The Input Service Distributor (ISD) plays a crucial role in simplifying the process of claiming Input Tax Credit (ITC). At the time GST came to India, the taxation system has introduced a uniform indirect tax structure and ISD is a part of this transformative structure. The article will through some light on the essential rules by providing Input Service Distributors under GST, providing a clear understanding of their functions and responsibilities. Let’s explore the world of ITC rules and their impact on businesses.

| Table of Content |

Short Note on Input Service Distributor under GST

Under the Goods and Services Tax (GST) system in India, an “Input Service Distributor” (ISD) is a designated office of a supplier of goods or services that plays a pivotal role in the distribution of ITC within a business entity or organization.

The concept of an Input Service Distributor is introduced to facilitate the distribution of ITC among various branches or units of a company or business, especially when there are multiple registrations across different states or within the same state. It serves as a centralized entity that receives invoices for input services utilized by different units and then allocates the eligible ITC to these units based on a fair and prescribed mechanism.

In simpler terms, the Input Service Distributor acts as a conduit for the seamless flow of tax credits, making it more convenient for businesses to claim ITC and offset their tax liabilities. By optimizing the distribution of ITC, the Input Service Distributor helps in reducing the cascading effect of taxes and ensures that the benefits of input tax paid on input services are availed at the appropriate units, leading to a more efficient and transparent tax system.

Meaning of Input Tax Credit Rules

ITC rules refer to the regulations and guidelines governing the claiming, utilization, and distribution of ITC under the GST regime. Input Tax Credit is a fundamental concept in the GST system that allows taxpayers to claim credit for the taxes paid on inputs (goods and services) used in the course of business. The ITC rules ensure that the credit mechanism operates smoothly and efficiently, preventing double taxation and cascading of taxes.

Who is an Input Service Distributor under GST?

Under the GST system in India, an ISD is a specific type of taxpayer designated under the law to facilitate the distribution of ITC among various branches or units of a business entity.

An Input Service Distributor can be defined as follows:

- Eligible Entity

- Centralized Function

- ITC Distribution

- GSTR-6 Return Filing

- Reversal of ITC

Income Tax Credit Rules for Input Service Distributors under GST

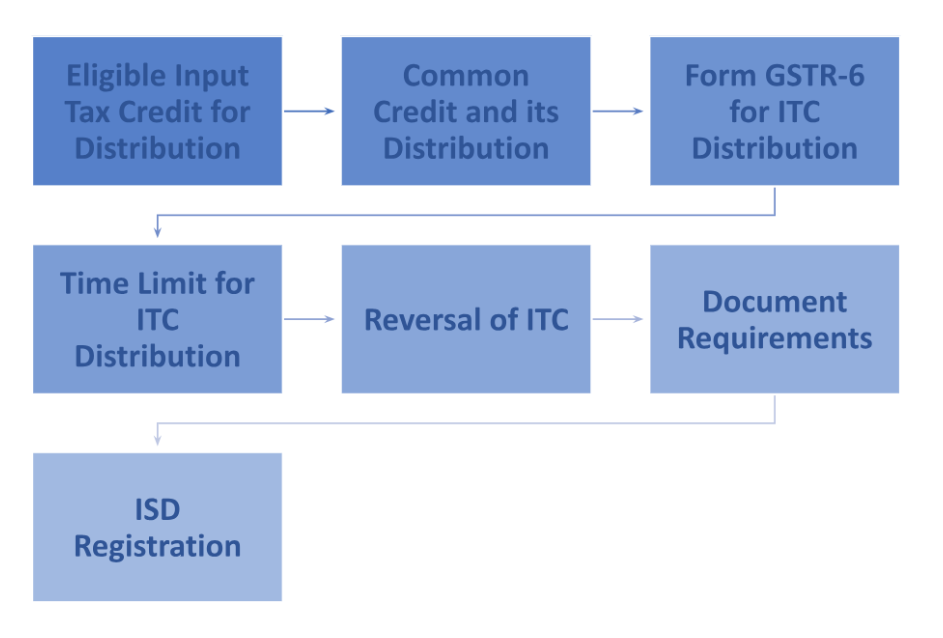

The key ITC rules for ISD under GST:

- Eligible Input Tax Credit for Distribution: The Input Service Distributor can distribute ITC only on those invoices for input services that are eligible for ITC under the GST law. ITC can be distributed only on input services used for making taxable supplies.

