| Content

Disadvantages of not filing the ITR Who is required to file return of income? When required to file Income tax return? Income tax slab rate for A.Y 2020/2021 and 2021-22 |

Income tax return is a detailed form entitling the details of a person’s income and the amount of tax applicable on it delivered to the income tax department. Every taxpayer is obliged to file it before or on due date.

Benefits of filing ITR

- Filing ITR helps in avoiding penalties the provisions related to this are mentioned at the end. As filing ITR saves us from unnecessary legal liability and as responsible citizens of this country it is our duty to file it on time.

- ITR is also a very important for availing bank loan as it the proof of your income and the taxes paid by you. As many banks and NBFCs consider it as a very authentic document while applying for high value loans.

- Again, while applying for visa most countries like USA, UK etc consider your past years ITR as it ensures them about your ability to bear the expenses of the trip in line with the honesty with the tax compliances.

Disadvantages of not filing the ITR

- When income tax return is filed after the due date, interest at the rate of 1 per cent per month or part of the month is levied up to the date of filing the ITR. The said interest is payable on tax payable after deducting the TDS (tax deducted at source), TCS (tax collected at source), advance tax and other reliefs/ tax credits available under the law.

- If the taxpayer is claiming a refund, delayed filing of income tax return will result into a delayed receipt of the tax refund.

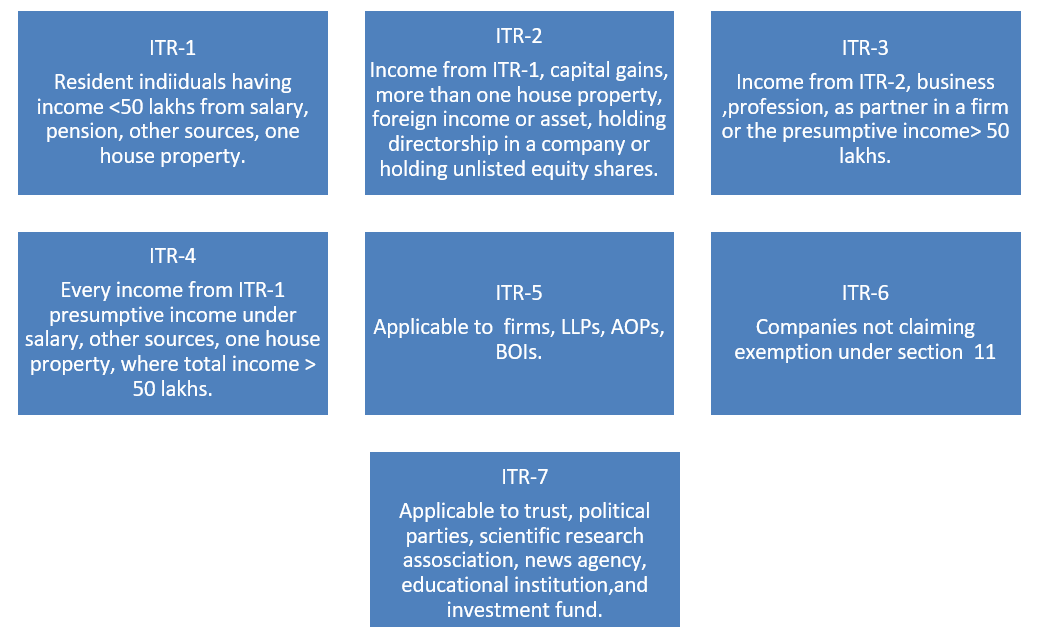

The department has notified 7 different forms

Who is required to file return of income?

- As per section 139(1), any person whether an individual or company, whose total in respect of which he is assessable under the act during the previous financial year exceeds the maximum amount chargeable for income tax as notified under finance act.

- In case of person other than company or firm, where he has,

- Deposited an amount or aggregate of the amounts exceeding 2 lakhs in one or more current accounts active with a banking company or a cooperative bank.

- Expended an amount or aggregate of the amounts exceeding 2 lakhs for himself or any other person for travel to a foreign country.

- Expended an amount or aggregate of the amounts exceeding 1 lakh on consumption of electricity.

- Fulfils any other criteria as may be prescribed, is required to file ROI irrespective of taxable income

- As per section 139(3), any person who has incurred any losses under the heads of “Profits and Gains of business or profession” or “capital gains” and claims the loss or carry forward it.

- Every person who has received income from property held under trustor other legal obligationwholly or partly for charitable or religious purposesor of income beingvoluntary contribution as referred to in sec 2(24) (iia) shall file ROI if the total income [before giving effect to the provisions of sec 11 and sec 12] in respect of which he is assessable as an authorized representative exceedsmaximum amount not chargeable to tax.

- As per sec 139(4B), the chief executive officer (CEO) [whether such CEO is known by secretary or by other designation] of everypolitical partyshall file ROI if the total income of such political party [before giving effect to the provisions of sec 13A] exceeds maximum amount not chargeable to tax.

When required to file Income tax return?

- If you have more than one source of income.

- If you want income tax refund.

- If you have or wish to invest in foreign assets during the financial year.

- If you want to apply for visa or loan.

- If you are a company or a Firm.

Income tax slab rate for A.Y 2020/2021 and 2021-22

| Total income (in Rs) | Income tax rate (in %) | |

| New scheme | Old Scheme | |

| Up to 2.5 lakh | Nil | Nil |

| 250000-500000 | 5 | 5 |

| 500000- 750000 | 10 | 20 |

| 750000- 1000000 | 15 | 20 |

| 1000000- 1250000 | 20 | 30 |

| 1250000- 1500000 | 25 | 30 |

| Above 1500000 | 30 | 30 |

Due date for filing Income tax return

As the due date of filing ITR is July 31 and who opts for presumptive taxation and shows income below specified limit due to which audit of accounts is required is 30th October 2020 but due to COVID-19 the government has extended the income tax return (ITR) filing deadline for financial year 2019-20 to November 30, 2020.

Why you should file ITR?

Late Fees applicability

A taxpayer is prone to pay late ITR filing fees of:

- Rs 5,000 if tax return is filed after the due date deadline but on or before December 31 of the relevant assessment year (in this case December 31, 2019).

- Rs 10,000 if tax return is filed after December 31 but before the end the relevant assessment year, i.e., before March 31.

If you are a small taxpayer whose gross total income does not exceed Rs 5 lakh then the maximum fees you are liable to pay is Rs 1,000.