In the world of taxation and consumer protection, the concept of anti-profiteering under the Goods and Services Tax (GST) system in India stands as a crucial safeguard. Its aim is to make sure that businesses do not unfairly capitalize on tax rate reductions or increased input tax credits at the expense of consumers. By promoting fairness, consumer welfare, and transparency, these measures play a vital role in upholding the principles of equitable taxation and fostering a level playing field in the GST ecosystem. This article, offers a simple introduction to the significance and implications of Anti-profiteering rules under GST.

|

Table of Content |

What is Anti-profiteering under GST?

Anti-profiteering rules under GST refers to measures and regulations implemented by governments to prevent businesses from making excessive profits or taking unfair advantage of changes in tax rates, input costs, or any other factors that affect prices. The objective of anti-profiteering measures is to ensure that the benefits of any cost reduction, tax reduction, or input tax credit are passed on to the end consumers, thereby promoting fair pricing practices.

In the context of the GST system in India, anti-profiteering provisions were introduced to safeguard the interests of consumers during the transition to the new tax regime. These provisions are intended to ensure that businesses do not retain the benefits arising from GST rate reductions or increased input tax credits, but instead, lower their prices to reflect these benefits.

Under anti-profiteering measures, businesses are expected to reduce their prices proportionately when there is a decrease in tax rates or an increase in input tax credits. This ensures that the cost savings resulting from such changes are passed on to consumers, leading to a more equitable distribution of benefits.

To enforce anti-profiteering regulations, authorities may establish a dedicated body or authority responsible for investigating complaints, conducting audits, and taking necessary actions against businesses that are found to be non-compliant. The authority typically examines pricing data, input costs, tax rates, and other relevant factors to determine if businesses have profited unjustly and failed to pass on the benefits to consumers.

Benefits of Anti-Profiteering Rules under GST

Here are some key benefits of Anti-profiteering rules under GST:

- Consumer Protection: Anti-profiteering rules aim to protect the interests of consumers by ensuring that businesses pass on the benefits of tax rate reductions or increased input tax credits.

- Fair Market Competition: By discouraging profiteering practices, anti-profiteering rules foster fair market competition. Businesses are compelled to compete on factors other than price manipulation, such as quality, innovation, and customer service.

- Transparency and Trust: The implementation of anti-profiteering rules enhances transparency in pricing and boosts consumer trust. When consumers see that businesses are passing on the benefits of GST, it instils confidence in the fairness of the system and strengthens their trust in businesses.

- Economic Stability: Anti-profiteering rules help maintain economic stability by preventing inflationary pressures that may arise due to businesses attempting to retain excessive profits.

- Enhanced Compliance: The presence of anti-profiteering rules encourages businesses to comply with the GST regulations. The fear of penalties, price adjustments, and cancellation of GST registration act as a deterrent against non-compliance, prompting businesses to maintain proper records, pass on the benefits, and ensure compliance with the provisions of the GST law.

- Government Revenue Protection: When businesses pass on the benefits of tax rate reductions or increased input tax credits to consumers, it leads to higher consumption and increased demand. This, in turn, can positively impact government revenue by stimulating economic activity, boosting tax collections, and supporting the sustainable growth of the economy.

How does the Government Spot Profiteering?

The government uses various mechanisms and tools to spot potential cases of profiteering and enforce anti-profiteering provisions. Here are some ways in which the government can identify and investigate instances of profiteering:

- Complaints from Consumers: One of the primary sources for identifying cases of profiteering are complaints filed by consumers. Consumers who believe that a business has not passed on the benefits of tax rate reductions or increased input tax credits can submit a complaint to the designated authority. These complaints serve as the basis for initiating investigations.

- Self-Reporting by Businesses: In some cases, businesses may voluntarily report their compliance with anti-profiteering provisions by providing details of the price reductions made and the methodology used to pass on the benefits. This self-reporting can help the government in monitoring and verifying whether the benefits have been appropriately passed on to consumers.

- Market Analysis: The government may conduct market analysis and studies to identify pricing patterns and trends. By comparing the pre-GST and post-GST pricing data, the government can assess whether businesses have adequately reduced prices in line with the tax rate reductions or increased input tax credits.

