Welcome to our comprehensive blog on “Change in Directors of Company- Resignation, Removal or Disqualification as per Companies Act, 2013.” In this series, we will delve into the crucial aspects of directorship in Indian companies, focusing on the procedures and legal implications of resigning, removing, and disqualifying directors. Understanding these processes is essential for ensuring effective corporate governance, safeguarding stakeholder interests, and maintaining compliance with the Companies Act, 2013. Whether you are a director seeking to step down, a company considering director removal, or need insights into the disqualification provisions, our blog aims to provide clarity and guidance in navigating these significant aspects. By the end of this guide, you should have a clear understanding of change in directors of company- resignation, removal or disqualification.

| Table of Contents |

Who is director?

Directors are members of the board of directors for the companies, in accordance with Section 2(34) of the Companies Act 2013. The collective body of directors for the companies is referred to as the board of directors. The position of director under companies Act, 2013 may be one of the three that is directors may act as agents, trustees, and managing partners.

In addition, Section 149 mandates that public businesses must have a minimum of three directors and private companies a minimum of two. One person companies have at least one director. A company can have up to 15 directors. In cases when there are more than 15 directors, the company must approve a specific resolution.

Resignation of director (Section 168 of the Companies Act, 2013)

- A director may resign from their position by providing the company with written notice.

- Within 30 days after resigning, the director may submit the e-form DIR-11 with the registrar as a notice of resignation.

- The Board of Directors is required to tell the shareholders in the General Meeting of the notice received from the director after receiving it.

- Following receipt of the resignation notice, the Company has 30 days to file the e-form DIR-12 with the registrar.

- The resignation will be effective as of the following dates: – the date on which the notice is received by the company, or the date specified by the director in the notice whichever is later.

Removal of Director (Section 169 of the Companies Act, 2013)

The company can remove a director in accordance with section 169 of the Companies Act of 2013 that is the removal of director by shareholder can be done before the end of the term of his office by passing an ordinary resolution after providing the director with a reasonable opportunity to be heard, illegal removal of company director is not permitted. The procedure of removal of director in private limited company is also same.

Procedure for removal of director from a company will be:

- At least 14 days prior to to the general meeting, a special notice requesting the dismissal of the director must be given to the company.

- The company must send the concerned director a copy of the special notice

- The concerned director has the right to submit a written representation against his removal.

- At least seven days before the general meeting, the company must notify all relevant parties of the resolution to remove the director, along with a copy of the written representation; and the fact that the director made a written representation.

- The director may demand that a written representation be read aloud during the meeting if it is not possible to distribute it.

- Within 30 days of the resolution’s passage, the company must submit an electronic copy of the DIR-12 to the registrar. So this is the procedure of removal of director as per Companies Act, 2013.

