The Goods and Services Tax (GST) regime has revolutionized the indirect tax system in India. Audit provisions form a crucial component of GST, empowering tax authorities to scrutinize the financial records and activities of taxpayers. These provisions help ensure that businesses adhere to GST laws, maintain accurate records, and fulfill their tax obligations. In this blog, we will provide an overview of the Audit provisions under GST Act, exploring the types of audits, eligibility criteria, audit process, and its significance for businesses. By understanding these provisions, taxpayers can navigate the audit process with confidence, mitigate risks of non-compliance, and build a robust GST compliance framework.

What is an audit provisions under GST Act?

The goal of the assessment and audit under GST is to confirm compliance with the GST law’s requirements, including the accuracy of the tax returns that were submitted, the payment of tax, and compliance with other legal requirements. The audit may be done by the tax authorities, and the taxpayer is expected to comply and supply all relevant information and documents.

The definition of “Audit” in Section 2(13) of the CGST Act is an examination of records, returns, and other documents kept or provided by the registered person under this Act or the rules made thereunder or under any other law currently in effect to verify the accuracy of turnover declared, taxes paid, refund claims, and input tax credit availed, and to evaluate his compliance with the provisions of this Act or the rules made thereunder.

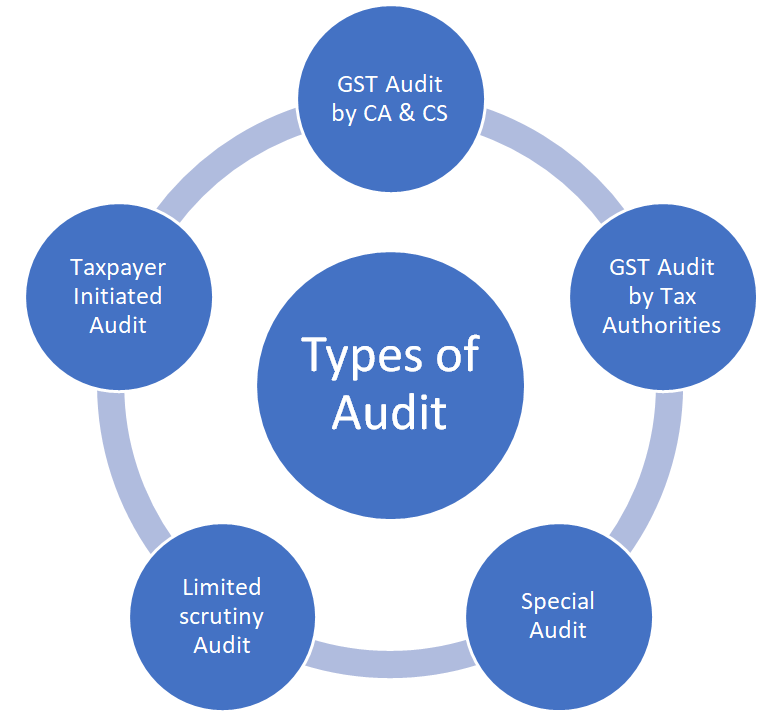

Types of GST Audit

There are mainly 3 types of GST Audit:

- Mandatory GST Audit (Section 35(5) Audit by professionals) valid up to 01/08/2021.

- Departmental GST Audit (Section 65 Audit by Tax Authorities under GST).

- Special Audit (Section 66 Audit by Tax Authorities)

There are two more types of audits under GST that is Limited scrutiny & Taxpayer-initiated audit.

In conclusion, taxpayers are required to abide by the law, and audits conducted under the GST regime are a critical component of the Indian tax system. The IRS advises taxpayers to file their tax returns on time, keep accurate and thorough records of their business transactions, and pay any taxes owed in a timely manner.

The repercussions of non-compliance with the provisions of the GST law are severe, including fines, penalties, and jail. Therefore, it is crucial for taxpayers to make sure that the GST law’s requirements are met, including those pertaining to audits.