- Audit and Examination of Records: The government can conduct audits and examinations of businesses’ financial and accounting records to verify whether the benefits of tax rate reductions or increased input tax credits have been appropriately passed on. This includes reviewing details such as sales invoices, purchase records, pricing policies, and other relevant documentation.

- Data Analytics and Technology: The government can utilize data analytics and technology tools to analyse large volumes of data and identify potential cases of profiteering. By examining pricing data, sales patterns, and other related information, the government can detect any anomalies or deviations from expected price reductions.

- Market Surveys and Consumer Feedback: The government may also conduct market surveys or gather consumer feedback to assess the impact of tax rate reductions or increased input tax credits on prices. This can involve collecting information directly from consumers, conducting surveys, or engaging with industry associations and stakeholders.

What could happen without Anti-profiteering rules?

Here are some potential consequences that could arise without anti-profiteering rules:

- Unjustified Price Increases: Businesses might increase their prices even if there is a decrease in tax rates or input costs. This would result in higher prices for consumers, eroding the intended benefits of such reductions. Without anti-profiteering rules, businesses would have the freedom to retain the cost savings for themselves, leading to unfair pricing practices.

- Lack of Consumer Protection: Anti-profiteering rules are designed to protect the interests of consumers. Without these rules, consumers would be vulnerable to unjustified price hikes, as businesses could exploit changes in the economic environment without any accountability. This would lead to a lack of transparency and fairness in pricing, putting consumers at a disadvantage.

- Market Distortions: In the absence of anti-profiteering rules, there could be market distortions and an imbalance in competition. Businesses that engage in profiteering would have an unfair advantage over those that pass on the benefits of tax reductions or cost savings to consumers. This could lead to an uneven playing field, hindering fair competition and potentially harming smaller businesses.

- Consumer Dissatisfaction: If businesses do not pass on the benefits of tax reductions or input cost reductions to consumers, it would create dissatisfaction among consumers. They would feel that they are not reaping the intended advantages of government policies aimed at easing their financial burden. This could erode consumer trust and confidence in businesses and the overall economic system.

- Inflationary Pressure: If businesses exploit changes in the economic landscape to increase their profits without passing on the benefits to consumers, it could lead to inflationary pressure. Higher prices without corresponding improvements in value or quality could result in an increased cost of living for consumers, impacting their purchasing power and overall economic well-being.

