In today’s dynamic business landscape, companies often explore various restructuring options to adapt to changing market demands and expand their operations. One such transformational journey is the conversion of a Limited Liability Partnership (LLP) to a Private Limited Company. This strategic shift allows businesses to unlock new opportunities, enhance their corporate structure, and access a broader range of funding sources. In this blog, we will delve into the reasons why businesses opt for such conversions, the key steps involved in the process, and the benefits that can be gained from this transformation.

Meaning of LLP and Private Limited company

LLP stands for Limited Liability Partnership. It is a legal entity where partners have limited liability for the company’s debts and obligations.

Private Limited Company is a type of business structure where the company is privately held, and its shares are not traded publicly. The liability of its shareholders is limited to their shareholding in the company.

Reason of LLP conversion into a private limited company

The followings are the reasons for conversion of LLP into Company:

- LLP changes its legal status to a private company in order to expand its current operations.

- LLP can only draw a limited variety of investors, thus they convert to draw more, such as global or equity investors.

- To issuing equity share capital in the private limited Company, the LLP is converted.

- To avoid a capital gains tax gain

- To carry forward the entire years’ worth of unrecovered losses and depreciation.

- The LLP decides to transform into a Company to maintain their brand name and goodwill.

Advantages of converting LLP Into a Private Limited Company

The advantages LLP conversion to a private limited company are as follows:

- Enhanced Credibility: Customers, suppliers, and potential investors frequently view private limited companies as having a higher level of credibility, which promotes trust and draws in additional business opportunities.

- Perpetual Existence: Private limited companies, as compared to LLPs, have a perpetual existence, providing continuity even if one of the shareholders leaves or passes away.

- Transferability of Shares: Shareholders in a Private Limited Company can readily transfer their shares to new owners, making ownership transitions and succession easier.

- Limited Liability Protection: Converting to a Private Limited Company offers limited liability protection to its shareholders, safeguarding personal assets from the company’s debts and liabilities.

- Ease of Raising Capital: Private Limited Companies have better access to funding options, including venture capital, private equity, and the ability to issue shares to raise capital for expansion and growth.

- Increased Employee Benefits: Converting to a Private Limited Company allows for better employee incentives and share-based compensation plans, aiding in attracting and retaining top talent.

- Global Expansion Potential: Private Limited Companies have a stronger legal framework for global expansion, facilitating international business operations and collaborations.

- Tax Benefits: Private Limited Companies may avail tax benefits and incentives offered by the government for promoting corporate growth and investment.

- Professional Image: Converting to a Private Limited Company gives a more professional image to the business, making it attractive for partnerships and contracts with larger corporations.

- Exit Strategy Options: Private Limited Companies provide more exit strategy options for shareholders, including the ability to go public through Initial Public Offerings (IPOs) in the future.

Pre-requisite conditions for LLP to Private Limited Company Conversion

Before taking any further steps to convert an LLP into a Private Limited Company, the following requirements must be met:

- The minimum number of partners needed for the Limited Liability Partnership to be incorporated as a Private Limited company is two.

- The conversion of the LLP should have had the consent of all partners.

- The LLP was supposed to submit all required returns.

- Publication of information about the conversion of the LLP into a private company in at least two newspapers, one in English and one in any local newspaper that is published in the region where the registered office is located.

- No Objection Certificate from the Registrar.

