Verifying the trustworthiness of estimates is a crucial responsibility in the audit procedure, considering their subjective character and dependence on the judgment of management. This article presents a thorough collection of auditing accounting estimates procedures designed specifically to verify estimates accurately. By presenting real-life instances and comparing against standards set by the industry, auditors adeptly manage through the complexities of verifying approximations, thus strengthening the overall confidence in financial statements. Let us examine these methods in detail to understand how they can be practically used in the thorough examination of Techniques for Auditing Accounting Estimates.

| Table of Contents |

Meaning of Accounting Estimates

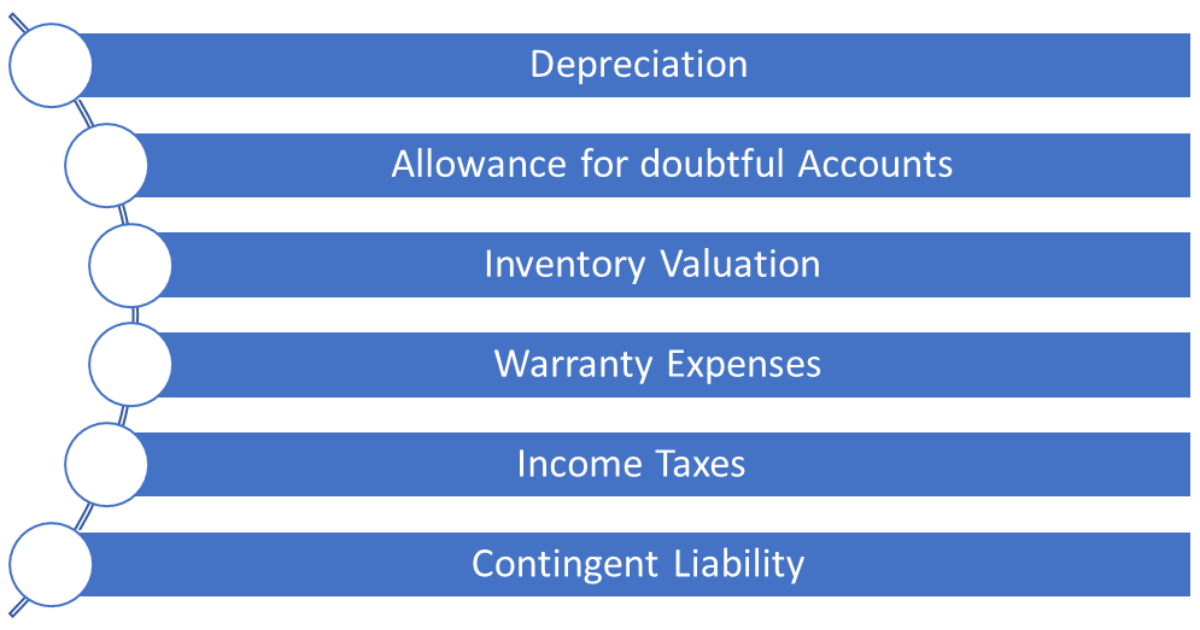

In accounting, estimates refer to approximations made by companies when exact figures are not readily available. These approximations are necessary for various aspects of financial reporting, including the preparation of financial statements. Auditing accounting Estimates are used to fill in gaps or to project future values based on available data and professional judgment. There are various types of audits like cost audit in auditing and many others. There are various types of accounting estimates:

Procedure of Estimation during Audit Process

- Acquire knowledge about the method employed by managerial staff to create estimations: Conduct interviews with management to gain insight into the approaches, presumptions, and sources of information employed in generating important assessments, such as estimations of fair value or reserves for doubtful accounts.

- Assessment of the proficiency and impartiality of management: Evaluate the skillfulness and fairness of management when providing estimates. An example that helps to clarify or demonstrate a concept or idea. Assess the credentials and background of the professionals accountable for generating estimates, ensuring they have the required knowledge and skills.

- Comparison to Earlier Time Frames: Examine current estimations in relation to past periods to ensure coherence and rationality. Examine the pattern of major predictions in recent years, exploring notable variations and comprehending the factors behind them.

- Employing the services of external professionals: Think about utilizing outside specialists to assess intricate estimates. Hire an expert in valuation to assess and confirm management’s estimates regarding the fair value of intricate financial instruments.

- Assessment of Historical Correctness: Evaluate the degree of historical precision in management’s estimations. To evaluate the dependability of previous estimates, particularly in areas such as depreciation rates or warranty provisions, analyse the contrast between past estimations and real results.

- Sensitivity Analysis is the examination and evaluation of the impact of different factors or variables on the outcome or results of a given situation or model. Conduct a sensitivity analysis to assess the influence of modifications in essential assumptions on the estimations. Evaluate the impact of alterations in discount rates or commodity prices on the appropriate valuation of investments or inventory, in that order.

- Adherence to the norms and regulations established by the industry: Determine if the estimates align with the norms and standards within the industry and benchmark them accordingly. Examine the company’s accounting estimates, such as the expected lifespan of assets, and contrast them with industry standards in order to detect any notable deviations.

- The act of questioning and confirming information: Conduct interviews with individuals in charge and validate estimations using external evidence. Conduct interviews with project managers to gain insight into the foundations of estimated project completion time and cross-reference the given information with project documentation to validate its accuracy.

- Evaluation of Events: Evaluate any future occurrences that could influence the calculations after the date of the financial statement. Examine events happening subsequent to the reporting date that could potentially impact estimates, such as modifications in market circumstances or the emergence of new information.

- Evaluation of internal controls: Assessment of the effectiveness of internal controls. Assess the efficiency of internal controls in place for the estimation procedure. Evaluate the division of responsibilities and authorization procedures that are established to monitor and manage important estimations, in order to guarantee effective supervision and control.

So what auditors looks for during the audit process, The intention of these auditing accounting estimates procedures and role of auditor is to offer a reasonable level of confidence that the estimates are dependable, impartial, and adhere to relevant accounting standards and regulations.

Takeaway

Auditors are like detectives for numbers! They double-check “Techniques for Auditing Accounting Estimates” in financial reports to make sure they’re accurate. This helps keep reports honest and protects everyone using them. By asking questions and comparing numbers, auditors ensure everything adds up, keeping the financial world fair and trustworthy.