Accurately calculating the Goods and Services Tax (GST) is crucial for businesses to maintain compliance and financial integrity. However, navigating the world of taxation can be quite challenging. There are common drawbacks that one must avoid. In this guide we will delve into the realm of GST calculation. Shed light on the prevalent errors that businesses often encounter. Whether you’re a tax professional or a business owner, understanding and avoiding these mistakes can ensure that your Common Mistakes in GST calculations are not precise but also contribute to the smooth operation of your enterprise. Let’s explore the knowledge required to master Common Mistakes in GST Calculation and stay on the side of tax regulations.

| Table of Content |

GST and Its Importance

GST is a value-added tax that is levied on the supply of goods and services at each and every stage of production or distribution. It has replaced many and multiple indirect taxes like excise duty, service tax, and VAT, streamlining the process of taxation. GST can be categorized into Central GST (CGST) and State GST (SGST), making it a basically dual taxation system where both the central as well as the state governments collects revenue. Filing GST returns is a crucial aspect of the GST system. Businesses are required to file regular returns, providing details of their transactions and tax liability. This promotes transparency in the tax system, making it easier for tax authorities to track and verify transactions. GST (Goods and Services Tax) is crucial for modern economies as it simplifies taxation, enhances transparency, reduces tax evasion, and fosters economic growth. It streamlines the tax structure, promotes formalization, and ensures a fair and efficient tax collection system, benefiting both governments and businesses.

Common Mistakes in GST Calculation

Goods and Services Tax (GST) is a complex taxation system that, while designed to streamline and simplify taxation, can still pose challenges for businesses. Several common mistakes in GST calculation can result in compliance issues and financial setbacks. Here are some prevalent errors to be cautious of:

- Incorrect Classification of Goods and Services: Misclassifying goods or services under the wrong GST rate can lead to underpayment or overpayment of taxes. It’s crucial to accurately determine the applicable GST rate for each product or service.

- Improper Calculation of Input Tax Credit (ITC): Failing to calculate ITC accurately by missing eligible credits on input taxes paid during procurement can result in higher tax liabilities and increased operational costs.

- Errors in Invoice Details: Inaccurate invoices, such as incorrect GSTIN numbers, invoice numbers, or dates, can lead to reconciliation issues and delays in claiming ITC.

- Failure to Reverse ITC: ITC claimed on expenses that are not eligible for credit, such as food and beverages or personal expenses, must be reversed. Neglecting this can lead to non-compliance.

- Mismatch in GSTR-2A and GSTR-3B: Not reconciling GSTR-2A (auto-generated purchase return) with GSTR-3B (self-declared sales and purchase return) can result in discrepancies and potential tax notices.

- Ignoring Reverse Charge Mechanism: Some transactions, like services from unregistered vendors, fall under the reverse charge mechanism. Ignoring this can lead to underreporting of tax liability.

- Late Filing of Returns: Missing the due dates for filing GST returns can result in penalties and interest charges. Timely return filing is essential to avoid compliance issues.

- Incorrect Calculation of Aggregate Turnover: Failing to include all taxable supplies while calculating aggregate turnover can lead to errors in GST registration requirements and tax liability.

- Non-Compliance with E-Way Bill Requirements: Not generating E-way bills or not complying with the e-way bill regulations for interstate movement of goods can lead to fines and confiscation of goods.

- Failure to Maintain Proper Records: Inadequate record-keeping of invoices, receipts, and other financial documents can hinder accurate GST calculation and compliance.

- Ignoring Place of Supply Rules: GST liability is often determined based on the place of supply. Ignoring these rules can lead to incorrect tax calculations.

- Inadequate Understanding of GST Rules: Insufficient knowledge of GST rules and regulations can result in inadvertent mistakes in tax calculations and compliance.

Strategies for Accurate GST Calculation

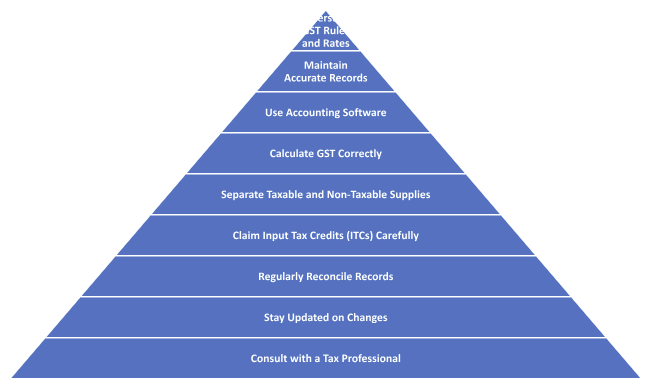

Accurate GST (Goods and Services Tax) calculation is crucial for businesses to ensure compliance with tax laws and to avoid penalties. Here are some strategies to help you calculate GST accurately:

- Understand GST Rules and Rates:

- First and foremost, ensure you have a clear understanding of the GST rules and regulations in your jurisdiction. GST rates and rules can vary by country and sometimes by region.

- Maintain Accurate Records:

- Keep detailed and organized records of all your business transactions, including sales, purchases, expenses, and GST collected or paid.

- Use Accounting Software:

- Consider using accounting software that is GST compliant. Many accounting software packages automate GST calculations, reducing the chances of errors.

- Separate Taxable and Non-Taxable Supplies:

- Clearly distinguish between taxable and non-taxable supplies. Not all products and services are subject to GST, and misclassification can lead to inaccuracies.

- Calculate GST Correctly:

- For GST calculation, the formula is usually: GST Amount = (GST Rate x Sale Price) / 100. Make sure you apply the correct GST rate to each transaction.

- Claim Input Tax Credits (ITCs) Carefully:

- If you are a business, ensure that you claim Input Tax Credits (ITCs) accurately. ITCs allow you to recover GST you paid on your business expenses. Keep receipts and invoices as evidence.

- Regularly Reconcile Records:

- Periodically reconcile your records with the GST returns filed. This can help identify any discrepancies and ensure that your records match what you’ve reported to tax authorities.

- Stay Updated on Changes:

- GST rules and rates can change over time. Stay informed about any updates or amendments to the GST law in your jurisdiction.

- Consult with a Tax Professional:

- If you are uncertain about any aspect of GST calculation, you can consult https://www.cagmc.com/gst-advisory/ as it’s advisable to consult with a tax professional or accountant who specializes in GST. They can provide guidance and ensure compliance.

Seeking Professional Assistance

Seeking professional assistance is crucial when dealing with GST returns to avoid common errors filing GST. Professionals possess expertise in navigating complex tax laws, ensuring accurate calculations, and timely submissions. They can help businesses identify potential pitfalls, such as misclassifications, miscalculations, or missed deadlines. Relying on experts minimizes the risk of costly penalties and audits, providing peace of mind and allowing business owners to focus on core operations. In the dominion of GST, where errors filing GST returns can have significant financial repercussions, professional guidance becomes an indispensable asset for tax compliance and financial stability.

Conclusion

In conclusion, accurate GST calculation and filing are imperative for businesses to adhere to tax regulations and prevent costly errors filing GST returns. By understanding GST rules, maintaining meticulous records, and seeking professional assistance, businesses can navigate the complexities of GST with confidence. Professional guidance helps in avoiding common errors, ensuring precise calculations, and meeting crucial deadlines. Ultimately, this not only ensures compliance but also safeguards a company’s financial health and reputation. In the ever-evolving landscape of tax laws, enlisting expert support remains a prudent strategy for businesses aiming to thrive while maintaining tax compliance.