Procedure of conversion of an LLP Into a Private Limited Company

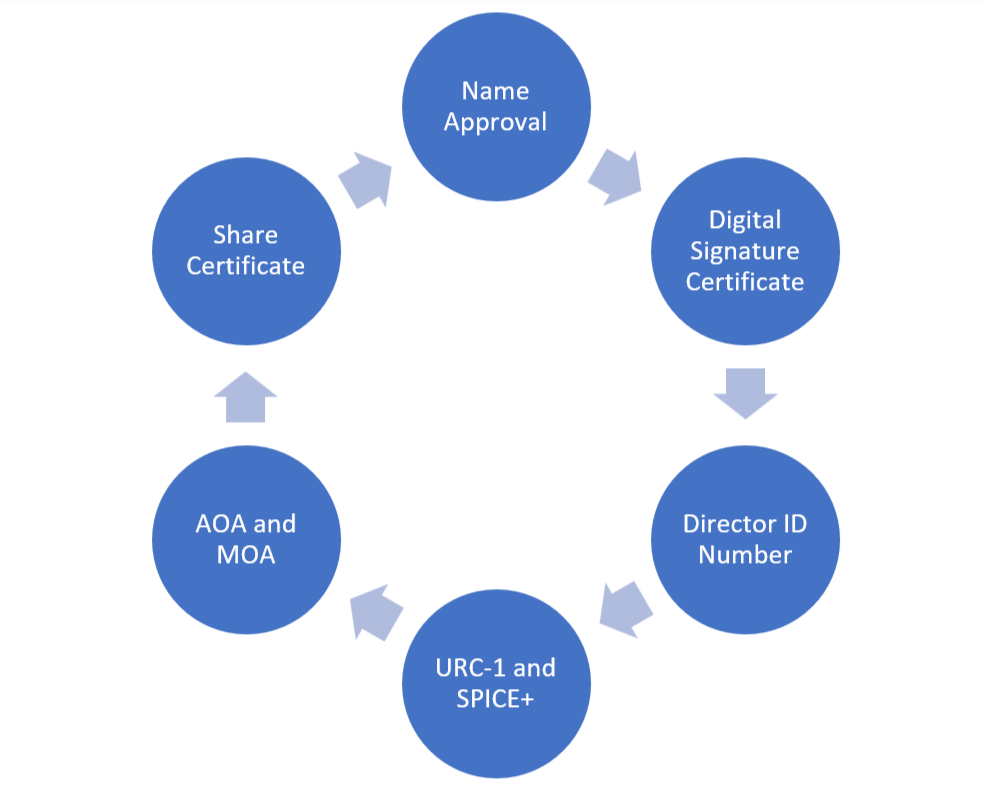

The procedure to conversion an LLP to private limited company is as follows:

- Getting the name approved

- Getting a Digital Signature Certificate and Director’s ID Number

- URC-1, SPICE+, and other associated forms must be submitted.

- Drafting the articles of association and the memorandum of association

- Issuing share certificates

Name Approval Procedure

Obtaining Name Approval from the ROC (Registrar of Companies) requires applying in e-format. To apply for this, you must select various items from the list on form INC-1. Once recognized by the authority, the name will be valid for sixty days.

Securing DSC & DIN

The Digital Signature Certificate (DSC) and Director Identification Number (DIN) for all prospective directors must be obtained if all seven members who will become directors of the company after the conversion do not already possess them. On the MCA portal, an application form must be submitted to obtain a DIN. The central government processes and approves DIN applications through the regional director’s office of the ministry of corporate affairs.

The form must be accompanied by self-attested evidence of address and proof of identity, as well as a recent color photograph of the applicant in passport size. All required documents must be attested by a cost accountant, chartered accountant, or company secretary in active practice.

Filing form no. URC – 1

After obtaining the name sanction from the Registrar of Companies, the applicant must complete and submit Form No. URC-1 along with the following documents.

- Members’ names, addresses, proportional shareholdings, etc., are included on the list.

- List of the first directors of the private company, including various information such as names, addresses, DINs, passport numbers with expiration dates, etc.

- Every person proposed as first directors must submit an affidavit stating that he is not disqualified from serving as a director under section 164, and all documents filed with the registrar for the registration of the firm must contain information that is complete, correct, and true to the best of his knowledge.

- Include a list of the names and addresses of the LLP’s partners, as well as a copy of the LLP’s agreement and registration certificate, duly attested by two of the LLP’s designated partners.

- A declaration indicating the following requirements nominal share capital of a company and the quantity of shares it is divided in and the number of shares acquired, and the price paid per share

- The company’s name must be followed by the word Limited or private limited.

- A letter of consent or No objections from each creditor.

- Copy of the newspaper advertisement, a statement of the company’s finances dated no more than six days prior to the date of the application, and duly attested by the auditor.

MOA and AOA

After obtaining the name approval and sanction of form no. URC-1 – from the registrar, the Memorandum of Association (MoA) & Articles of Association (AoA) must be drafted and submitted with the RoC. The conversion process provides certain tax benefits.

However, in order to take advantage of them, several additional conditions must be met, such as maintaining the same shareholding by the partners as in the previous LLP when the conversion occurs, and for five years following the conversion, the former partners of such LLP who are now shareholders in the newly formed company cannot have a combined shareholding of less than 50 percent.

Alternatively, the LLP may establish a separate private limited company and then transfer the entire business to the private company with the aid of a written agreement; in this case, the above-mentioned requirements, such as a minimum of seven partners and newspaper publication, are not necessary. However, a capital gains tax is imposed in this instance. Additionally, stamp duty implications apply to such a transfer.

Conditions for Claiming Income Tax Exemption on Conversion

If the following criteria are met, the capital gains tax resulting from the limited liability partnership firm’s conversion to a Private limited company will be exempt:

- Prior to conversion, all of the LLP’s assets and liabilities became the Private company’s assets and liabilities.

- In the same ratio as their capital accounts were recorded in their books as of the conversion date, all partners of the LLP immediately before to the conversion became shareholders in the new Private company.

- The only indirect or direct profit that the firm’s partners should obtain is through the distribution of shares of the company.

- The combined voting power of the LLP partners in the company cannot be less than 51% of the overall voting power. Additionally, their ownership of the shares shall remain unchanged for five years following the conversion.

The tax implications of converting an LLP into a Private company were discussed above. The capital gains tax will not be levied on the conversion of an LLP to a private limited company if the requirements are met.

Takeaway

Converting a Limited Liability Partnership to a Private Company can be a strategic move for businesses seeking to improve their corporate structure, credibility, and growth prospects. Companies can unlock benefits such as limited liability protection, access to diverse funding sources, and increased investor confidence by adhering to specified conditions and legal procedures. Additionally, the transition enables companies to establish a more professional image, expand internationally, and implement effective exit strategies. Nonetheless, during the conversion process, entrepreneurs and business owners must carefully evaluate their specific needs, obtain expert counsel, and ensure full compliance with applicable regulations.