the public. Address any objections raised during this period.

- Approval and Issuance of Certificate: Upon satisfying all requirements and resolving any objections, the RoC approves the conversion and issues a fresh Certificate of Incorporation. This certificate will indicate the new type of company.

- Transfer of Assets and Liabilities: Transfer the assets, rights, licenses, and liabilities of the Section 8 Company to the newly converted company. This may involve legal documentation and agreements.

- Compliance and Reporting: Fulfil any additional compliance requirements specific to the new type of company, such as obtaining new licenses, registrations, or approvals.

- Update Statutory Records: Update all relevant statutory records, licenses, permits, and registrations to reflect the new company type.

- Communicate the Conversion: Inform stakeholders, partners, beneficiaries, and relevant authorities about the successful conversion of the Section 8 Company into the new company type.

- Tax and Financial Considerations: Address any tax implications and adjust financial reporting and documentation based on the new company structure.

Conclusion

The conversion of a Section 8 Company into another type of company represents a significant transformation that holds the potential to shape the future trajectory of the organization. This strategic decision allows the company to adapt, evolve, and align its structure with new objectives and operational requirements. As the business landscape continues to evolve, the choice to convert represents a dynamic step forward, enabling the company to navigate changing demands, contribute meaningfully to society, and embark on a renewed journey toward sustainable success.