Anti-Profiteering Provisions Under the GST Law

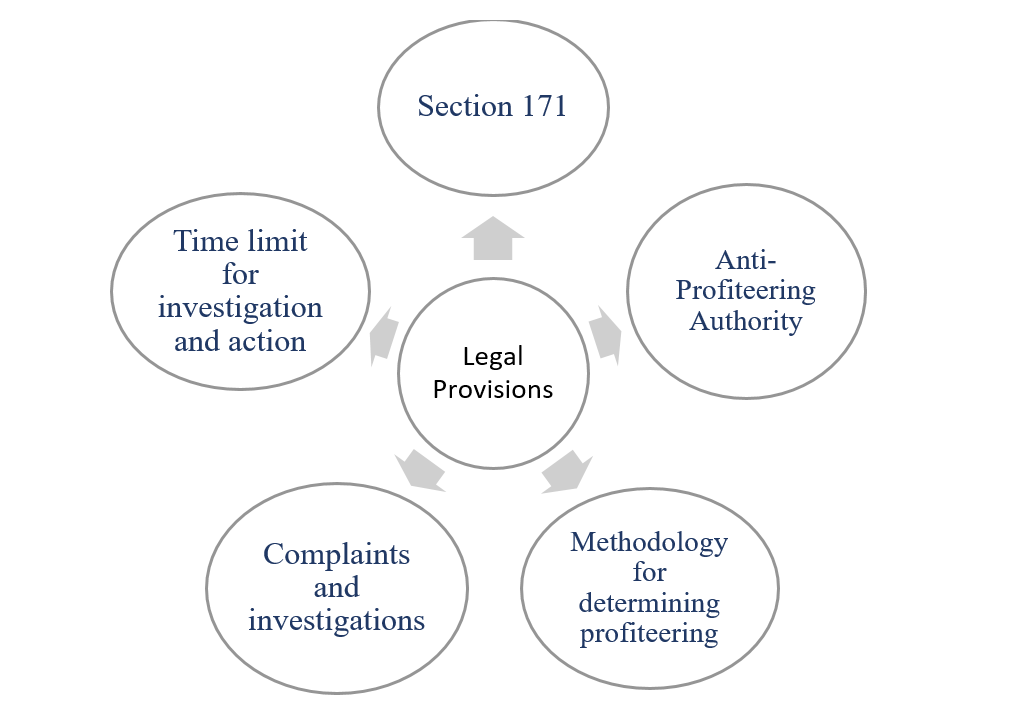

The legal provisions related to anti-profiteering under the GST law in India primarily exist in Section 171 of the Central Goods and Services Tax Act, 2017. This section lays down the anti-profiteering measures and establishes the framework for ensuring that businesses pass on the benefits of tax rate reductions or increased input tax credits to consumers. Here are the key provisions:

- Section 171: This section is titled “Anti-profiteering measure” and serves as the main provision for anti-profiteering under the GST Act, 2017. It states that any reduction in the rate of tax on goods or services or the benefit of the input tax credit shall be passed on to the recipient (consumer) by way of a commensurate reduction in prices.

- Anti-Profiteering Authority: Section 171 also provides for the establishment of the National Anti-Profiteering Authority (NAA). The NAA is responsible for examining complaints of profiteering, conducting investigations, and taking necessary actions to ensure compliance with anti-profiteering provisions.

- Methodology for Determining Profiteering: The Act empowers the NAA to determine the methodology and procedure for determining whether a business has engaged in profiteering. This methodology typically involves comparing the tax reduction or increased input tax credit to the actual reduction in prices and assessing whether the benefits have been passed on to consumers.

- Complaints and Investigations: The Act allows consumers, businesses, or the concerned authorities to file complaints against businesses alleging non-compliance with anti-profiteering provisions. The NAA may initiate investigations based on these complaints or Suo moto to determine if a business has not passed on the benefits. The investigations involve examining relevant records, pricing data, input costs, and other factors.

- Time Limit for Investigation and Action: The Act sets a specific time limit for completing the investigation and taking action. As per the law, the investigation must be completed within six months from the date of initiation, unless extended for reasons recorded in writing. The time limit ensures that investigations are conducted promptly.

- Penalties and Actions: If a business is found to have not passed on the benefits to consumers, the NAA may direct the business to reduce prices or return the undue profits to the affected customers. Additionally, the NAA has the power to impose penalties, which may include fines and can cancel the GST registration of the business in certain cases of serious non-compliance.

What happens if someone breaks the rules?

If a business is found to have violated the anti-profiteering rules under the GST system, there can be several consequences and penalties imposed. Here are the possible actions that can be taken if the rules are breached:

- Direction to Reduce Prices: The NAA or the relevant authority can direct the business to reduce its prices to pass on the benefits of tax rate reductions or increased input tax credits to consumers. The direction may specify the extent of the price reduction and the time frame within which it must be implemented.

- Restitution to Consumers: In addition to directing price reductions, the NAA may order the business to refund the undue profits earned as a result of not passing on the benefits. Restitution may involve returning the excess amount collected from consumers along with interest.

- Imposition of Penalties: Businesses found guilty of profiteering can face penalties as prescribed under the GST law. These penalties can include fines, which may be a percentage of the profiteered amount, and can be substantial. The penalties serve as a deterrent against non-compliance with anti-profiteering provisions.

- Cancellation of GST Registration: In cases of serious violations or repeat offences, the authorities have the power to cancel the GST registration of the business. This can have severe implications, as it would prevent the business from conducting taxable transactions and operating within the GST system.

- Public Disclosure of Non-Compliant Businesses: The NAA has the authority to publish the details of businesses that have violated anti-profiteering rules. This public disclosure aims to create awareness among consumers and acts as a deterrent for businesses engaging in non-compliant practices.

Takeaway

Through the above mentioned information, this can be said that the implementation of anti-profiteering measures under the GST regime in India. It has been playing a vital step towards ensuring fairness and consumer protection in the business environment. These provisions’ objective is to prevent businesses from unjustly profiting from changes in tax rates or input costs, and instead, pass on the benefits to consumers. The implications for businesses that fail to comply with anti-profiteering rules are significant. Penalties, price adjustments, and even the cancellation of GST registration serve as deterrents against non-compliance and ensure that businesses prioritize consumer interests. These measures also instil consumer confidence, as they assure that the benefits of GST are being passed on to them.