- Common Credit and Its Distribution: In case there is common credit available (input services used for both taxable and non-taxable supplies), the Input Service Distributor needs to distribute the credit fairly and reasonably between the units eligible for ITC and those not eligible for ITC.

- Form GSTR-6 for ITC Distribution: The Input Service Distributor is required to file a monthly return called GSTR-6. This return includes details of the ITC received and the ITC distributed to each eligible unit during the tax period.

- Time Limit for ITC Distribution: The Input Service Distributor must distribute the ITC to its eligible units using GSTR-6 within the prescribed time limit. As of my last update, the deadline was the 13th of the following month for which the distribution is being made.

- Reversal of ITC: If the Input Service Distributor has distributed common credit to various units, it must reverse the credit attributable to non-taxable supplies before making the distribution.

- Document Required for ISD registration under GST: The ISD should maintain proper records and documentation of invoices, credit notes, and debit notes for input services received and distributed. These records should be readily available for scrutiny during audits or as required by the tax authorities.

- ISD Registration under GST: The Input Service Distributor must have a separate registration as an ISD under GST.

Commercial Benefits from ITC Rules for Input Service Distributors under GST

Here are some commercial benefits of ITC rules for an Input Service Distributor under GST:

- Streamlined Credit Distribution: The ISD allows businesses with multiple units or branches to centralize their ITC distribution. It streamlines the process of distributing ITC to different units, making it easier to manage and optimize credits.

- Reduced Tax Burden: By effectively distributing ITC to eligible units, an ISD can significantly reduce the tax liability of each unit. This helps in lowering the overall tax burden of the organization and leads to cost savings.

- Minimized Cascading Effect: GST’s ITC mechanism aims to eliminate the cascading effect of taxes, where taxes are levied on taxes. By availing and distributing ITC correctly, an ISD ensures that taxes are levied only on the value added at each stage of the supply chain, leading to a more efficient and less tax-burdened system.

- Improved Cash Flow: Efficient utilization of ITC through an ISD leads to reduced cash outflow towards tax payments. As eligible units can offset their tax liabilities with distributed ITC, they retain more working capital, contributing to improved cash flow.

- Better Compliance: The ITC rules for an ISD mandate accurate record-keeping and timely filing of returns. By adhering to these rules, a business can maintain better compliance with GST regulations, avoiding penalties and interest on late filings.

- Cost Savings and Competitiveness: Reduced tax liabilities and improved cash flow due to ITC benefits can lead to cost savings for businesses. This, in turn, can make products and services more competitively priced in the market.

- Transparent Credit Allocation: The ITC rules for ISD require a fair and transparent allocation of credits to eligible units based on turnover. This promotes transparency and accountability within the organization.

- Simplified Tax Management: With the ITC rules for ISD, businesses can simplify their tax management processes. By centralizing credit distribution and compliance activities, companies can streamline their tax-related operations.

- The Incentive for Branch Expansion: The presence of an ISD system can incentivize businesses to expand their operations and open new branches or units since the ITC distribution process becomes more manageable with centralized credit allocation.

Final Note

Through the above information, we can say that the ITC rules for ISD ensure fair and efficient credit allocation, promoting transparency, compliance, and cost optimization within the organization. The centralized function of the ISD simplifies tax management and incentivizes branch expansion, encouraging businesses to grow and expand their operations. Moreover, the proper implementation of ITC rules for ISD fosters better compliance, as businesses are required to maintain accurate records and file timely returns. This promotes a culture of accountability and adherence to GST regulations.