The workplace is a very important place for any business. Any company should have a registered office as per the provisions of the Companies Act. The registered office of the company is supposed to be mentioned in Memorandum of Association and Articles of Association of the company. Sometimes due to change in circumstances or due to other business exigencies a company might need to change its registered office. So, to do the same any company has to follow the provisions of law. In this article our aim is to understand those provisions.

|

Table of Contents |

General provisions for Registered Office of a Company

Following are the guidelines for any company regarding Registered Office of a Company-

- Any company should have a Registered Office within 15 days of its incorporation. So that it can receive and acknowledge all communications and notice.

- Also the company has to furnish the details of its registered office to Registrar within 30 days of its incorporation.

- A company should have a Registered Office throughout its existence.

- All letter heads, bill papers will contain address of the registered office printed on them.

In situations a Company might need to change its registered office. Following chart depicts the possible scenarios.

Now, we will understand the compliances that a company needs to make for Change in Registered Office of the Company under these circumstances.

Under Same ROC

If the Company shifts its Registered Office in the jurisdiction of the same Registrar of Companies then the compliances are relatively simple.

a) Change in Registered Office of a Company within Same City

Compliances for Change in Registered Office of a Company within Same City, village or town are as follows:-

- The company has to pass a Board Resolution for change of Registered Office.

- Form INC-22 should be submitted with ROC within 15 days of Board Resolution.

B) Change in Registered Office of a Company outside the City

Compliances for are Change in Registered Office of a Company outside the City or town, where it still falls under the jurisdiction of same ROC are as follows:-

- The Board of Directors need to hold a meeting and pass a resolution for calling the Extra Ordinary General Meeting.

- The shareholders of the company need to pass a special resolution for shifting the Registered Office of the Company.

- The form INC-22 and MGT-14 have to be submitted to ROC within 30 days of passing the special resolution.

Along with forms mentioned above a company has to submit following documents should both the cases-

- Copy of the Special Resolution, in case of change of city.

- Other documents like rent agreement, latest utility bills to substantiate the claim of address change.

Under Different ROC

In cases where the company shifts its registered office from jurisdiction of one ROC to another ROC, the procedure involved becomes little lengthy. Let us understand the procedure:-

Change of Registered Office within Same State

Compliances for change in the registered office of a company outside the city limits but under the jurisdiction of another ROC within the same state are:-

Passing Resolution

- The Board of Directors should pass a resolution for calling EGM.

- The company has to pass a special resolution at EGM.

- The special resolution will be submitted to ROC with MGT-14 within 30days of passing of resolution.

Application to Regional Director

- At least one month prior to application to Regional Director the company should issue a public notice via newspaper regarding change of registered office.

- The company should give individual notice to all the debenture holders, creditors, and depositor. So that, if their rights are getting affected they can inform the same to Regional Director. Such intimation should be within 21 days of receipt of notice.

- The company can apply to Regional Director with form INC-23 after issuing notice.

Filings at ROC

- If Regional Director is satisfied he will issue confirmation within 30 days of receipt of application.

- The Company should file such confirmation with ROC within 60 days.

- ROC will also issue a confirmation for change of office within 30 days.

- Order from ROC will be confirmation that all the provisions of act has been followed.

Documents Required

- Board Resolution and Special Resolution passed by the company for change in registered office.

- Key Managerial Person or Directors should give a declaration. The declaration should state that workmen’s dues have been paid and consent of creditors has been obtained for change of registered office.

- An intimation should be made to Chief Secretary of the state regarding change of registered office. It should be stating that employee’s interest have been taken care of. This intimation should be filed with application to Regional Director.

