implementation of the Goods and Services Tax (GST) system has brought about significant changes in the way businesses handle their tax obligations. Among these changes, proper bookkeeping has emerged as a fundamental requirement for all entities registered under GST. Accurate and organized bookkeeping practices play a crucial role in ensuring compliance with tax regulations and facilitating smooth business operations. In this article, we will learn about the requirements of bookkeeping under GST.

What do you mean by Bookkeeping under GST?

Bookkeeping under the GST refers to the process of maintaining accurate and organized financial records related to GST transactions. It involves recording, categorizing, and documenting various business activities, such as sales, purchases, expenses, input tax credit (ITC), and tax liabilities, following the GST regulations.

Bookkeeping under GST’s primary focuses is on the following significant aspects:

- Recording GST Transactions;

- Maintaining Tax Invoices;

- Tracking ITC;

- Retaining Records;

- Reconciling books with GST Returns

Requirement of Bookkeeping under GST

Here are some key requirements for bookkeeping under GST:

- Maintain Detailed Records: Every registered GST taxpayer is required to maintain detailed records of their business transactions. This includes invoices, bills of supply, debit and credit notes, delivery challans, and any other documents related to the supply of goods or services.

- Separate Records for Input Tax Credit (ITC): It is essential to maintain separate records for all purchases and expenses for which you intend to claim an input tax credit. This includes invoices, bills, and other supporting documents that demonstrate the GST paid on such purchases.

- Accurate Classification of Goods and Services: Goods and services must be classified correctly under the applicable GST tax rates, i.e., CGST (Central GST), SGST (State GST), or IGST (Integrated GST). The bookkeeping should identify the tax rate applicable to each transaction.

- Timely Entry of Transactions: All transactions, including sales, purchases, expenses, and other financial activities, should be recorded accurately and promptly. Delayed or inaccurate entries may lead to non-compliance and penalties.

- Invoice Details: Every tax invoice issued by a registered taxpayer should contain specific details such as the supplier’s and recipient’s GSTIN (Goods and Services Tax Identification Number), invoice number, date, item description, quantity, value, tax rate, and tax amount.

- Credit and Debit Notes: In case of adjustments or revisions to invoices, credit notes and debit notes should be issued. These documents should mention the reasons for issuing them and the corresponding adjustments to the tax liability.

- Reconciliation of Books: Regular reconciliation of the books of accounts with GST returns is necessary to ensure consistency and accuracy. Discrepancies, if any, should be identified and rectified promptly.

- Retention of Records: GST law mandates that all books, records, and documents related to GST must be retained for a minimum of six years from the end of the financial year to which they pertain. These records may be required for audits, inspections, or other compliance-related purposes.

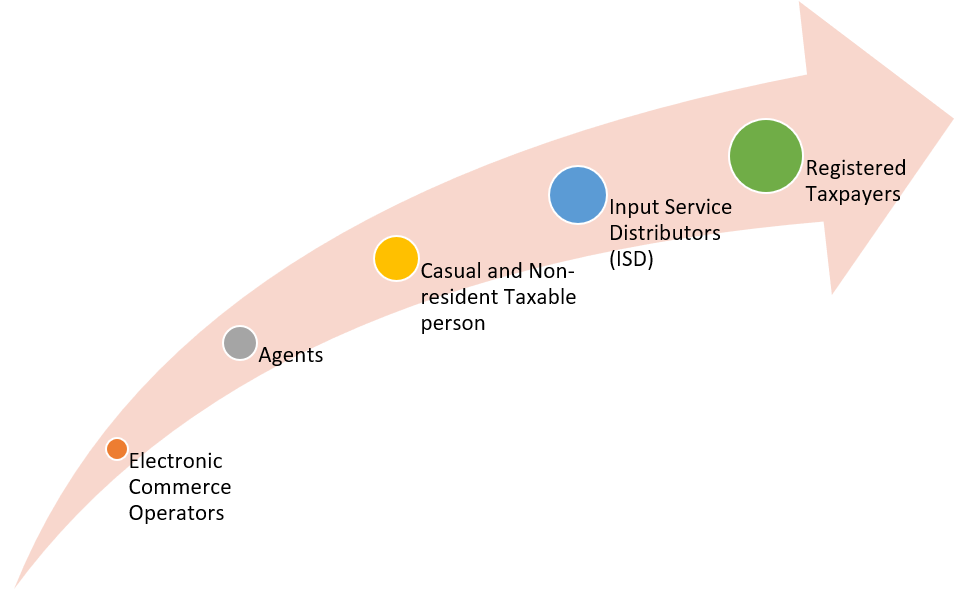

Who is required to maintain bookkeeping records under GST?

Under the GST system, various entities are required to maintain records. The following are the key individuals or entities that must maintain records under GST:

- Registered Taxpayers: All businesses that are registered under GST are obligated to maintain records. This includes entities such as sole proprietors, partnerships, limited liability partnerships (LLPs), companies, and any other form of business organization that is liable to register for GST.