GST Audit Based on Assessee Turnover by CA or Cost Accountant

Taxpayers who exceed the threshold of 2 crores for the current financial year must hire a chartered accountant or a cost accountant to audit their financial records. According to Section 35(5) of the CGST Act 2017, specifies the threshold limit.

The documents must be submitted by the assessee in accordance with section 44(2) of the CGST Act 2017:

- Audited Annual Accounts

- Reconciliation Statements

- Other prescribed documents

The taxpayer must submit annual returns GSTR 9 on or before December 31 of the year before the current fiscal year. The CGST Act of 2017’s Section 44 refers to this. This implies that a u/s 35 audit report must be provided together with annual returns.

According to the 5 July 2022 meeting, CBIC exempted GST-registered taxpayers with an annual aggregate turnover of up to Rs. 2 crores in FY 21-22 from submitting Form GSTR-9.

As guided by the Finance Act, 2021, the requirement of GST audit and submission of GSTR-9C by CA was removed.

GSTR 9C is mandatory for taxpayers with a turnover exceeding Rs. 5 crores in the previous financial year on a self-certification basis. The GST Auditor is required to digitally sign GSTR-9C and note any errors or liabilities in the GST returns submitted throughout the fiscal year.

The GSTR-9C is a statement that reconciles:

GSTR-9 Annual Returns submitted for a financial year, along with data from the taxpayer’s audited annual financial statements.

The GSTR-9C consists of two primary parts:

- Reconciliation Statement in Part-A

- Self-certification in Part-B

All registered taxpayers are required to submit the GSTR-9 form yearly under the GST. The GSTR-9C is the GST Reconciliation Statement due on or before December 31 for a specific FY. Companies with a turnover of more than 5 crores are required to have a reconciliation certified by a CA.

GST Audit by Tax Authorities

To ensure that there are as few differences in tax compliance as possible, tax authorities may audit businesses. The CGST Act of 2017’s Section 65 contains measures for tax authority audits. The GST Commissioner has the authority to conduct audits or delegate this authority to other officials.

Whether the Commissioner issues a broad or specific order will determine the audit’s scope.

- A general order would imply that the audit would be conducted in accordance with the Commissioner’s or the authorized official’s previously established standard criteria. One or more people may be excluded from the audit at once.

- The audit will be performed on a certain registered individual in the event of a specific order, and the cause may be very specific, such as an input-output relationship or matching, total defaults, a monetary limit of input utilized, etc.

The Audit must be completed within three months. At least 15 days before the audit begins, the concerned Taxpayers or Registered Persons are sent a notification. The audit must be finished within three months starting on this date. The deadline for finishing the audit may be extended in exceptional circumstances, but never longer than six months.

After the audit is finished, the registered person or taxpayers will be notified. The registered taxpayer’s rights and obligations, along with all findings and their justifications, must be communicated post-completion within these thirty days.

Depending on the results, a suitable GST Official may order immediate stern action against incorrectly credited or claimed ITCs as well as incorrectly underpaid, incorrectly refunded, or not paid tax credits under the requirements of sections 73 or 74 of the CGST Act of 2017.

Special Audit by Tax Authorities (U/s 66 of CGST Act 2017 read with rule 102 of CGST Act 2017)

Due to any disparities in liabilities as well as any manipulation in a transaction to escape tax, Section 66 of the CGST Act, 2017 empowers the Assistant Commissioner or any higher rank officer in the GST Department to designate a chartered accountant or a cost accountant (Auditor).

These manipulations include practices like:

- Dubious Revenue Declaration

- Complex Third-Party Transactions

- Wrong ITC claim

- Excess ITC claim as well as no reverse input of credit

As a result, with the GST Commissioner’s agreement, a notification can be given to the questioned taxpayer or the individual registered person requesting that they request an audit from one of the CAs or the Cost accountant (Auditor) designated by the Commissioner. The CA will next conduct a thorough audit of the subject of the investigation’s records and financial records.

