It is essential to prepare for a smooth transition into the new financial year by addressing critical financial tasks. To follow proactive steps now one can, have a significant impact on your financial stability and success in the coming months. In this article, we will outline four tasks to complete before the end of the financial year 2023-2024. That all individuals and businesses should prioritize before the year comes to a close. By setting alarms for all these tasks, one can establish effective financial planning, tax management, and overall financial well-being. Let’s explore and ensure one is well-prepared for the financial year.

Table of Content

What do you mean by Financial Year?

A financial year is also known as fiscal year. It is a specific 12-months period, which is maintaining the accounting and financial reporting. It is not necessary to match with the calendar year (1st of January to 31st of December) as it depends on the organization and their jurisdiction.

There several factors that can impact a financial year such as business cycles, industry norms, and regulatory framework. In general, financial year has been running from 1st of April to 31st March, whereas some companies go with their financial year as per calendar year. In the period of financial year, company keep on track of their financial performances, expenses, revenue, and other financial metrics.

At the end of the financial year, they compile financial statements that provide insights into their financial performance and position, helping stakeholders assess the health and direction of the business.

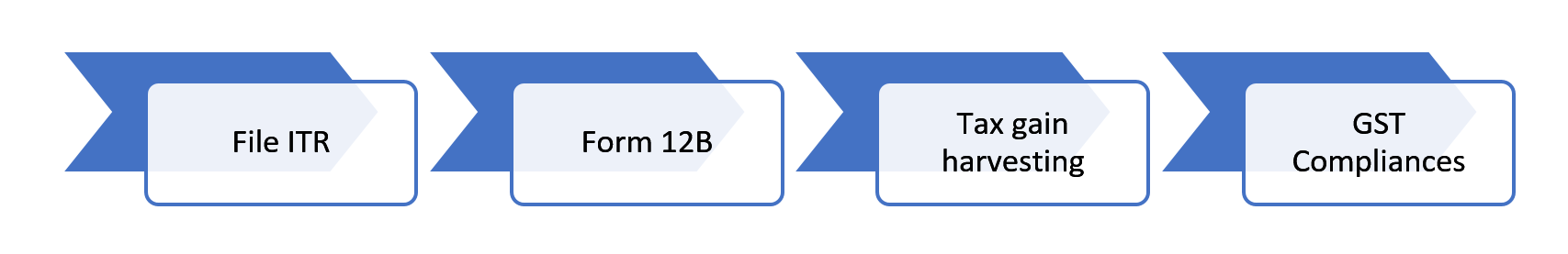

Four tasks to complete before the end of the Financial Year 2023-2024

Here are four tasks to complete before the end of the Financial Year 2023-2024 are:

- File Updated Income Tax Return:File Updated income tax returns is animportant task in financial year, in which businesses and individuals require to accomplish annual compliances. It includes deductions, income and other financial compliances to the tax authorities. Taxpayers require to file their income returns till last week of April or first week of May for the financial year 2023-2024. However, salaried employees have to file till mid-June as at this time employees get their Form-16 from their employers.

- Form 12B: In India, Form 12B is used for reporting income from a previous employer, in case a person switches job at the time of financial year. Details need to mention are salary, deductions, benefits, and taxes paid by the previous employer to the new one. It is significant to calculate accurate tax and make sure that the individual’s whole income for the year is correctly accounted. The form needs to furnish details of income as per provisions of section 192(2) for the year ending 31st of March, 2024.

- Tax gain harvesting: It is also referred as the Capital gain harvesting, which is strategy and used by investors to reduce tax liabilityby selling investments intentionally that have been appreciated. The tax gain harvesting’s main goal is to make sure about the capital gains up to a certain tax threshold in a given FY. It leads to tax benefits like preferential tax rates for long-term capital gains.

- GST Compliance: There are multiple compliances of the GSTthat need to be completed before the end of the Financial Year 2023-2024. These are as:

- Pay TDS for August 2023 by the 7th of September, 2023.

- Pay September’s 2023 TDSby the 7th of September, 2023.

- File GSTR-1 for the quarter ending September 2023 by the 31stof October, 2023.

- Pay October’s TDS by the 7th of September, 2023.

- Submit the third instalment of advance tax for individuals, professionals and businesses without tax audit requirements by the15th of December, 2023.

- Pay December’s TDS by the 7thof February, 2024.

- Submit the fourth instalment of advance tax for individuals, professionals and businesses without tax audit requirements by the 15th of February, 2024.

- File GSTR-3B for January 2024 by the 20thof February, 2024

- Pay February 2024’s TDS by the 7th of March, 2024.

- Submit the final instalment of advance tax for individuals, professionals and businesses without tax audit requirements by the 15th of March, 2024.

- Deadline for file updated income tax returns for the FY 2023-2024. Also, the deadline for GSTR-1 filing is in the fourth quarter. By the 31st of March, 2024.

What is the impact of the compliance tasks of the financial year?

Here are some key impacts of complying with financial year-end requirements:

- Financial Transparency: Proper compliance ensures that an organization’s financial records and transactions are accurately documented, providing transparency into its financial health. Transparency in financial statements is significant for gaining the trust of shareholders, lenders, investors, and other stakeholders.

- Legal and Regulatory Requirements: There are several compliances in a FY, that will be necessary to accomplish. Such as Income tax return filing, financial reports submission, and providing to particular accounting standards. Non-compliance can result in legal penalties and reputational damage.

- Tax Efficiency: Meeting tax-related compliance obligations before the end of the financial year allows for efficient tax planning. Businesses can identify eligible deductions, credits, and incentives to optimize their tax liability and reduce the risk of audits or penalties.

- Financial Planning: Year-end financial activities provide valuable insights into an organization’s financial performance over the past year. This data is critical for setting budgets, making forecasts, and creating strategic plans for the upcoming year.

- Investor Confidence: For publicly listed companies, complying with year-end reporting requirements demonstrates a commitment to accountability and transparency. This can boost investor confidence and attract potential investors.

- Creditworthiness: Lenders, banks, and financial institutions often require up-to-date financial statements and reports to assess the creditworthiness of a business or individual. Proper compliance can facilitate access to loans and credit facilities.

- Performance Assessment: By reviewing financial statements, businesses can assess their operational efficiency, profitability, and liquidity. This evaluation aids in identifying areas for improvement and making informed decisions for growth.

- Internal Controls: The year-end compliance process often involves a thorough review of financial records, which helps identify any irregularities or discrepancies. This process contributes to strengthening internal controls and minimizing the risk of fraud or financial mismanagement.

- Strategic Decision-Making: Accurate financial statements resulting from compliance activities provide decision-makers with the necessary data to make informed strategic decisions for the organization’s future.

- Stakeholder Communication: Properly documented financial reports are essential for communicating with various stakeholders, including employees, shareholders, vendors, and customers. Clear financial information fosters effective communication and relationships.

Foot Notes

Through this article, we have informed you about four tasks you need to complete before the end of the FY. By the above mentioned information; one can set their individual and business goals in more secure and prosperous manner. From reviewing financial statements and optimizing tax strategies to refining budgets and measuring investments, each task plays a vital role in shaping your financial report. Embracing these tasks not only ensures compliance with deadlines but also empowers you to make right decisions that align with your goals.