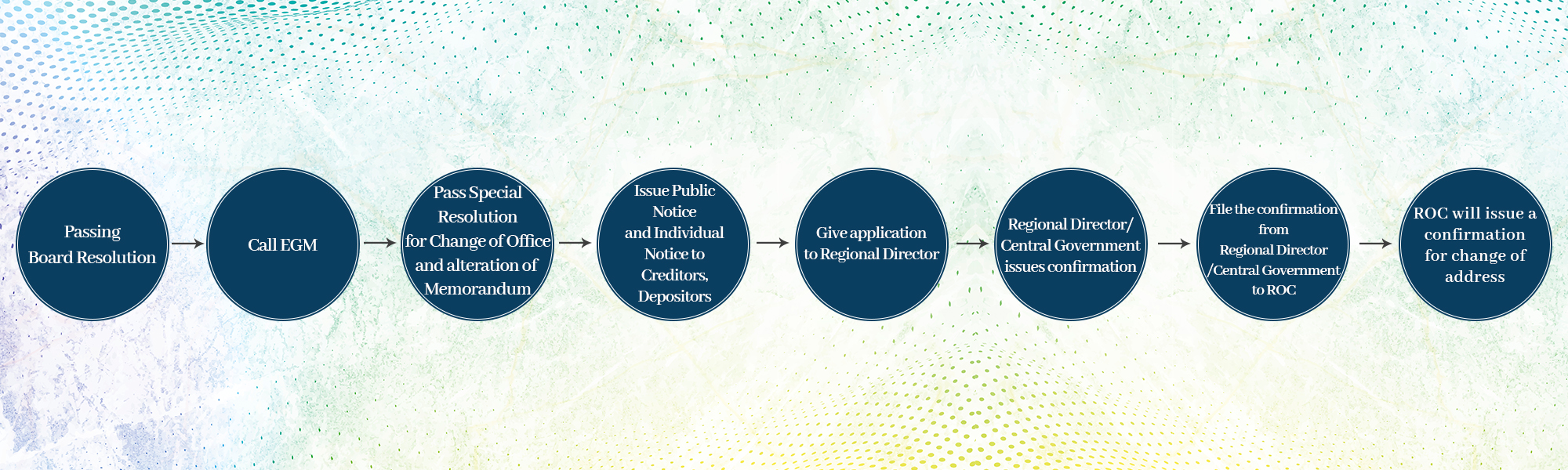

Change of Registered Office Out of State

Compliances for change in the registered office of a company from one state to another state are:-

Passing Resolution

- The Board of Directors should pass a resolution for calling EGM

- The company has to pass a special resolution at EGM for change of registered office and alteration of Memorandum of Association.

- The special resolution will be submitted to ROC with MGT-14 within 30 days of passing of resolution.

Application to Regional Director

- Atleast one month prior to application to Regional Director the company should issue a public notice via newspaper regarding change of registered office

- The company should give individual notice to all the debenture holders, creditors, depositor. So that if their rights are getting affected they can inform the same to Regional Director. Such information should be given within 21 days of receipt of notice.

- The company can apply to Regional Director with form INC-23

- If Central Government is satisfied it will issue confirmation within 60 days of receipt of application.

Filings at ROC

- The Company should file confirmation from Regional Director with ROC within 60 days with form INC-22.

- The approval of Central Government should be filed with ROC of both states with form INC-28.

- ROC will also issue a confirmation for change of office. Order from ROC will be confirmation that all the provisions of act has been followed.

Documents Required

- Board Resolution and Special Resolution passed by the company for change in registered office and alteration in Memorandum of Association.

- Copy of altered Memorandum of Association.

- A list of amount payable to debenture holders and creditors with a declaration that list submitted is complete and there is no other amount payable.

- A declaration that employees will not suffer any job losses due to the change in registered office of the company.

Penalties for Non-Compliance

Company has to comply with all the provisions of the act. Failing to do the same will attract penalties. The company and every person in default will be liable for a penalty of Rs.1000 for every day the default continues but not exceeding one lakh rupees.

Responsibilities of Company after change of Registered Office

Company has to fulfil following responsibilities after the change of address of Registered Office-

- The company has to update the address with all the government authorities.

- Address should be changed on all the letter heads, bill prints and boards etc.

- It is advisable to issue a general notice via newspaper or media advertisement to inform general public about the address change.

- Company has to update address in all the documents like PAN, TAN, GSTIN etc.

Conclusion

The company has to do compliances as mentioned above for change in Registered Office. It is clear from above discussion, that with distance the formalities and compliances also increase. The basic reason of increased compliances is that more and more people might get impacted. The company should ensure that it completes filing with ROC in time to avoid unnecessary penalties. So, this was the discussion about compliances for change in registered office of a company.