A salary slip is a document that shows how much money you earn from your job. It provides important information about your salary, deductions, and other financial details. Decoding a salary slip is crucial, as it helps you know where your money is going and how much you take home after taxes and other deductions. In this guide, we’ll break down the different sections of a salary slip to help you decode and make sense of the numbers and terms you see. Let’s get started!

| Table of Content |

Understanding your Salary Slip?

A payslip is a document issued monthly by an employer to its employees. A pay slip contains a detailed breakdown of an employee’s salary and deductions for a given period. This document can either be printed in hard copy or mailed to employees. Employees can download the pay slip in PDF format. Also, the company is legally bound to issue pay slips to its employees periodically as evidence of salary payments and deductions made.

Contents of a Salary Slip

Understand your Salary Slip as the important terms mentioned in it:

- Name and Address of the Employer

- Employee Number, Job Section, Designation, Date of Joining,

- Bank details of the employee where the salary is deposited.

- PF and ESI account numbers and other details

- Number of leaves taken in a particular month

- Basically, salaries are broken down into things like allowances, incentives, etc.

- Tax calculation and TDS deduction details

Why is Salary Slip important?

Following are the importance of a salary slip which can be understood while decoding a salary slip:

- Proof of employment: The payslip serves as legal proof of employment. When applying for travel visas or admission to universities and colleges, applicants must submit a copy of the salary slip as legal proof of the last drawn salary and position. Also, a salary slip is one of the most important documents for a background check. Understanding your Salary Slip document serves as legal evidence against the salary claim.

- Income Tax Planning: A pay slip contains a monthly breakdown of earnings and deductions. It also includes components that are tax-deductible. Apportionment of earnings, i.e., basic pay, HRA, medical allowance, and travelling allowance Also deductions, i.e., profession tax, EPF, and TDS. TDS helps the employee plan his tax liability in advance. These deductions increase the take home pay.

- Looking for future employment: A pay slip is a legal proof of current employment and the pay scale the employee is currently working on. This document helps in negotiating with potential employers at the overall level, i.e., company CTC, and the total cost of each component level, i.e., basic pay and allowances. Almost all companies require past payslips as proof of employment and earnings.

- Get loans and credit cards: A pay slip contains all the details of the salary and position. It serves as legal proof of the employee’s ability to repay the credit. Moreover, availing loans, credit cards, mortgages, and other borrowings depends on the pay slip. Therefore, this document is required while applying for loans, credit cards, mortgages, etc. Lending institutions and banks ensure that they take a copy of the pay slip.

- Take advantage of government subsidies: Pay slips can be used to avail yourself of certain free services. In fact, they can even be used to access services that are heavily subsidised. Such services include medical care, food grains, etc.

Various Incomes in a Salary Slip

Following are the various incomes found while decoding a salary slip:

- Basic pay: Basic, as the name suggests, is the basic component of the salary. It constitutes 35–50% of the salary. It forms the basis of other components of the salary. At junior levels, the basics tend to be high. As the employee grows in the organisation, other allowances tend to be higher.

- Dearness Allowance: A Dearness Allowance is paid to offset the impact of inflation on one’s pay. It is usually 30–40% of the basic pay. Dearness allowance is directly based on the cost of living. Hence, it is different for different locations. For income tax purposes, basic and DA are considered pay. Therefore, it is taxable. It appears on the earnings side of the pay slip, right after the basic pay.

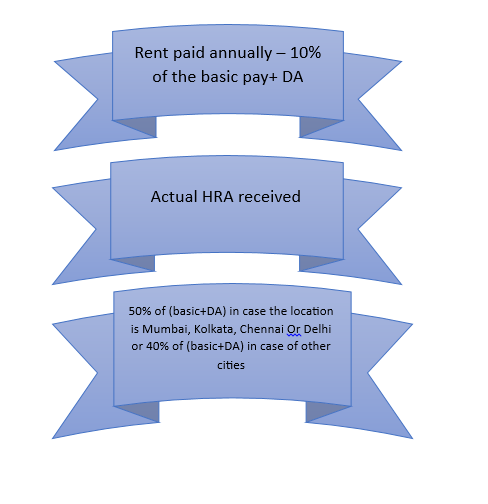

- House Rent Allowance: House Rent Allowance (HRA) is given to employees living in rented facilities. The HRA depends on the city of residence of the employee. For a metropolis, HRA is 50% of the basic pay. For all other cities, it is 40% of the basic pay. Since the housing rent allowance is an allowance, it is exempt from tax up to a specific limit, provided the employee pays the rent. It appears on the earnings side of the salary slip. One can save income tax on HRA. The exemption is the minimum of the following:

