In today’s era of fast-paced business, companies often want to expand their operations to capitalize on new opportunities. One of the significant strategies is to shifting your company’s registered office from one state to another. However, shifting a company’s registered office is not that simple. It involves careful planning for a smooth transition and certain legal formalities. Furthermore, this expansion can offer several benefits, which we are going to discuss in detail in this article. We explain the step-by-step procedure for shifting of registered office from one state to another.

Glimpses of Registered Office

The registered office is the official address of a company, which is recorded with the appropriate government authorities, typically the Registrar of Companies (ROC) in India. It serves as the company’s legal address for official communication and is the place where all official documents, notices, and legal correspondence related to the company are sent.

The registered office is a crucial aspect of a company’s existence and is required to be mentioned in various legal documents, including the Memorandum of Association (MOA) and Articles of Association (AOA) of the company. The location of the registered office determines the state or union territory in which the company is registered and governed under the laws of that particular jurisdiction.

The registered office does not necessarily represent the company’s operational office or place of business. A company can have its operational offices or branches in multiple locations while maintaining only one registered office. It is open to public inspection, and anyone can visit the registered office to inspect certain company documents as required by law.

Any change in the registered office’s address, whether within the same state or from one state to another, must comply with the legal procedures specified by the Companies Act and the Ministry of Corporate Affairs (MCA) in India. Such changes require approvals from the company’s board of directors, shareholders, and the National Company Law Tribunal (NCLT) to ensure transparency and proper compliance with the law

Mandatory requirements for Shifting of Registered Office of the Company from one State to Another

There are mandatory requirements are as follows:

- Board Resolution: The board of directors must pass a resolution approving the shift of the registered office from one state to another.

- Shareholder Approval: Shareholders must approve the change by passing a special resolution in an Extraordinary General Meeting (EGM) of the company.

- Application to NCLT: A formal application must be filed with the NCLT for approval of the change in the registered office. The application should be accompanied by necessary documents and fees.

- Public Notice: A public notice about the change in registered office address must be published in at least one English newspaper and one vernacular newspaper in both the current state and the proposed state. The notice should be made at least 21 days before the hearing at NCLT.

- NCLT Approval: The NCLT will examine the application and grant approval if it finds the application to comply with the relevant laws and regulations.

- Amendment to MOA and AOA: After obtaining NCLT approval, the MOA and AOA of the company need to be amended to reflect the new registered office address.

- Intimation to ROC: The company must inform the ROC in both the current state and the proposed state about the change in the registered office address within 30 days of obtaining NCLT approval.

- State-Specific Compliances: The company must comply with state-specific laws and regulations of the new state, such as obtaining new licenses or registrations if required.

- Update PAN and TAN: The company’s PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) must be updated with the Income Tax Department to reflect the new registered office address.

- Financial Disclosures: The company may need to make necessary disclosures about the change of registered office in its financial statements and reports.

- Other Legal Requirements: Apart from the above, there might be other legal requirements specific to the nature of the company and the states involved, which should be adhered to.

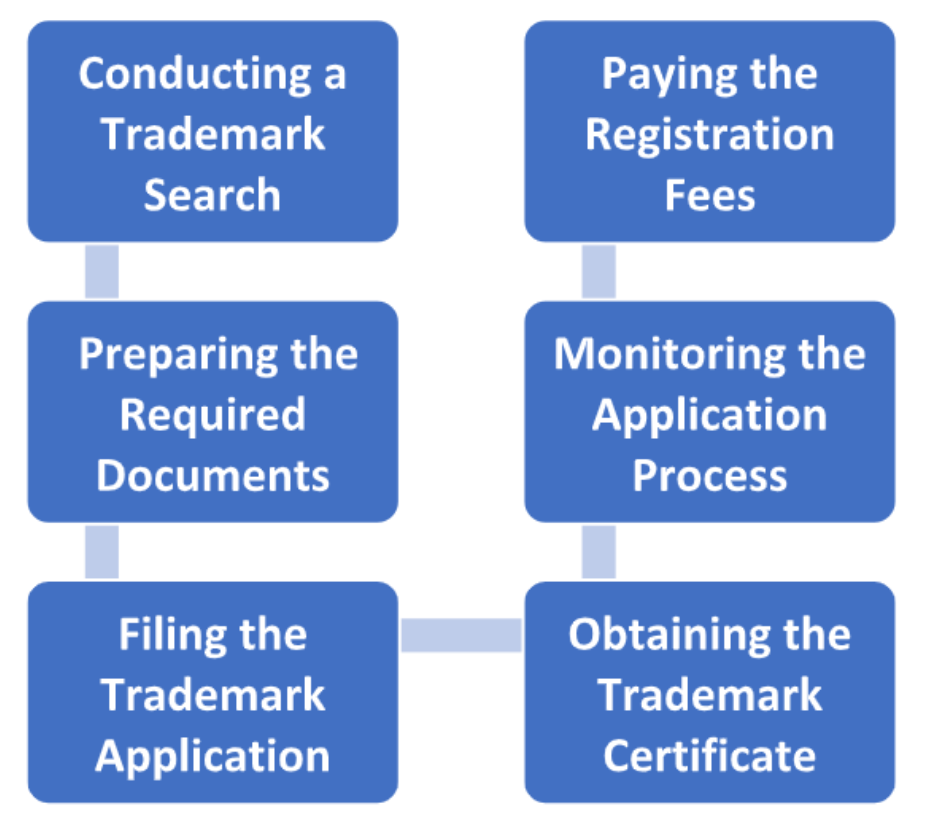

Step-by-step procedure for Shifting of Registered Office from one State to Another

The procedure for shifting the registered office of a company from one state to another in India involves the following steps:

- Board Resolution: Convene a meeting of the Board of Directors and pass a resolution approving the shifting of the registered office from one state to another. The resolution should also authorize a director or any other person to make necessary applications and filings with the concerned authorities.