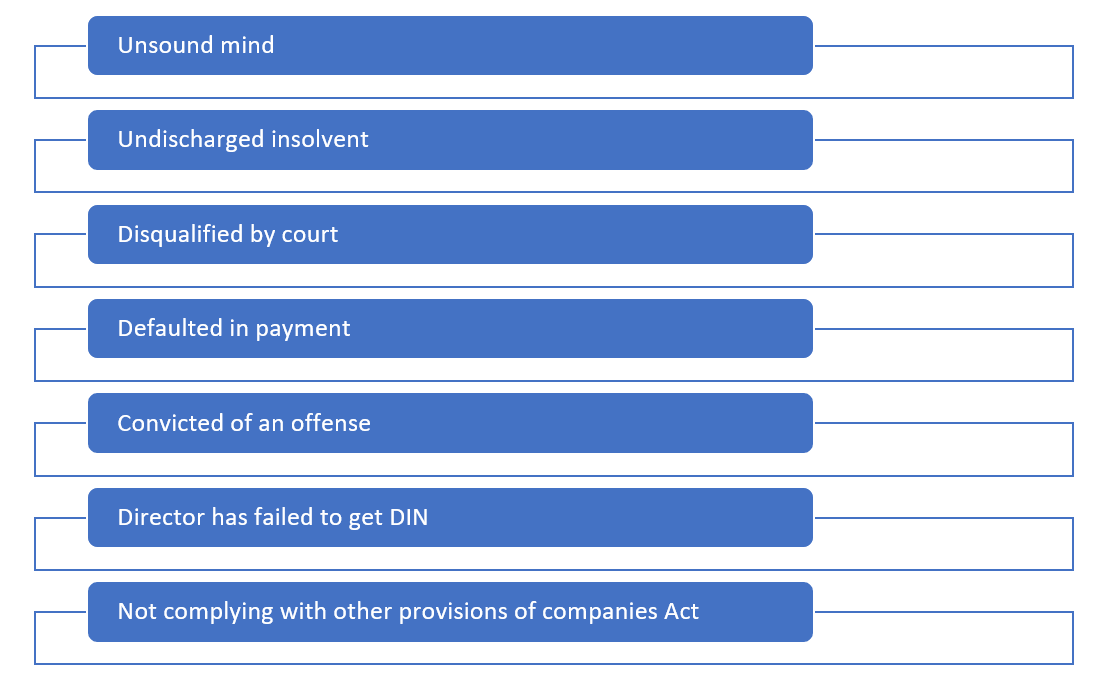

Disqualification of Directors (Section 164 of the Companies Act, 2013)

The grounds for disqualifying a director are outlined in the Section 164, of Companies Act of 2013, which was passed in 2013.

The Companies Act of 2013 specifies the circumstances for disqualification of a director. –

- Where he or she has been declared mentally unfit by a court of competent jurisdiction.

- Where he/she is an undischarged insolvent.

- Where insolvency has been requested, but the request is still pending.

- If he or she has been convicted of a crime involving moral turpitude and sentenced to at least six months in prison.

- If any court or tribunal has issued an order disqualifying him from being appointed as a director, he is ineligible.

- If he or she is a shareholder in a company and has not made payment of any of such call, and six months have elapsed since the last date on which such a payment was due.

- In the preceding five years, he or she has been convicted of an offense involving related party transactions governed by Section 188 of the 2013 Companies Act.

- Where he or she has not acquired a Director Identification Number (“DIN”).

- Where he/she is the director of a company that has –

- Failed to file annual returns for three consecutive years

- Failed to pay interest on/repay deposits for more than a year

- Failed to pay any declared dividend for more than a year; or

- Failed to redeem debentures or pay interest on debentures for more than a year.

Regarding this particular provision, the period of ineligibility for directorship will be five years from the date of the default, regardless of whether it occurred in the same company or another.

Removal of Disqualification

Directors who have been disqualified can adopt a few strategies that will serve as their lifeboats.

- Disqualification appeal: Disqualified directors may file a High Court writ suit for remedy. This suspends the order. This offers the director enough time to correct the wrongs, if legal.

- Temporary directors appointed: If all directors are disqualified, the firm may appoint new directors to stay compliant. This ensures regulatory and legislative compliance.

- In the meantime, the DIN and DSC of the new directors can be used to upload and submit all pending forms.

- NCLT application filing: If the company’s status is changed to “Strike Off” due to non-compliance with filing returns, an application can be submitted with the NCLT to restore its “Active” status. The NCLT and Registrar of Companies can clear “Strike Off” status with the proper documentation. The directors’ DINs can be reinstated if the company’s status is restored to “Active” and strike off is cleared.

Takeaway

In conclusion, change in directors of company can occur due to several reasons: resignation, removal, or disqualification of director. Resignation is a voluntary decision by a director, often influenced by personal reasons or new opportunities. On the other hand, removal of director in a company law may result from factors such as misconduct, non-performance, or breach of fiduciary duty, and it involves a formal process. Disqualification, initiated by regulatory authorities, arises from legal violations. For the smooth functioning and corporate governance of a company, it is crucial to manage these changes with transparency, adherence to relevant regulations, and careful consideration of the company’s best interests.