Company Registration Process in Rajasthan is a crucial process for entrepreneurs looking to establish their businesses in the state. This legal procedure grants recognition, protection, and access to government incentives. Understanding the various business structures, compiling essential documents, and adhering to registration requirements are vital steps. Entrepreneurs can choose between online and offline registration options, with the Registrar of Companies being the governing body. Once registered, businesses must comply with tax regulations and annual filing obligations. The benefits of company registration include enhanced credibility, attracting investors, and eligibility for government schemes. This guide aims to simplify the process and empower entrepreneurs in Rajasthan’s dynamic business landscape. in this blog, we will tell you the complete process of Company Registration Process In Rajasthan.

|

Table of Content |

Brief overview of Rajasthan’s business environment

Rajasthan offers a thriving business environment with abundant opportunities across diverse sectors. Its strategic location, skilled workforce, and investor-friendly policies make it an attractive destination for entrepreneurs. Company registration process in Rajasthan is of utmost importance for entrepreneurs as it confers legal recognition and protection, allowing them to conduct business operations seamlessly. Registered companies can access government incentives and benefit from enhanced credibility, vital for building trust with customers and investors. This process ensures compliance with laws and regulations, enabling entrepreneurs to focus on growth and expansion, making Company Registration process in Rajasthan a fundamental step towards entrepreneurial success.

Step-by-Step Company Registration Process

The company registration process can vary depending on the country and legal requirements. Here’s a general step-by-step guide for registering a company in many jurisdictions:

- Business Idea and Planning: Define your business idea, determine the structure of your company (e.g., sole proprietorship, partnership, limited liability company), and create a business plan outlining your objectives, target market, and financial projections.

- Choose a Business Name: Select a unique and appropriate name for your company that complies with the naming regulations of your country or state.

- Determine the Legal Structure: Decide on the legal structure of your company (e.g., LLC, corporation) based on the liability protection and taxation implications you want for your business.

- Registered Office Address: Provide an official address where your company will be located and where legal documents can be sent.

- Appoint Directors or Partners: Identify and appoint directors (for a corporation) or partners (for a partnership) who will be responsible for managing the company’s affairs.

- Shareholders or Members: If applicable, determine the shareholders or members who will hold ownership interests in the company.

- Obtain Necessary Licenses and Permits: Depending on your industry and location, you may need specific licenses or permits to operate legally. Research and obtain these licenses before proceeding further.

- Draft Company Constitutive Documents: Prepare the necessary legal documents such as articles of incorporation or articles of association, partnership agreement, or operating agreement (for an LLC) that outline the rights and responsibilities of the company’s stakeholders.

- Register with Government Authorities: Submit the required documents and forms to the appropriate government agency or company registrar in your country. This may involve providing details about the company’s directors, shareholders, and registered address.

- Pay Registration Fees: Pay the applicable registration fees to the government or company registrar. The fees can vary depending on the country and type of company.

- Obtain Tax Identification Number (TIN) or Employer Identification Number (EIN): After registration, apply for a TIN or EIN from the tax authorities. This number will be used for tax-related purposes.

- Open a Business Bank Account: Once you have the necessary legal documents and registration, open a business bank account to manage your finances separately from personal accounts.

- Comply with Local Employment Laws: If you plan to hire employees, ensure you comply with local labor and employment laws, including obtaining necessary work permits for foreign employees if required.

- Get Business Insurance: Consider getting business insurance to protect your company from potential risks and liabilities.

- Post-Registration Compliance: Familiarize yourself with ongoing compliance requirements, such as filing annual reports, paying taxes, and adhering to other regulatory obligations specific to your business type and location.