- Conveyance Allowance: Conveyance Allowance is the amount an employer pays an employee to travel to and from work. It is an allowance. Hence, it is exempt from tax up to a specific limit. It appears on the earnings side of the salary slip. One can save income tax on conveyance allowance. The exemption is the minimum of the following:

- INR 1600 per month

- Actual conveyance allowance received

- Medical Allowance: Medical Allowance is the amount an employer pays to an employee for medical expenses during the term of employment. One can save income tax on a medical allowance. However, the employee only receives this amount upon submission of medical bills as proof.

- Leave Travel Allowance: Employers use it to cover the cost of employee travel while on leave. It includes the travel expenses of the employee’s immediate family members as well. Proof of the journey is required to avail of the deduction, subject to certain limits. Any expenses incurred during the trip apart from travel do not count towards the leave travel allowance tax exemption.

- Special Allowance in Salary: Special allowances include performance-based allowances. These are usually given to encourage employees to work better. Also, these allowances vary from company to company. Special allowances are 100% taxable. It appears on the earnings side of the salary slip.

Various deductions in a Salary Slip

Following are the various deductions found while decoding a Salary Slip:

- Professional Tax: Professional tax is a small tax levied by state governments on earring professionals. It is payable only in certain states. Namely, Karnataka, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Orissa, Tripura, Jharkhand, Bihar, and Madhya Pradesh. It is imposed not only on professionals but on anyone who earns a living through the medium. This amount is deducted from taxable income. Also, it is usually only a few rupees per month and is subject to the gross total income. It appears on the deduction side of the payslip.

- Standard deduction: Under the old tax system as well as under the new tax system, a standard deduction of Rs. 50,000 is available. Standard deduction has replaced transport allowance and medical reimbursement.

- Tax deduction at source: This is the amount that the employer deducts on behalf of the Income Tax Department. It is based on the gross tax slab of the employee. One can reduce this amount by investing in tax-free investments like equity funds (ELSS), PPF, NPS, and tax-saving FDs. It appears on the deduction side of the pay slip. Hence, investing in Section 80C instruments of the Income Tax Act increases your take-home salary. An individual can invest in mutual funds (ELSS), submit proof of investment to the company, and claim a TDS refund.

- Employees’ Provident Fund (EPF): It is an employee contribution to the provident fund. This is suitable for Section 80C of the Income Tax Act. A provident fund is an accumulation of funds for the period of an employee’s retirement. The Employees Provident Fund Organisation administers it. 12% of the employee’s basic salary goes to EPF. Employers also make similar contributions on behalf of employees towards their superannuation.

What do you mean by Cost to Company(CTC)?

CTC is the total cost that the company incurs for using your services. Apart from your take-home pay, it includes employer’s contribution to your PF, any group insurance premium, your annual performance incentive payment (which you may not get 100%), some other benefits you are entitled to such as low-interest loans, cars Lease amount. and other expenses related to your employment (which you may consider allowable)

Difference between CTC and In-hand Salary?

CTC is the total amount that the company spends on the employee. It includes HRA, CA, medical expenses, gratuity, EPF, and other allowances. It depends on various factors, which affect your net salary. You can calculate CTC as the employer’s total expenditure on hiring an employee.

Gross pay is the amount you get before deductions. The employer deducts gratuities and PF from this income. The total salary is not reflected in the pay slip. It is only mentioned in your offer letter. Finally, the amount you get after taxes and other deductions is known as your take-home or in-hand salary. In-hand salary is always lower than CTC because you get it after deductions.

Takeaway

Decoding your salary slip is important to understand your financial health and ensure accurate payments. Familiarise yourself with the various ingredients and cross-check the amounts to spot any discrepancies. If you have any questions or concerns, don’t hesitate to contact your company’s HR department or payroll team for clarification. Understanding of your salary slip can help you take control of your finances and plan for a secure financial future.