When a business depends on shipment on time and budgets, managing freight expenses can be a hard thing to do. An internal audit of your freight expenses can be your map to cost-cutting treasure. Think of it as a detective story for your shipping costs, finding out hidden savings and making your supply chain run smoother. In this blog we will deep dive into Freight expenses Audit checklist and process.

|

Table of Contents |

Overview

Ever feel like your business is paying a huge amount to get stuff from A to B? Shipping costs got you down. That’s where a freight expense audit comes in, so the freight audit meaning is it’s like a superhero for your budget! It’s a deep dive into your shipping bills, searching for hidden savings and sneaky fees. Imagine a magnifying glass on those invoices, spotting wasteful routes and uncovering duplicate charges. The goal? To slash those annoying costs and make your supply chain run smoother than a greased wheel. There are different types of Internal Audit, freight internal audit is one of its types.

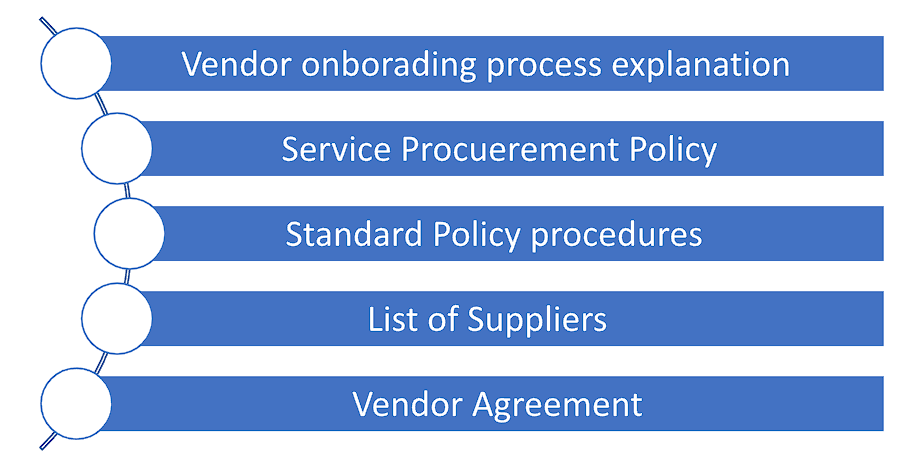

Essential documents for Your Freight Expense Audit

Fright audit checklist are:

- Vendor Onboarding process explanation: Documentation providing information on the procedure for bringing vendors on board. This entails procedures for verification, requirements for documentation, and steps for approval.

- Service Procurement Policy: A detailed policy stating the procedures for obtaining services. Includes the standards for choosing, the steps for obtaining permission, and the regulations that need to be followed.

- Standard Operating Procedures: Records of standard operating procedures pertaining to the procurement of freight and services are documented. Provides a comprehensive outline of the sequential procedures and guidelines to adhere to.

- List of Current Suppliers or Potential Substitute Suppliers: A compilation of existing suppliers offering freight-related services. This document comprises of contact information, the range of services offered, and other potential vendors.

- Vendor Agreement: Copies of agreements or contracts with every vendor. Outlines terms, conditions, service levels, and any other applicable agreements.

From Paperwork to Profits: Cracking the Code of Your Freight Costs

- The internal request for services or hiring of a vendor has undergone thorough examination, validation, and has been officially approved.

- The internal request clearly states the desired service specifications and the chosen vendor, as well as the expected date of service delivery.

- The registered vendors have been contacted for quotations in accordance with company policy.

- Quotations have been initiated and recorded, and a comparison chart has been created and approved.

- The service order has been awarded to the bidder with the lowest offer, pending the fulfilment of all other requirements, specifications, qualifications, etc.

- A purchase order (PO) has been generated in accordance with the internal requisition and the specified service delivery date.

- The contract should include a penalty provision in case the supply does not meet the terms and specifications stated in the purchase order.

- Accounts department should have access to one copy of each purchase order.

- The invoice should be issued under the organization’s name.

- Number of penalties applied to sellers throughout the year and the causes for their imposition.

- The accounts department has approved the bill for the services hired, taking into account any deductions for quality issues, violation of terms or conditions, and delays or non-provision of services on time.

- Agreements and requests for the acquisition of services, as well as the endorsement of any changes or alterations to them.

- Commencement of bidding/ quoting process

- Comparison chart showing technical and financial bids.

- If the service is acquired from a vendor other than the registered vendor or if a purchase order is not generated, the rates must be authorized.

- Issuing a debit or credit note to address concerns regarding a service defect, discrepancy in rates, or delayed delivery.

- Coverage for merchandise during transportation and automobiles.

- Analysing the expense budget and comparing it with the actual expenses, while also determining the reasons for any deviations and seeking authorization for any necessary changes.

- Having authority and influence over the progress of vendors and market prices in order to attain a combination of lower costs and improved quality.

- Expense reduction resulting from technology upgrade and/or the creation of new supply sources.

So, from following above steps internal audit applicability is checked.

Procedures followed by Account department for Freight Expense Audit

Below mentioned is the fright audit process:

- Accurate Expense Registration: Please ensure that all expenses are accurately recorded, providing details on whether they are related to operations or administration.

- Procurement of funds for capital expenditures: Make sure that the procurement of services connected to capital expenditure, such as repair and maintenance, technical inspection, erection, commissioning, and installation, is not classified as revenue expenditure.

- Recording of Input Tax Credit: Ensure that the accurate financial transactions are represented by recording the value of services, deducting Input Tax Credit if applicable.

- Deduction and Declaration of TDS: Make sure to check if TDS (Tax Deducted at Source) has been deducted as per the specified rate. Make sure that any declaration you receive states that TDS (tax deducted at source) should not be charged to expenses but should instead be treated as a liability when recorded.

- Charge Mechanism: Decide whether the transporter functions using Forward Charge Mechanism (FCM) or Reverse Charge Mechanism (RCM). Please acknowledge the receipt of Annexure V and ensure that the declaration is included on the invoice when using FCM.

Conclusion

The internal audit is just the start! Optimizing freight costs is a continuous journey, each improvement leading to smoother sailing. Remember, efficiency is about maximizing value, not just cutting corners. Embrace technology, empower your team, and stay vigilant. By constantly polishing your processes and using the internal audit as your guide, freight expenses won’t drag you down. They’ll become the fuel that propels your business to success!