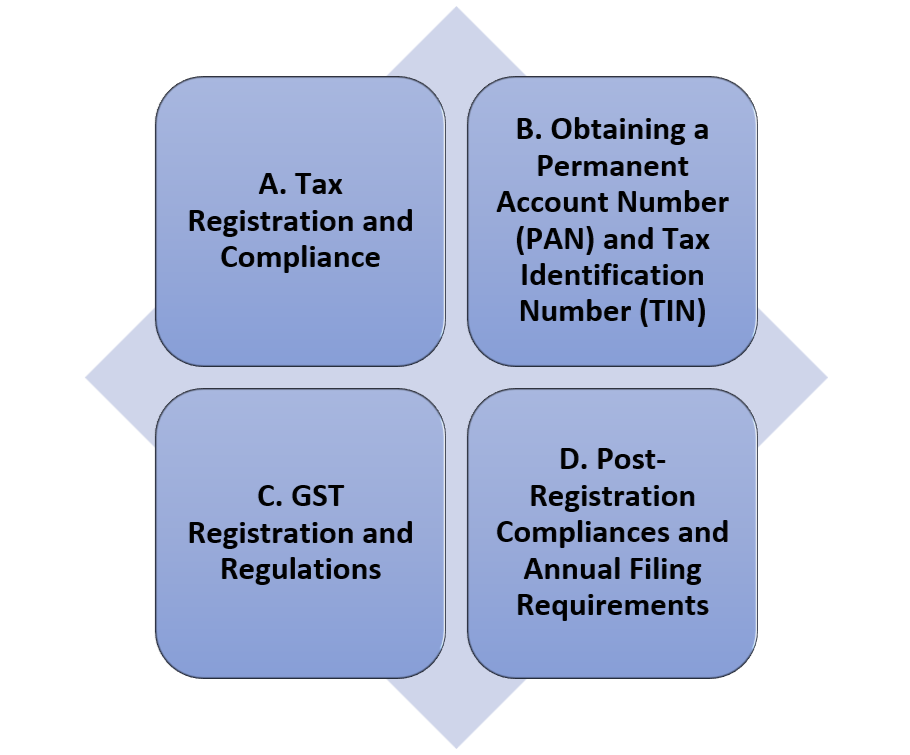

Business Compliance and Post-Registration Formalities

- Tax Registration and Compliance: After company registration in Rajasthan, businesses must obtain tax registration, such as Goods and Services Tax (GST) registration, Professional Tax (PT), and Employee State Insurance (ESI) registration, depending on their nature and size. Adherence to tax compliance is crucial to avoid penalties and legal issues.

- Obtaining a Permanent Account Number (PAN) and Tax Identification Number (TIN): Entrepreneurs need to obtain a PAN and TIN for their registered company. PAN is essential for various financial transactions, while TIN is necessary for VAT and CST purposes.

- GST Registration and Regulations: Companies with a certain turnover threshold must register under GST, a unified indirect tax regime. GST compliance involves timely filing of returns and adherence to GST rules and regulations.

- Post-Registration Compliances and Annual Filing Requirements: Registered companies in Rajasthan must comply with various post-registration obligations, including annual filings with the Registrar of Companies (RoC), maintenance of statutory records, conducting board meetings, and complying with financial reporting standards. Failure to meet these requirements may lead to legal repercussions.

Benefits of Registering a Company in Rajasthan

Company Registration Process In Rajasthan, or any other state, offers several benefits. Here are some advantages of business registration in Rajasthan:

- Legal Recognition: Registering your company provides legal recognition to your business entity, making it a separate legal entity from its owners. This separation offers limited liability protection to the company’s shareholders or owners.

- Access to Funding: A registered company can easily access funding from banks, financial institutions, and venture capitalists. It becomes more credible and trustworthy in the eyes of investors, which can attract more investment opportunities.

- Brand Protection: Registering a company also allows you to protect your brand name and logo under the trademark law. This helps prevent others from using similar names and protects your brand identity.

- Government Tenders and Contracts: Registered companies are eligible to participate in government tenders and contracts, opening up opportunities to work with government agencies and departments.

- Business Bank Account: Having a registered company enables you to open a business bank account, which helps separate personal and business finances, making accounting and tax compliance easier.

- Enhanced Credibility: A registered company appears more credible and reliable to customers, suppliers, and partners, which can positively impact business relationships and growth prospects.

- Continuity and Perpetual Succession: The existence of a registered company is not dependent on the existence of its owners or directors. It continues to exist even if the ownership changes, providing continuity and perpetual succession.

- Tax Benefits: Depending on the business structure chosen (e.g., LLP, Private Limited Company), there may be tax benefits available, such as tax deductions and exemptions, which can help in managing the company’s finances more efficiently.

- Limited Personal Liability: By registering as a private limited company or LLP, the personal assets of the owners are protected from business debts and liabilities, limiting their personal liability to the extent of their investments in the company.

- Government Incentives: The government of Rajasthan and the central government of India often offer incentives and benefits to registered companies operating in specific industries or regions, encouraging business growth and investment.

Conclusion

In conclusion, registering a company in Rajasthan, or any other state, offers numerous advantages and benefits for entrepreneurs and business owners. The process of business registration provides legal recognition to the entity, separates personal and business liabilities, and enhances the credibility of the business. By registering, a company gains access to funding, can protect its brand, and becomes eligible for government tenders and contracts. Additionally, a registered company can open a business bank account, making financial management more efficient. Moreover, tax benefits and government incentives can further promote business growth and investment in Rajasthan. Overall, business registration in Rajasthan empowers entrepreneurs to establish a strong foundation for their ventures, ensuring legal compliance, financial security, and the potential for sustained success.