Procedure For Special Audit Under GST

- The registered person in Form GST ADT-03 may seek guidance from the Assistant Commissioner or any other senior authority regarding the CA that the commissioner has appointed to audit the books of accounts.

- The Assistant Commissioner or other senior officer must make a judgment regarding the value of the input and whether the taxpayer’s claimed credit is accurate.

- During the 90 days of the investigation, the chartered accountant or cost accountant is expected to give the Assistant Commissioner the entire special audit report, duly signed and certified by him.

- If a registered person, chartered accountant, or cost accountant applies for a legitimate reason, the Assistant Commissioner may extend the deadline by an additional 90 days.

- The current special audit, not the prior one, will be used as the basis for any actions or outcomes if the Assistant Commissioner is looking into the financial accounts of a registered person.

- According to the GST regulations, during the Special Audit, the registered person is permitted to present the Assistant Commissioner with any complaints or challenges. It is intended to be used in any proceedings brought against him under to this Act or the rules issued thereunder.

- The Assistant Commissioner is entitled to cover all costs associated with the review and investigation, including the compensation of any chartered accountant or cost accountant.

- The registered person will be advised of the special audit’s findings or results via FORM GST ADT-04.

- The registered individual will be the target of a special audit if their taxes were not paid on time, were underpaid, were reimbursed inappropriately, or were improperly claimed or used as input tax credits. The government will punish the registered person severely.

Penalties Post Special Audit by GST Appointed Expert

The registered taxpayer is also permitted to provide an explanation for any evidence that has been acquired against them under Section 66 of the CGST Act, 2017. The evidence may be used subsequently when the taxpayer is being assessed penalties. Initiation of penalty actions against proven tax disparities, such as non-payment of taxes, underpayment of taxes, questionable ITC claims, and other similar acts, is permitted under sections 73 or 74 of the CGST Act.

In the case of tax fraud and evasion, there are provisions for starting penalty actions under Section 66 (GST department audit notice). In cases when the taxpayers under investigation have been found guilty of tax fraud, the GST Commissioner is also the final arbiter over the payment of costs incurred during scrutiny, investigation proceedings as well as approving the remuneration of the third-party auditor during cases where the taxpayers under scrutiny have been convicted of tax fraud.

Limited scrutiny Audit

This is a restricted audit that is carried out circumstances where the tax authorities suspect a violation of the GST law’s requirements. The goal of restricted inspection is to confirm compliance with the GST law’s requirements, including the accuracy of the tax returns submitted, the payment of tax, and compliance with other legal requirements.

Taxpayer-initiated Audit

This is an audit that is initiated by the taxpayer himself. A taxpayer-initiated audit’s goal is to confirm compliance with the GST law’s provisions, including the accuracy of the tax returns filed, the payment of tax, and compliance with other legal requirements.

The GST legislation stipulates several punishments for breaking the law’s rules, including fines, penalties, and jail time. Therefore, it is crucial for taxpayers to make sure that the GST law’s requirements are met, including those pertaining to audits.

Taxpayers are advised to maintain accurate and comprehensive records of their business transactions, including invoices, receipts, and other supporting documentation, to ensure compliance with the GST law’s stipulations. Additionally, taxpayers are recommended to timely file their tax forms and pay any outstanding taxes and time limit for GST audit by department is also mentioned.

Takeaway

In conclusion, the audit provisions under the GST Act play a pivotal role in promoting compliance and transparency in the taxation system. By subjecting businesses to audits, the tax authorities can verify the accuracy of financial records, assess compliance with GST laws, and detect any instances of fraud or evasion. For businesses, understanding and adhering to the audit provisions are essential to avoid penalties, ensure accurate reporting, and maintain trust with tax authorities. By maintaining meticulous records, cooperating with auditors, and rectifying any discrepancies, businesses can navigate the audit process successfully and contribute to a robust GST ecosystem in India.