Welcome to our blog, where we uncover the crucial aspects of Disqualification in Director’s Appointment. Being a director comes with responsibilities and rules. In simple terms, these rules help ensure that directors act in the best interest of the company and its stakeholders. In this blog, we will delve into two important aspects, first the liabilities of the directors, and second, the reasons that could lead to someone being disqualified from becoming a director. Let us explore how these elements play a significant role in maintaining the trust and integrity of businesses.

Meaning of Director

According to the 2013 Companies Act, a director is an individual appointed to the board of a company in order to participate in its decision-making, governance, and management. Directors are accountable for guiding the strategic direction of the company, ensuring compliance with laws and regulations, protecting the interests of stakeholders, and supervising the company’s operations. They are instrumental in defining the company’s policies, making crucial financial and operational decisions, and contributing to the organization’s overall growth and success.

Liabilities of a Director

Resigned directors are still accountable for their offenses. He is accountable for company offenses while a director. In addition, section 166 of the Companies Act 2013 outlines director obligations that might result in an INR 500,000 punishment. One of such duty is the director must not make or seek to make any undue gain or advantage for himself or his relatives, and if found guilty, he must pay the firm the amount of the gain.

Further, any person found guilty of fraud involving at least ten lakh rupees or one percent of the company’s turnover, whichever is lower, shall be punished with imprisonment for a term not less than six months but not more than ten years and a fine not less than the amount involved in the fraud but not more than three times it. If the fraud affects public interest, the sentence must be at least three years.

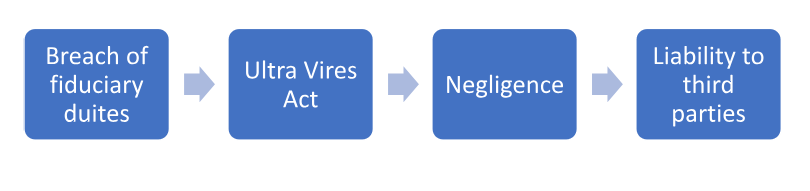

The following situations can make a director liable to the company:

- Breach of fiduciary duty: Directors are required to use their power for the company’s benefit. If a conflict of interest arises, the director should disclose it and seek stakeholder support in the general meeting. If not, it will be considered a breach of fiduciary duty and the company will be indemnified and the director will be liable of this indemnification. As trustees, directors must manage business and its property as they would their own.

- Ultra Vires Act: Directors’ powers are limited by the Companies Act, Memorandum, and Articles of Association. Ultra vires acts are their responsibility if they surpass these boundaries. The shareholders can ratify intra-vires acts in the general meeting, but if a company suffers a loss due to ultra-vires conduct of its directors, the firm can sue the directors.

- Negligence: Directors are personally liable for damages if they fail to take due care and precaution. However, judgment error is not negligence.

- Liability to third parties: The directors are usually not personally accountable for company transactions. They bind the corporation to third parties. Directors are usually accountable where agents are in a principal-agency relationship. Contract act holds them personally liable only in unusual cases when they contract in a personal capacity, when the principal is not disclosed, when it is a pre-incorporation contract, or when the deal is ultra vires the company and not ratified.

Criteria for disqualification of company Directors

The intention and purpose of having disqualifications of a director in the law is to appoint a suitable person as director to protect investors from mismanagement, ensure compliance of filing annual accounts and annual returns, increase compliance rate of filing statutory documents, infuse good corporate governance into the regulations of corporate affairs, and protect investors’ interests.

Section 164 of the Companies Act of 2013 outlines the circumstances under which a director is ineligible for appointment. During the disqualification period, a person cannot be appointed as the company’s director.

Disqualification due to personal actions of the Directors

According to Section 164(1), the following individuals are ineligible to serve as directors of a company:

- Person of unsound mind, as declared by a court of competent jurisdiction

- Undischarged insolvent

- Individual whose application to be declared insolvent is pending

- A person who has been convicted by a court of any offense, whether involving moral turpitude or not, and sentenced to imprisonment for 6 months or more and less than 5 years has not elapsed from the date of expiry of the sentence. Therefore, after the completion of a sentence, a person is ineligible for appointment for the following five years

- However, if a person has been convicted of a crime and sentenced to imprisonment for such office for seven years or more, he is ineligible to serve as a company director.

- Where a court or tribunal has issued an order disqualifying him from appointment as a director and the order is in effect

- Any person who has not paid any calls on any shares of the company he holds, whether alone or jointly, and six months have passed since the last day on which the call was due to be paid

- He has been convicted of an offense involving related party transactions under section 188 within the preceding five years

- He has not complied with section 152(3), so he has not received a DIN.

- He has not complied with section 165(1), which states that a director cannot simultaneously hold directorships in more than twenty companies, including alternate directorships.

Disqualification for violations of company policy

Any noncompliance by the company has repercussions for the board of directors as well. In accordance with Section 164(2) of the Companies Act, a director is disqualified from being appointed in the following instances due to the company’s noncompliance:

- Non-submission of financial statements or Annual returns for three consecutive fiscal years.

- A person who is or has been a director of a company that has failed to submit its annual return or financial statement for a continuous period of three financial years is ineligible for appointment as a director.

- Inability to repay deposits or interest or to redeem debt instruments, etc.

- Similarly, if a company fails to make the following payments or redeem its bonds for at least one continuous year

- If company fails to Repay the company-accepted deposit or pay interest on it; or

- If company fails to Redeem any debentures at maturity or pay any accrued interest; or pay any designated dividends

- Then, any person who is or has been a director of such a company in case of above three mentioned cases is ineligible for appointment as a director.

- Therefore, all directors who held directorship during the relevant period will be disqualified, regardless of whether they were directors when the due date for submitting financial statements or annual returns for the third year had passed, or when one year had passed since the due date for payment.

- Disqualified directors are ineligible for re-appointment as a director of the same defaulting company or any other company for a period of five years beginning on the date that the defaulting company fails to comply with its obligations.

- However, for a period of six months from the date of his appointment, a person who is appointed as a director of a company that has engaged in the defaults is exempt from being disqualified.

Consequences of Disqualification

- Loss of Directorship in Existing Organization

- Any director who is disqualified under Section 164 of the 2013 Companies Act must vacate his office

- In the event of disqualification under section 164(2), the director must resign from all companies other than the company in default.

- Any disqualified director cannot be appointed or reappointed as director in any other company for the period mentioned in Companies Act.

Consequences for Noncompliance

If a person continues to serve as a director despite knowing that the position, he previously held has become vacant, he will be subject to a fine of not less than INR 1 Lacs and not more than INR 5 Lacs.

In the event of noncompliance with Section 164, the company and each officer in default shall be subject to a penalty of INR 50,000. In the event of a continuing failure, a further fine of INR 500 per day will be imposed, up to a maximum of INR 3 Lacs for a company and INR 1 Lacs for a defaulting officer.

Renewing the directorship of a disqualified company Director

When the period of disqualification expires or the event that triggered disqualification is no longer present, such as an undischarged insolvent or impaired mind, the director’s disqualification will end.

However, directorship is not instantaneously restored. A director must submit Form DIR-10 to the Registrar to be removed from the list of disqualified directors and to have his or her name removed from the disqualification list.

Final Words

In conclusion, it is crucial to understand the responsibilities and consequences of directorship. Directors are responsible for assuring the company’s wellbeing, which entails legal obligations. If these responsibilities are not conducted adequately, directors may incur liability. In addition, there are regulations in place that prevent certain individuals from becoming directors for specific reasons. By adhering to these guidelines, businesses can preserve transparency, integrity, and a foundation of trust, thereby assuring a healthy and prosperous business environment.