- Input Service Distributors (ISDs): ISDs, which are entities that receive invoices for input services and distribute the input tax credit to other branches or units of the same organization, are also required to maintain records under GST.

- Casual and Non-Resident Taxable Persons: Individuals or businesses that engage in occasional or infrequent taxable activities in a particular state or union territory as casual or non-resident taxable persons must maintain records.

- Agents: Agents who act on behalf of a principal to supply or receive goods or services are required to maintain records of their activities under GST.

- Electronic Commerce Operators: Electronic commerce operators, such as online marketplaces or platforms, that facilitate the supply of goods or services through their portals must maintain records of the transactions facilitated through their platform.

What records are to be maintained under GST?

The records to be maintained under GST include the following:

- Tax Invoices: Every registered taxpayer must maintain a record of tax invoices issued for the supply of goods or services. Tax invoices should contain details such as the supplier’s and recipient’s GSTIN (Goods and Services Tax Identification Number), invoice number, date, description of the goods or services, quantity, value, tax rate, and tax amount.

- Bills of Supply: In cases where tax invoices are not issued (applicable to certain types of supplies), taxpayers need to maintain bills of supply. These documents should contain similar details as tax invoices, excluding the tax amount.

- Credit and Debit Notes: Records of credit notes and debit notes issued for any adjustments or revisions to invoices should be maintained. These notes should mention the reasons for issuing them and the corresponding adjustments to the tax liability.

- Receipt Vouchers: Receipt vouchers are to be maintained for all advance payments received against future supplies. These vouchers should contain details such as the supplier’s and recipient’s names, GSTINs (if registered), the amount received, and the applicable tax rate.

- Delivery Challans: In cases where goods are being transported without a tax invoice (for reasons such as job work or supply to an unregistered person), delivery challans should be maintained. These documents should contain details such as the supplier’s and recipient’s names, addresses, GSTINs (if registered), description of the goods, quantity, and mode of transport.

- Records of Input Goods and Services: Taxpayers must maintain records of all purchases and expenses for which they intend to claim ITC. This includes invoices, bills, and other supporting documents that demonstrate the GST paid on such purchases.

- Annual Financial Statements: Taxpayers need to maintain their annual financial statements, including the balance sheet, profit and loss statement, and cash flow statement.

- Other Relevant Records: Additional records that need to be maintained include accounts of stock, records of goods lost, stolen, or destroyed, records of goods disposed of as free samples, records of goods supplied as gifts or for personal use, and records of goods removed for personal use.

Significant points to know relating to bookkeeping under GST

When it comes to record-keeping under the GST system, there are several important points to keep in mind. Here are some key aspects to be aware of:

- Timeframe

- Accuracy and Completeness

- Retention of Physical and digital record

- Organized Record-keeping system

- Regular Reconciliation

- Input Tax Credit

- Timely Entry of Transactions

- Compliance with GST Regulations

- Software and Automation

Consequences of not maintaining proper bookkeeping under GST?

Failing to maintain proper bookkeeping under the GST system can have various consequences, including:

- Non-Compliance Penalties: Tax authorities may impose penalties for non-compliance with record-keeping requirements. Penalties may be imposed for not maintaining records, maintaining inaccurate records, or failing to produce records when requested by the tax authorities.

- Loss of Input Tax Credit (ITC): If bookkeeping records are not maintained or are found to be inadequate, tax authorities may disallow the claimed input tax credit. This can result in increased tax liability and financial losses for the taxpayer.

- Inaccurate Reporting: Without proper bookkeeping records, accurate reporting of sales, purchases, expenses, and other financial transactions becomes challenging. Inaccurate bookkeeping can lead to incorrect calculation of tax liabilities, which can result in underpayment or overpayment of taxes. Both situations can have financial implications and may attract penalties or additional tax assessments.

- Increased Risk of Tax Audits: Inadequate bookkeeping practices raise red flags during tax audits. Tax authorities are more likely to scrutinize businesses that do not maintain proper records, increasing the risk of audits, inspections, and inquiries. Tax audits can be time-consuming, costly, and disruptive to business operations.

- Inefficiencies and Operational Challenges: Without proper bookkeeping, businesses may face difficulties in managing their finances, analysing business performance, and making informed decisions. It can lead to inefficiencies in record retrieval, reconciliation, and compliance-related tasks.

- Reputational Damage: Non-compliance and inadequate bookkeeping practices can damage a business’s reputation. It can erode trust among customers, suppliers, and business partners, impacting future opportunities and relationships.

Takeaway

Through the above-mentioned information, bookkeeping is a fundamental requirement under the GST system. It plays a crucial role in ensuring accurate reporting, compliance with tax regulations, and the smooth functioning of businesses. Maintaining proper records is crucial for all registered taxpayers to fulfil their GST obligations effectively. By adhering to the requirements of bookkeeping under GST, businesses can benefit in various ways. Accurate and detailed records enable businesses to claim input tax credits, reconcile their books with GST returns, and facilitate a streamlined tax audit process. Additionally, organized record-keeping systems enhance financial management, decision-making, and overall operational efficiency.