- Shareholder Approval: Call an Extraordinary General Meeting (EGM) and seek approval from the shareholders for the proposed shift of the registered office. This requires passing a special resolution by the shareholders.

- Filing of Form MST-14: Form MGT-14 is a crucial document that needs to be filed with the ROC in India as per the provisions of the Companies Act, 2013. It is required to be filed in cases where the company is seeking approval for the shifting of its registered office from one state to another. The special resolution passed by the shareholders during the EGM for the shifting of registered office comes under the purview of Form MGT-14.

- Publish the Advertisement in e-form INC 26: It is an electronic form used for shifting the registered office from one state to another in India. It is filed with the ROC to seek approval for the change.

- Made a List of Creditors and Debenture Holders: Making a list of creditors and debenture holders is an essential step when shifting the registered office of a company. The list must include details of all outstanding debts, liabilities and obligations owed to creditors and debenture holders as of the date of the special resolution for the shifting of the registered office.

- Application submission to ROC: Access the Ministry of Corporate Affairs (MCA) portal and log in using valid credentials. Upload the filled and signed application form and attach the necessary documents.

Is there any timeline for Shifting of Registered Office of the Company from one State to Another?

Yes, there are specific timelines that need to be adhered to when shifting the registered office of a company from one state to another in India. The timelines are prescribed by the MCA and are essential to ensure a smooth and timely process. Here are the key timelines involved in the shifting process:

- Conducting Board Meeting: There is no specific timeline for this step, but it should be done before proceeding to the next stages.

- Conducting Extraordinary General Meeting (EGM): After obtaining the board’s approval, an EGM should be conducted to seek shareholder approval for the change of registered office. The notice for the EGM should be given at least 21 days before the meeting, and a special resolution is passed during the EGM.

- Application to NCLT: Once shareholder approval is obtained, the application for shifting the registered office should be filed with the NCLT within 30 days of passing the special resolution in the EGM.

- Publication of Public Notice: After applying with the NCLT, a public notice about the change in registered office address should be published in at least one English newspaper and one vernacular newspaper in both the current state and the proposed state. The notice should be made at least 21 days before the hearing at NCLT.

- NCLT Approval: The NCLT will examine the application, consider any objections raised, and, if satisfied, issue an order approving the change of registered office. The NCLT typically takes a few weeks to a few months to approve.

- Amendment to MOA and AOA: The amendment should be filed with the ROC of both the old and new states within 30 days of NCLT approval.

- Intimation to ROC: The company must inform the ROC of both the old and new states about the change in registered office address within 30 days of obtaining NCLT approval.

Benefits of Shifting of Registered Office of the Company from One State to Another

Shifting the registered office of a company from one state to another can offer several benefits, which may contribute to the growth and success of the business. Some of the key advantages include:

- Access to New Markets: Moving the registered office to another state can provide the company with access to new geographical markets. This expansion can open up opportunities to reach a larger customer base, explore untapped markets, and diversify the customer profile.

- Better Business Environment: Certain states in India offer more favourable business environments, including tax incentives, subsidies, and other benefits. By relocating to such a state, the company can reduce operational costs and enhance profitability.

- Regulatory and Compliance Ease: Some states may have more straightforward and business-friendly regulatory frameworks. Shifting the registered office to such a state can result in reduced compliance burdens, faster approvals, and streamlined regulatory processes.

- Improved Infrastructure: Relocating to a state with better infrastructure facilities, such as transportation networks, communication systems, and availability of skilled labour, can enhance operational efficiency and productivity.

- Attracting Investment and Talent: A move to a prominent business hub or state with a robust economy can attract potential investors and top talent. Companies may find it easier to raise capital and recruit skilled professionals, contributing to overall growth and competitiveness.

- Cultural and Industry Synergies: Moving to a state with a thriving industry ecosystem related to the company’s sector can lead to better collaboration, knowledge sharing, and access to specialized resources and expertise.

- Strategic Growth and Expansion: Shifting the registered office is often a strategic decision to expand the company’s presence and seize growth opportunities. It allows the company to explore new avenues and stay ahead of competitors.

- Brand Perception: In some cases, a relocation to a more prominent or prestigious location can positively impact the company’s brand perception and reputation.

- Geopolitical Considerations: In situations where geopolitical factors or government policies significantly impact the company’s operations, shifting the registered office to another state can provide stability and continuity.

Foot Notes

Throughout the journey of shifting your company’s registered office, there is a requirement for approvals from the shareholders and Board of Directors. Seeking clearance from the NCLT and updating legal documents are vital steps. Companies should be diligent in complying with state-specific regulations and requirements in the new state of registration. A well-executed relocation can propel a company towards enhanced competitiveness, increased efficiency, and improved market positioning.